Credit Strength as a Buffer

One of the primary reasons investors are willing to accept the risks associated with GCC perpetuals is the strong fundamental profile of the issuers. Banks in the UAE and Saudi Arabia are generally well-capitalized, consistently profitable, and often benefit from implicit or explicit government support. This financial strength and sovereign backing provide investors with greater confidence in the issuers’ ability to meet their obligations, even under stress scenarios.

Spreads, Reset Mechanics, and CallBehavior in GCC Perpetuals

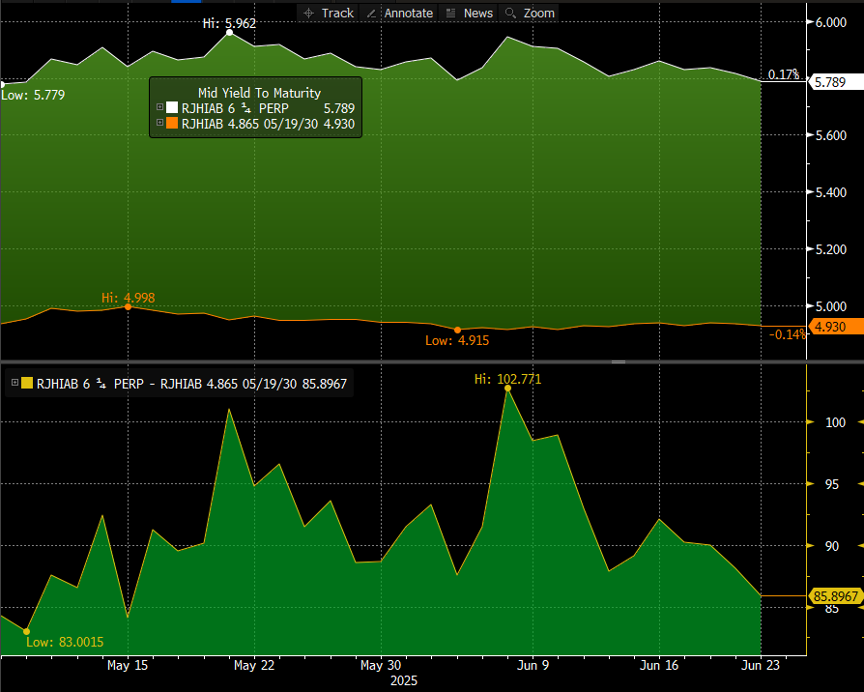

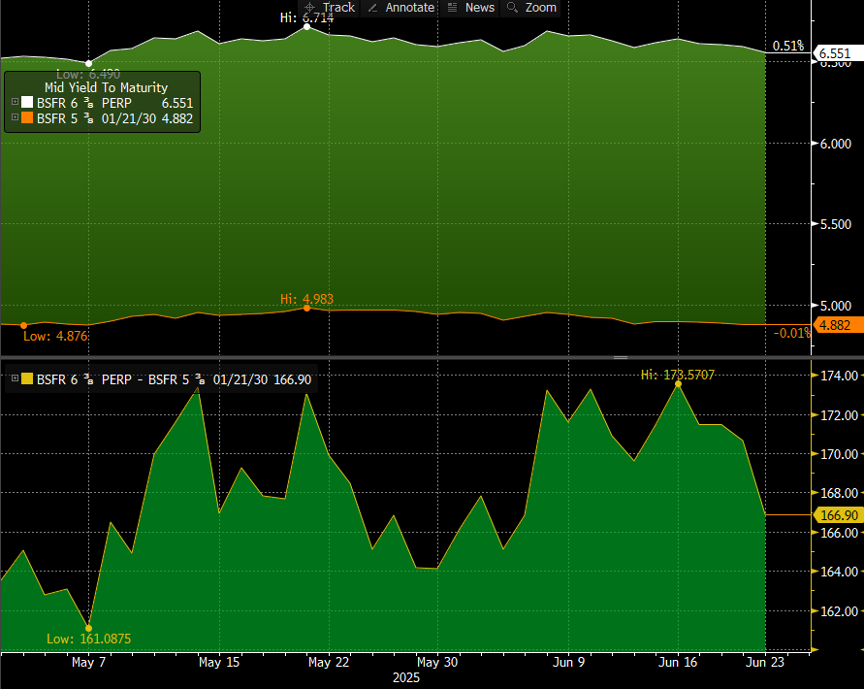

Spreads and reset mechanics are fundamental to pricing perpetual bonds and shaping investor return expectations. In the GCC, Tier 1 instruments typically reset every five years, using a benchmark such as the 5-year U.S. Treasury yield plus a fixed spread.

Reset spreads generally range between 180 and 250 basis points and serve as a key indicator of both extension risk and reinvestment appeal. Analyzing Z-spreads (zero-volatility spreads) and reset margins provides investors with valuable insight into regional credit risk, sovereign support, and the likelihood of an issuer exercising its call option. In a declining global interest rate environment, the convexity and positive reset optionality embedded in these structures become increasingly relevant, especially when issuers have demonstrated disciplined call behavior.

DPWDU 6 PERP, a perpetual bond with an upcoming call date on October 10, 2025, has a fixed reset spread of +575 basis points. Based on the current 5-year U.S. Treasury yield of 3.96%, the assumed reset coupon would be approximately 9.71%. This represents a significantly higher financing cost for the issuer compared to current market rates, making it highly likely that the issuer will exercise the call option.

Another example is the DIBUH 4⅝ PERP, a Tier 1 perpetual issued by Dubai Islamic Bank, callable on May 19, 2026. With a reset spread of +407.70 basis points, the projected coupon post-reset would be around 8.12%. Similar to DPWDU 6 PERP, this elevated cost relative to new issuance levels suggests a strong likelihood of the bond being called.

Balancing Complexity and Opportunityin GCC Perpetuals

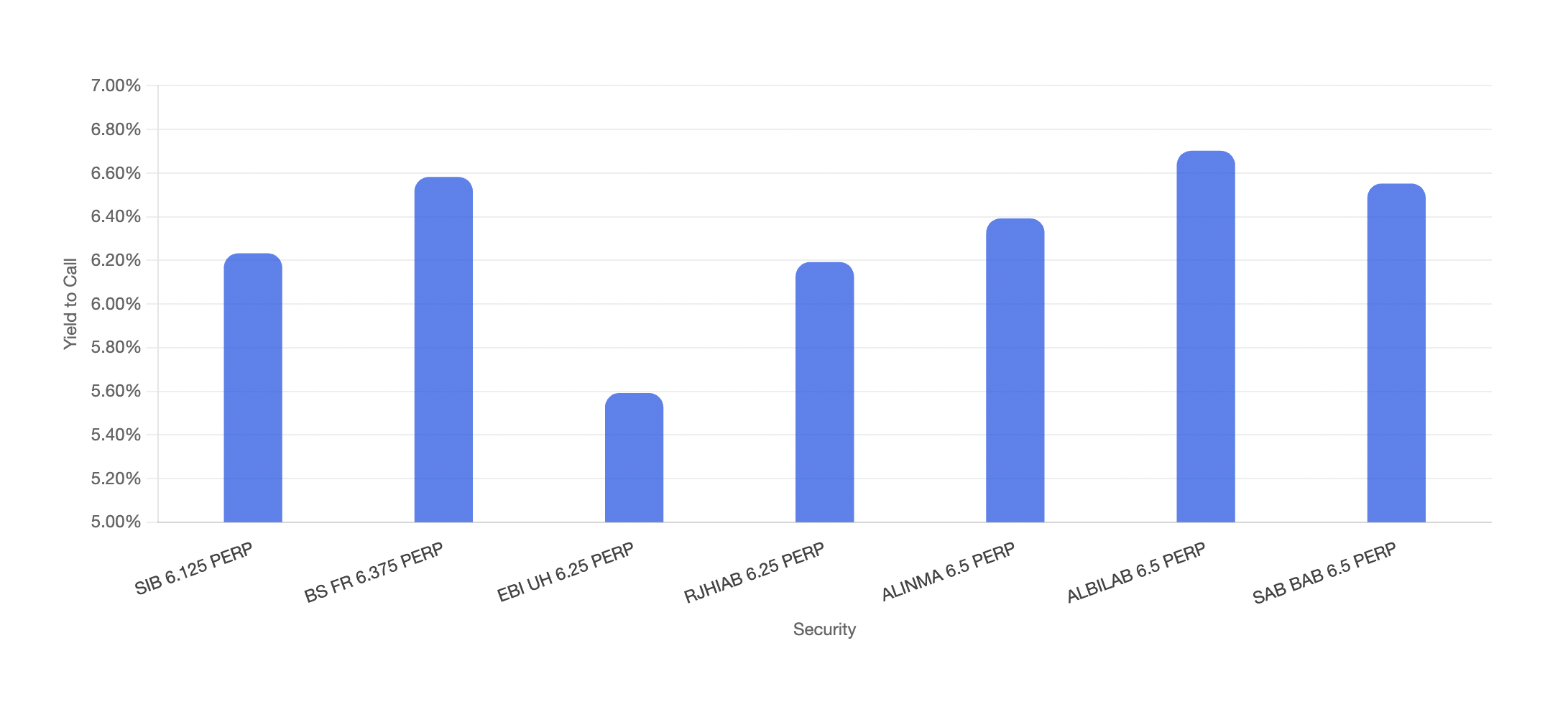

Despite their structural complexities, GCC perpetuals continue to present compelling opportunities for yield-seeking investors. In a relatively stable credit environment, value can still be found, particularly among state-linked or well-established issuers. However, it is essential for investors to look beyond headline coupon rates.

Key considerations include historical call behavior, the transparency and consistency of issuer communication, and the presence of investor-friendly features such as attractive reset spreads. While perpetuals are inherently more complex and carry higher structural risk—especially for the average retail investor—the GCC market offers a favorable risk-reward profile when compared to global peers.

For investors with a higher tolerance for duration and credit risk, these instruments remain a viable option for portfolio diversification and yield enhancement.