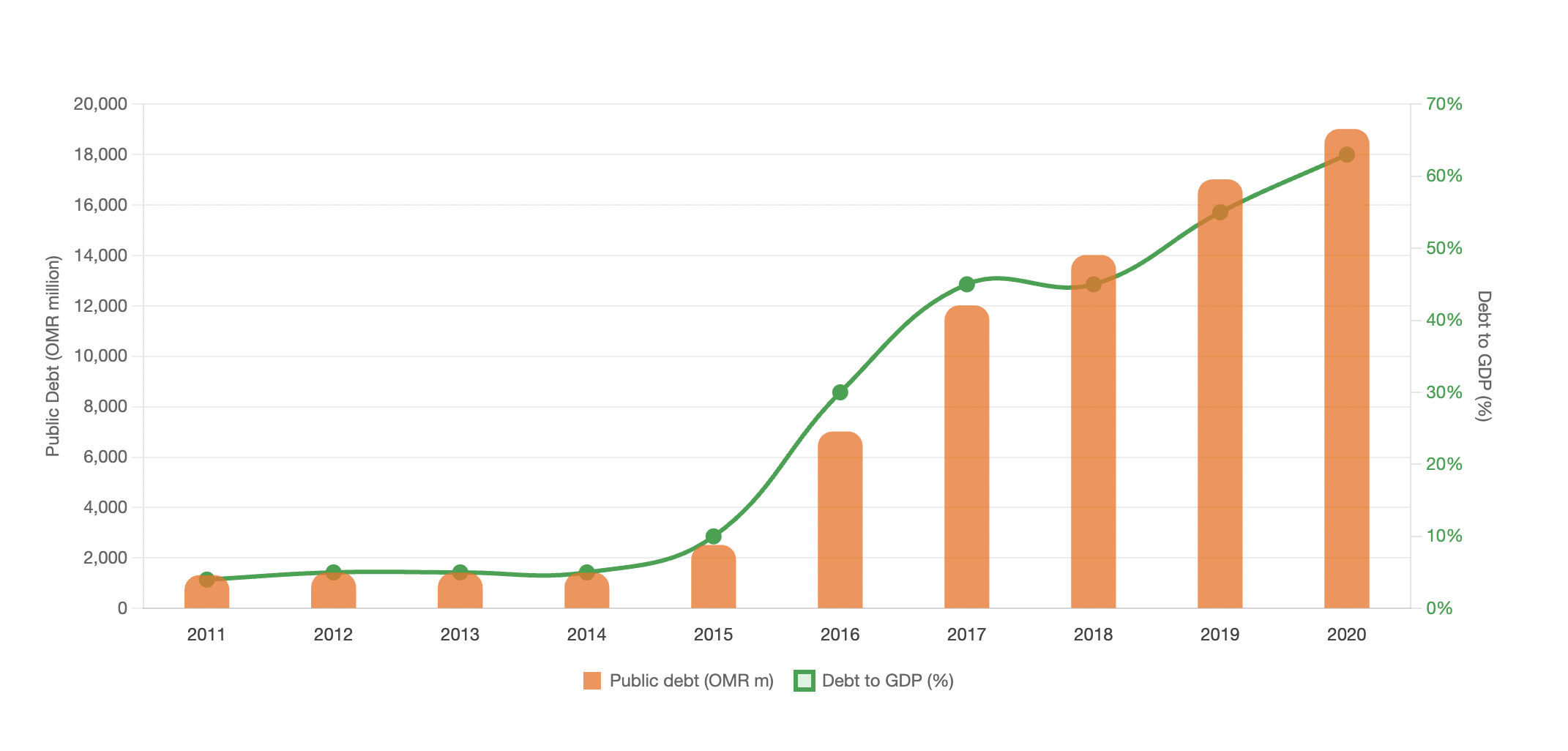

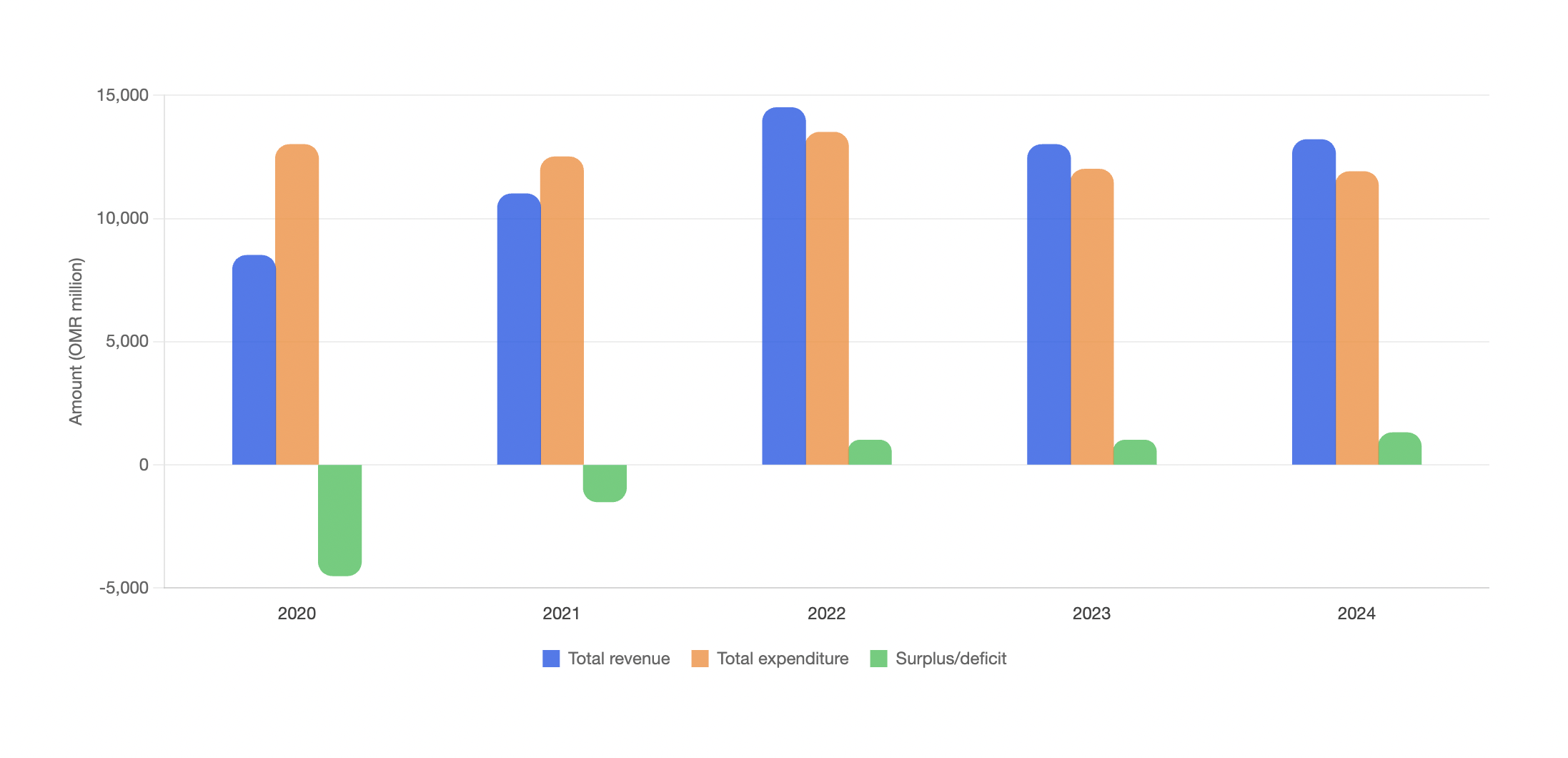

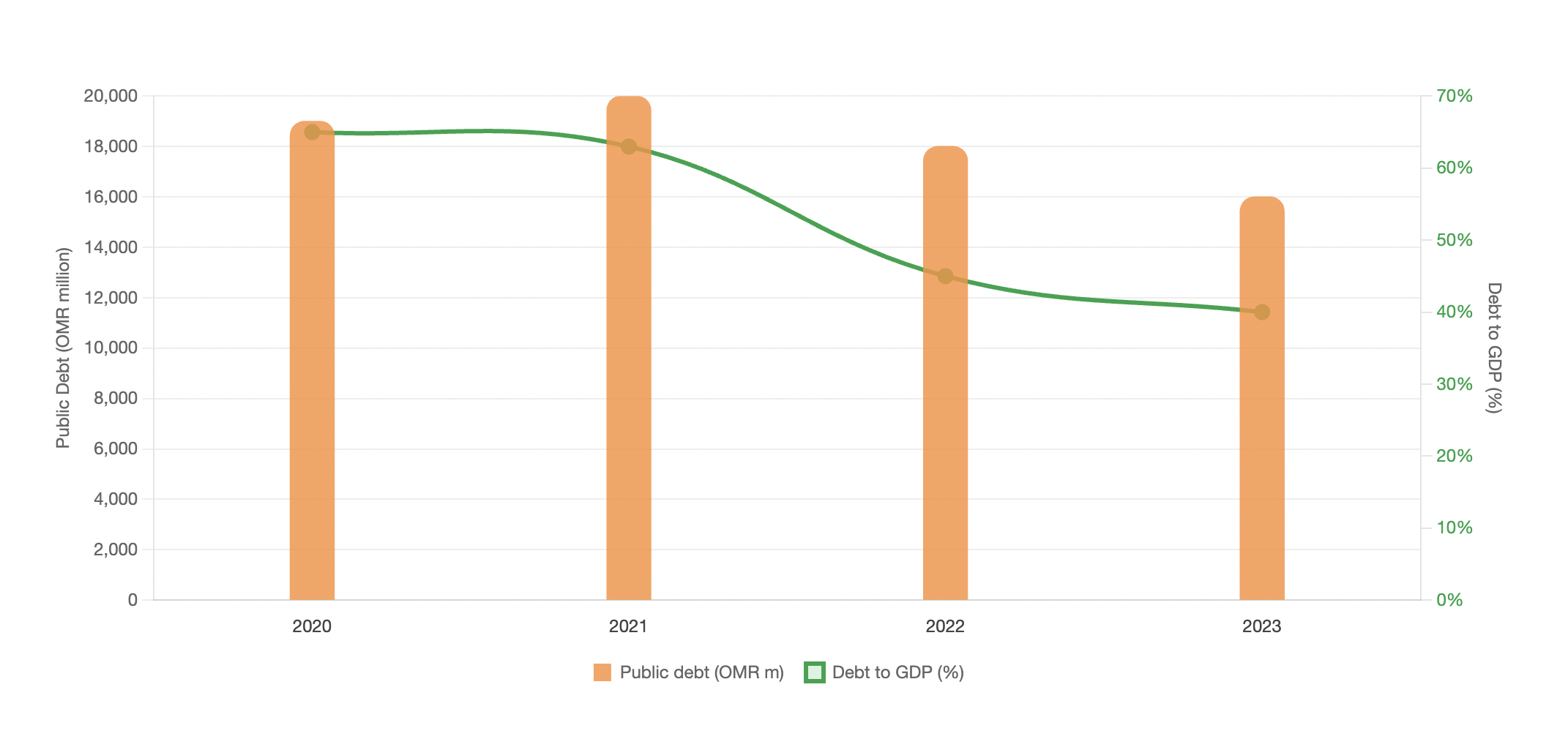

The 2025 budget projects a deficit of OMR 620 million, primarily due to conservative oil price assumptions. However, given current price trends and ongoing regional tensions, it is likely that Oman will post another surplus, which could be used to further reduce debt. In recognition of its improved fiscal health, Oman’s sovereign credit rating was upgraded to investment grade (BBB-) in September 2024. This upgrade is expected to lower debt servicing costs. Oman also plans to issue OMR 750 million in new bonds and sukuk in 2025.

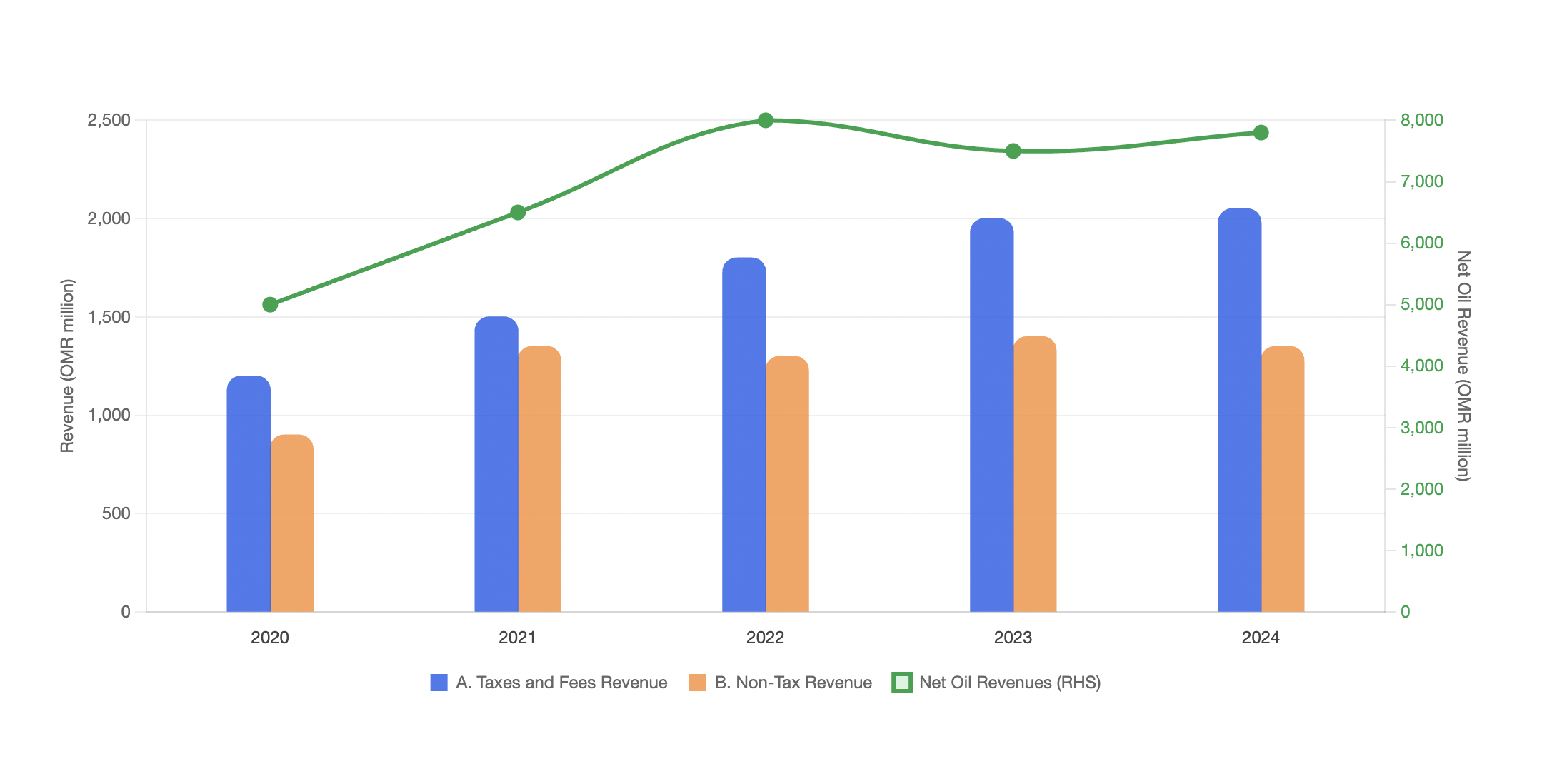

The fiscal consolidation achieved over the past five years provides a strong foundation for Oman to accelerate its ambitious development agenda, which spans sectors such as transportation, energy, housing, hospitality, and construction (Fig. 7). While the government hasn’t been aggressively spending on development activities directly in the past 10 years, they have the capacity to speed up spending in the next five years. This will be supported by additional revenue sources such as the domestic minimum top up tax (applicable from 2025) and personal income tax (to be effective from 2028). We believe that accelerated development spending will translate into loan growth for local banks such as Bank Muscat and Bank Sohar.

Fig 7: Project pipeline

Despite delivering an annualized total return of 10% over the past five years, Oman’s equity market has returned only 15% over the past decade. The upcoming wave of large-scale projects is expected to drive corporate earnings growth. With the market trading at attractive price-to-earnings (P/E) multiples—estimated at 9.5x for 2025—this growth could serve as a catalyst for a market re-rating. Additionally, initiatives like the Tanmia Liquidity Fund, launched in May 2024, are expected to enhance market liquidity and investor participation.