Financial Results

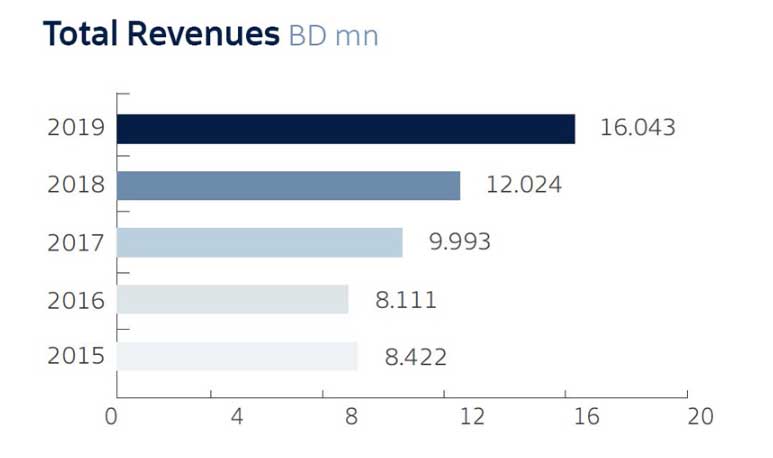

2019 was one marked by ever-shifting market dynamics, both in frontier and emerging markets and around the globe. Despite the headwinds, SICO saw its consolidated net profit for the year surge 63% to BD 6.0 million from the BD 3.7 million at the end of 2018. Net operating income hit BD 14.6 million in 2019 up 36% compared to BD 10.7 million in the previous year.

Total operating expenses, including general administration expenses, staff overheads, and other expenses, recorded BD 8.5 million at the end of 2019 versus BD 6.7 million in the same period of 2018. Earnings per share for 2019 came in at 16.32 Bahraini fils, up 63% from the 10.01 Bahraini fils recorded at year-end 2018. Total comprehensive income gained 81% compared to the BD 3.8 million recorded at the end of 2018 to BD 6.8 million in 2019. Growth during 2019 was driven primarily by an increase in the bank’s net fee income, which rose 51% to BD 6.3 million from the BD 4.2 million reported at the end of 2018. Meanwhile, investment income climbed 41% from BD 3.1 million at the end of 2018 to BD 4.3 million at year-end 2019.

“SICO continued to deliver on its mission to create value for shareholders, clients, employees, and the community, cementing its reputation as a leading financial services provider in the GCC by offering its clients a full suite of solutions and advisory services that enables them to capitalize on a multitude of investment opportunities. In spite of uncertainty in the geopolitical environment, our results continued to speak for themselves with strong top- and bottom-line growth on account of multiple mandates throughout the year that attest to our position as a trusted partner on some of the most complex transactions across the region.” Chairman of the Board Shaikh Abdulla bin Khalifa Al Khalifa said.

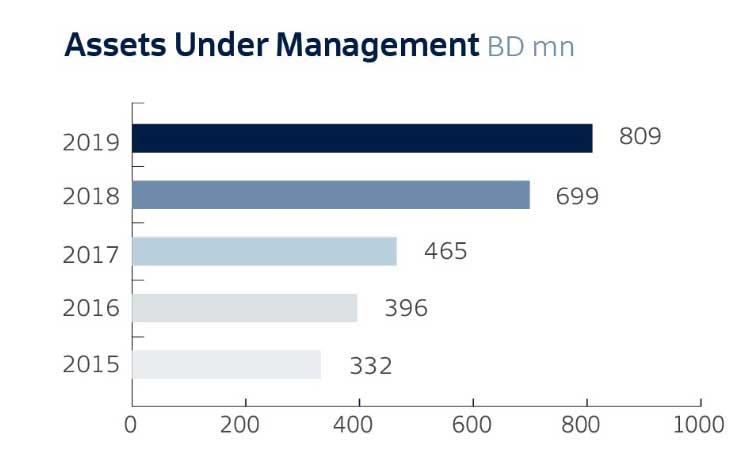

Total Assets under Management (AUMs) amounted to BD 808.7 million (US$ 2.1 billion) as of 31 December 2019, inching up 16% compared to BD 699.1 million (US$ 1.9 billion) at year-end 2018, with SICO continuing to be the asset manager of choice for clients. Total assets under custody with SICO Funds Services Company came in at BD 2.8 billion (US$ 7.4 billion) by the end of the year, up 20% from BD 2.3 billion (US$ 6.2 billion) at year-end 2018

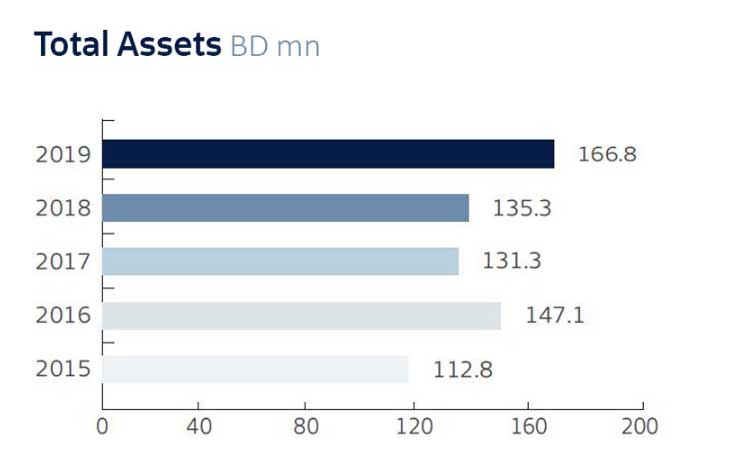

SICO’s total balance sheet footings recorded BD 166.8 million at year-end 2019, increasing by 23% from the BD 135.3 million recorded at year-end 2018, driven largely by increased assets, particularly cash and bank balances as well as securities and other assets. Consolidated capital adequacy ratio for the bank came in at a healthy 63.57% at the close of 2019.

SICO’s Board of Directors approved a cash dividend of 10% of share capital, equivalent to 10 Bahraini fils at the bank’s annual general meeting.

Full details on the bank’s performance during the year can be found in SICO’s 2019 annual report.