News Highlights

SICO obtains licensing to offer asset management services in Saudi Arabia through new subsidiary SICO Financial Saudi Company

SICO received a license from the Saudi Capital Markets Authority (CMA) to manage private non-real-estate investment funds and sophisticated investor portfolios in the Kingdom of Saudi Arabia through its newly formed subsidiary, SICO Financial Saudi Company. This move marks the SICO Asset Management Division’s first entry into a market outside Bahrain and stands as a major milestone towards the full execution of the bank’s regional expansion strategy.

SICO Investment Banking successfully executes mandate on Bahrain’s largest M&A

SICO was selected as issue execution advisor, receiving agent, and allotment agent in the acquisition of Bahrain Islamic Bank (BisB) by National Bank of Bahrain (NBB), one of Bahrain’s largest transactions to date. The transaction comes amid a raft of mergers and acquisitions throughout the GCC as companies across key sectors look to cost savings, synergies, and efficiencies. As part of the transaction, NBB is subject to a minimum acquisition of 40% of the issued share capital of BisB, which would bring its ownership in BisB from 26% to at least 70%. The acquisition would take place at either cash of BHD 0.117 per share, or a shares exchange at a ratio of BHD 0.167 NBB shares per BisB share, which would price the Islamic lender at BHD 124 million. The transaction was accepted by a total of 47.64% of shareholders, as of 31 December 2019, thereby rendering the offer unconditional as to acceptances. The final closing date was announced to be January 15, 2020 with BIsB shareholders participating in the offer set to receive their payment in cash or share on the settlement date of January 22, 2020.

SICO Appointed as Bahrain Receiving Agent, Bahrain Execution Advisor, and Cross-Listing Advisor for Kuwait Finance House’s Offer to Acquire 100% of Ahli United Bank

SICO has been mandated by Kuwait Finance House K.S.C.P. (KFH) as Bahrain receiving agent, Bahrain execution advisor and crosslisting advisor in KFH’s offer to acquire Ahli United Bank B.S.C. (AUB). The cross-border acquisition will create a USD 104 bn regional banking powerhouse that is set to become the world’s largest Islamic bank in terms of assets. Implementation of the deal is through a voluntary conditional offer by KFH to AUB shareholders to acquire 100% of AUB’s issued and paid up ordinary shares. The offer by KFH is by way of share swap at an exchange ratio of 1 new KFH share for every 2.325581 AUB shares. It is conditional upon KFH receiving valid acceptances for AUB shares representing at least 85% of total issued share capital, and is subject to approvals, exemptions and/or waivers granted by the CBB.

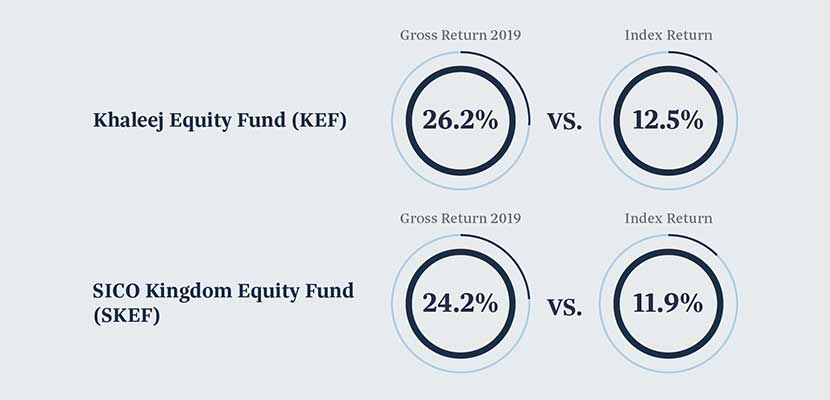

SICO’s signature asset management funds continued to outperform the market

SICO’s signature asset management funds witnessed an exceptional year, outperforming the market. Our flagship GCC fund, the Khaleej Equity Fund (KEF), generated a gross return of 26.2% in 2019 vs. an index return of 12.5% which positioned it to close the year as the top-performing GCC and MENA fund for the second consecutive year. KEF was named Best Equity Fund in Bahrain at the Global Banking and Finance Awards 2019.

Shakeel Sarwar, SICO’s Head of Equities Asset Management commented, “We are extremely proud of the fact that the Fund has generated gross returns of around 60% over the past 3 years, 160% over the past 10 years and 500% since its inception in March 2004 and has consistently remained amongst the top performing regional funds.” KEF’s exceptionally strong and consistent long-term performance of the fund is attributable to SICO’s time tested and research-intensive investment strategy based on stock picking.

The flagship SICO Fixed Income Fund generated returns of 10.6% during 2019 ending as one of the best years for GCC fixed income. The Fund’s strong performance was primarily driven by lower benchmark rates after the US Federal Reserve cut rates 3 times during 2019 in an attempt to stave off a fall in global growth pushing up bond prices in the process. The Fund also swapped duration risk with credit risk and benefitted from a combination of better fiscal balances and the implementation of budget deficit reducing measures by GCC states. Asset Management’s strategy to overweight Bahrain also worked in the Fund’s favour as it ended the year as the best performing GCC sovereign on the back of improving economic conditions and fiscal reforms, setting up the Kingdom as a prime candidate for a rating upgrade in 2020.

SICO’s top-performing Kingdom Equity Fund, which provides investors with access to the Saudi equity market, continued to outperform the league tables delivering positive returns of 24.2% vs. an index return of 11.9% in 2019.

"The success is driven by a comprehensive strategy that incorporates a number of different ideas, instead of a few stocks contributing to the alpha,” commented fund manager Malik Zahir. “It is a strategy that sees us well positioned going into 2020, which has already had an inauspicious start -- initially due to the rapid spread of COVID-19 and more recently due to the significant fall in the price of oil. Given the challenging conditions ahead, we positioned our portfolio defensively so that as of February 2020 KEF was down only 3.5% compared to a market average of an 8% decline."

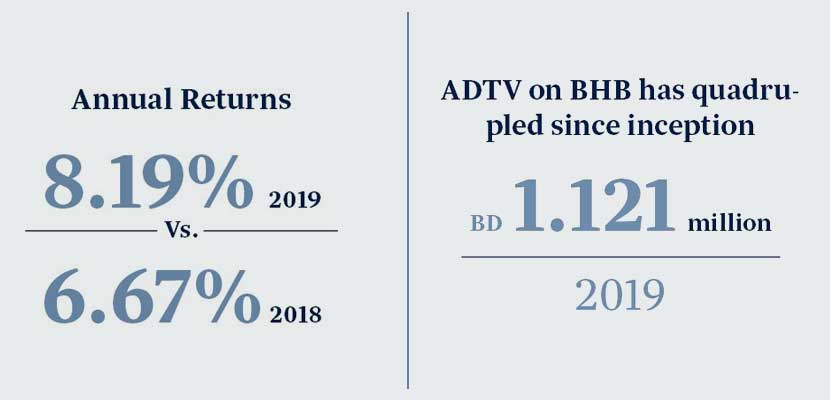

Bahrain Liquidity Fund Increases ADTV on the BHB

The Bahrain Liquidity Fund (BLF), now in its fourth year, has continued to make a major impact on the average daily traded volume (ADTV) of the Bahrain Bourse. The Bahrain Bourse ADTV has reached BD 1.121 million in 2019 increasing by 3.6% YoY. BLF transactions in 2019 represented 31.25% of the total ADTV on the Bourse compared to the 22% recorded in 2018.

Commenting on the track record and performance of the Fund, Fadhel Makhlooq, SICO’s Chief Capital Markets Officer, said, “The Fund had a positive impact on the BHB despite it reduced size, resulting from paying back 10% of the Fund’s size to its shareholders and paying out all dividends received during 2019. The increase in the participation rate over last year is a clear manifestation of the Fund’s role as a liquidity provider.”

SFB climbs to tenth spot in DFM rankings

SICO Financial Brokerage (SFB), SICO’s Abu Dhabi based subsidiary, which currently offers equity trading for retail and institutional clients on the DFM, ADX, and Nasdaq Dubai managed to significantly improve its ranking on the DFM in 2019. SFB climbed seven notches to number 10 up from number 17 in 2018 with total traded value outpacing the markets by over 15%.

SICO receives mandate as Investment Manager for Bahrain’s Minors’ Estate Directorate’s Fixed-Income and Equity Portfolio

SICO was appointed as Investment Manager for the Bahraini Ministry of Justice, Islamic Affairs & Endowments manager for the fixed-income and equity portfolio of the Minors’ Estate Directorate. Under the agreement, SICO will manage a USD 20 million portfolio, with the objective of creating long-term value and enhancing income and dividend distribution payouts into the Minors’ Estate Directorate accounts. This new mandate falls within the framework of the Minors’ Estate Directorate’s strategy to enhance partnerships with the private sector, ensure diversification of the investment basket and benefit from its expertise in improving financial and investment returns, which will contribute to developing the investment portfolios of the Minors’ Estate Directorate, while attesting to the trust the Bahraini government has placed in SICO’s market leading capabilities.