TASI’s price returns have remained broadly flat over the past four years (1H21–1H25), despite a vibrant primary market that saw over 50 listings, many of which generated substantial wealth for investors. The index’s largest sectoral weight, based on free-float market capitalization, is the banking sector. This sector has experienced a range-bound consolidation between the 11,000-13,000 levels after peaking above 16,000 in early 2022.

The implementation of the mortgage law spurred significant lending growth among Saudi banks, doubling the banking index by April 2022 compared to pre-COVID levels. However, rising benchmark interest rates dampened mortgage demand and compressed bank margins, as most mortgages were fixed-rate. This led to a pullback in the index. While loan growth remained strong, averaging 3% per quarter, it was largely driven by lower-risk, less-profitable public sector credit.

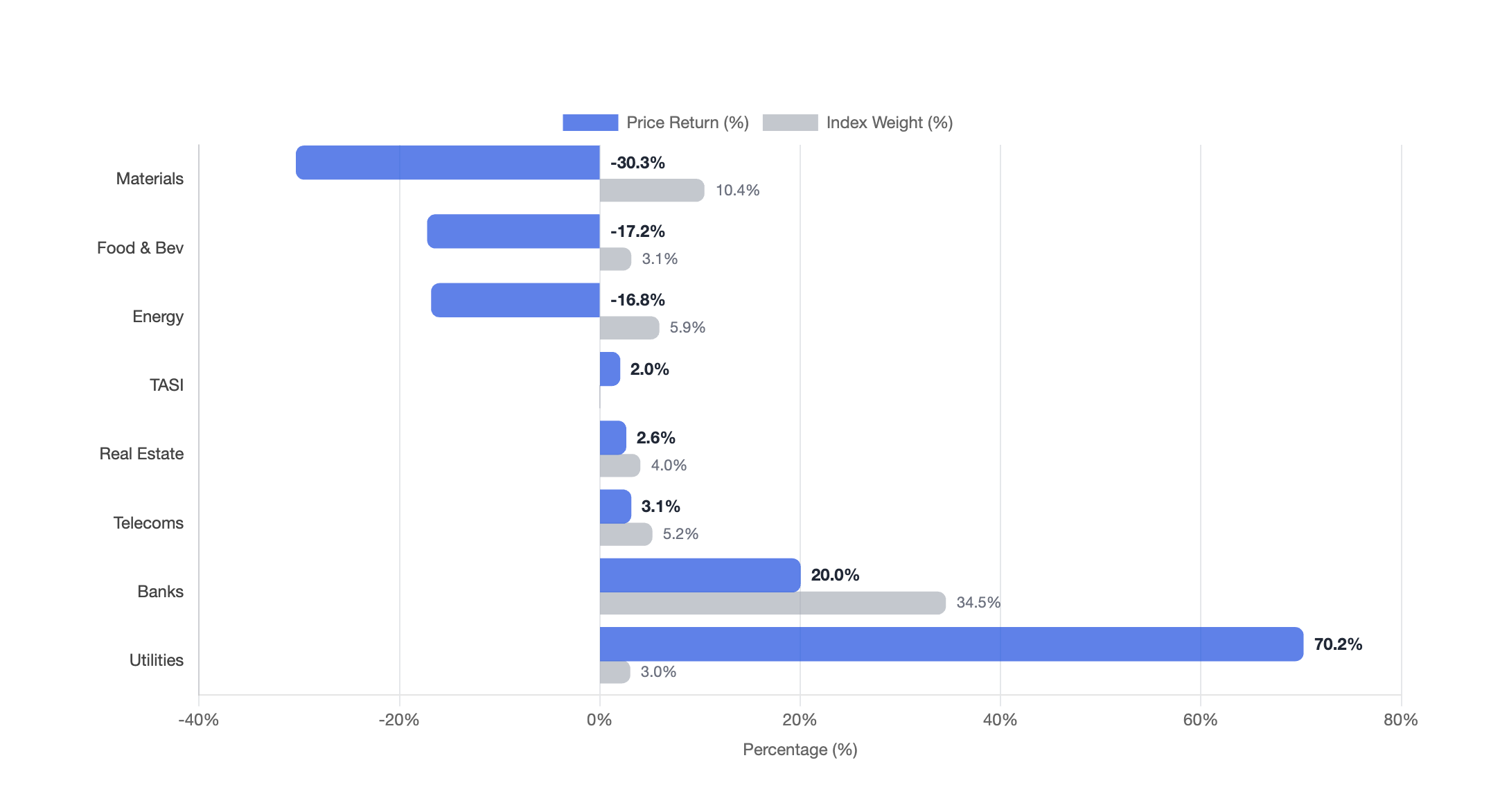

Without the banking sector’s positive contribution, the TASI index would have been significantly lower, dragged down by negative returns in the materials (petrochemicals, metals & mining, cement) and energy sectors (primarily Aramco). The petrochemical sector notably underperformed, with some leveraged constituents declining 60-75% over the period. This was largely due to a severe supply-driven downcycle in the olefins market—arguably the worst in history—compounded by a demand slump following the COVID-era excesses. Ma’aden stood out as an exception, thanks to its diversified product mix of fertilizers, aluminum, and gold. However, its valuation remains rich, and the stock has traded sideways since 2Q22.

The cement sector also suffered, with most stocks down 30-60%. This was driven by the peak of the mortgage boom by mid-2021, a sharp rise in interest rates post-COVID, and a structural margin decline due to soaring fuel costs in 2024/25. Some central region companies, however, bucked the trend, outperforming or tracking the S&P GCC Index, supported by favorable long-term demand and tighter supply dynamics.

In the energy sector, Aramco led the decline, mirroring the drop in oil prices from their 2022 highs. The telecom sector posted modest gains, largely thanks to Mobily’s 80% surge, which offset STC’s roughly 20% decline. STC faced headwinds from the Public Investment Fund (PIF) gradually reducing its stake and rising competition in the enterprise segment.

Despite its small index weight (3%), the utilities sector delivered stellar performance, led by ACWA Power. Since its listing in November 2021, ACWA’s stock has risen 4.4x, despite pulling back from its October 2024 peak. In contrast, the consumer sector was weighed down by Almarai’s underperformance due to company-specific issues. The real estate sector was supported by Dar Al Arkan, which posted strong earnings from land sales.