News Highlights

SICO Solidifies Saudi Presence with Muscat Capital Acquisition

SICO announced the signing of a landmark agreement with Bank Muscat SAOG to acquire a majority stake amounting to 72.7% in Saudi-based Muscat Capital, a wholly owned subsidiary of Bank Muscat, offering a full suite of investment banking services. The acquisition will take place by way of a share swap, with SICO swapping treasury shares for a majority stake in Muscat Capital. As a result of the share swap, Bank Muscat will own a 9% stake in SICO. The acquisition comes as part of SICO’s medium and long-term strategic objectives to broaden its regional footprint and deepen its on-the-ground presence in Saudi Arabia with asset management, investment banking and brokerage services. The transaction is set to be completed upon receiving all necessary approvals from the relevant regulatory authorities in Saudi Arabia and other relevant jurisdictions.

SICO Research Begins Providing ESG data on Companies Under Coverage

SICO will begin embedding IdealRatings’ ESG data in SICO’s research products to provide comprehensive reports featuring insights into companies’ ESG progress, offering investors a full picture of companies’ performance. IdealRatings determines a listed company’s ESG rating by researching and documenting answers to a series of qualitative questions during its research process across the environmental, social, and governance pillars. The IdealRatings ESG data will be included in its listed companies’ reports, providing investors with a full picture of their performance. This new addition will offer SICO’s clients better investment strategies, superior portfolio allocation and attract ESG-focused investors across the globe to the MENA region.

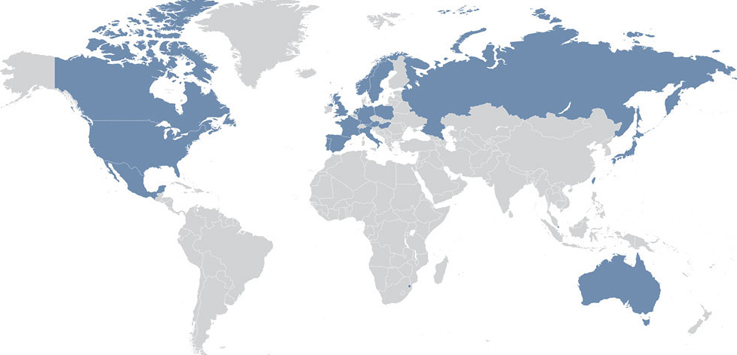

SICO Launches New Global Trading Platform

SICO launched its all-new SICO LIVE Global platform, offering clients access to more than 30 global markets with support for over 25 currencies. Through the online platform, clients can trade stocks and ETFs, benefiting from simplified trading, easy fund transfers, and daily market updates on the go. The platform launch forms part of SICO’s ongoing strategy to act as a gateway for its clients to key markets in the region and worldwide.

SICO Enhances Functionality on Regional Trading Platform SICO LIVE

SICO debuted its updated SICO LIVE regional platform, offering online trading access to Bahraini and regional markets. In addition, the platform offers key insights from our dedicated research team as well as market updates and financial news through a single secure platform, accessible from any device. The platform update comes coupled with the launch of the bank’s global trading platform in order to offer its clients comprehensive access to key regional and global markets.

SICO Asset Management Fully Implements Bloomberg AIM

As part of its efforts to consistently offer clients best-in-class services, SICO adopted the Bloomberg Asset and Investment Manager (AIM) system for both its equities and fixed income asset management business. The AIM system allows the bank to fully automate asset management operations, ranging from portfolio management, to trading, to order management and execution. Bloomberg AIM will enable SICO’s investment managers to further evolve their trading practices and become more efficient bringing more value to their clients. It is viewed as a particularly important and timely step given the restrictions presented by COVID. The team was able to implement and launch Bloomberg AIM, remotely in record time, during particularly challenging conditions with all transaction execution taking place electronically through the system as of early September.

SICO Begins Offering Murabaha Sukuk Service

SICO signed an agreement to begin offering the Bahrain Bourse’s newly established sukuk-based Murabaha service, launched in collaboration with the Central Bank of Bahrain (CBB), when conducting Islamic commodity Murabaha financing transactions with sukuks as collateral. The new service will complement SICO’s current Murabaha facility structures, which is conducted by way of local and international commodity brokers, and is set to increase overall demand for sukuk issuances, providing support to Sharia-compliant financing services and increasing sukuk trading volumes on the Bahrain Bourse. The platform is set to help SICO further expand on its asset management business, which includes depending on clients’ appetite for leveraged strategies. SICO’s asset management clients are currently able to benefit from a consolidated, comprehensive range of collateralized funding facilities for liquidity and general trading purposes.

SICO Continues to Rank as Bahrain’s Top Broker for first six months of 2020

SICO was named the number one broker on the Bahrain Bourse for the first six months of the year, with a market share of 60%, a ranking which it has consistently maintained for more than two decades. This accolade attests to the strength and the resilience of the bank’s operations even in the face of global uncertainty.

Assets Under Management Rebound Post Market Shock

After an initial shock to markets resulting from the decline in oil prices coupled with the onset of the COVID-19 pandemic, SICO’s total assets under management (AUMs) steadied following an initial hit in the first half of the year. In the third quarter of 2020, total AUMs amounted to BD 792.5 million (USD 2.1 billion) compared to BD 808.7 million (USD 2.1 billion) recorded at year-end 2019. AUMs increased in the third quarter of 2020 by BD 133.2 million (USD 353.3 million) thanks to the asset management team’s active and successful fund raising, as well as improved market performance.

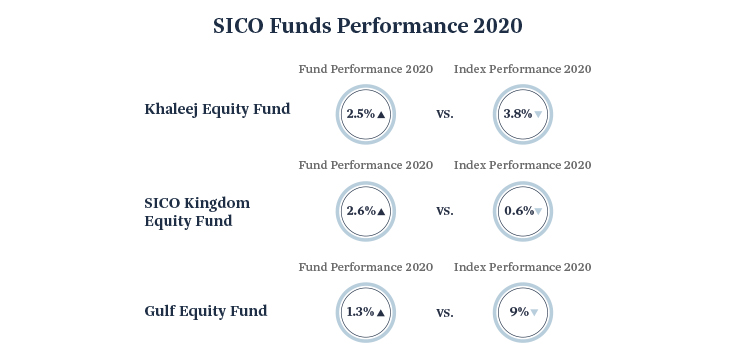

SICO Funds Continue to Outperform the Market

SICO’s asset management division manages three equity funds, which have consistently outperformed regional benchmarks. Despite the steep market declines experienced at the beginning of the year, the three funds managed to recover all losses and post gains for the year. The bank’s flagship Khaleej Equity fund, which invests in equities listed in stock markets in the GCC and Egypt, was up 2.5% for the year while the benchmark was down 3.8%. The fund continues to be among the top-performing funds in the region. The SICO Kingdom Equity Fund, which focuses on the Saudi market, was up 2.6% while the benchmark was down 0.6%. The Gulf Equity Fund, which invests in equities listed in GCC markets - ex Saudi Arabia, was up 1.3% whereas the benchmark was down by 9%.

The year-to-date performance of the fund is a testament to the team's investment strategy that focuses on investing in undervalued stocks with limited downside risk. Over the past 15 years, the region has experienced four major downturns including the COVID-related downturn experienced earlier this year. Throughout all four slumps, the team was able to generate significant alpha by preserving capital.

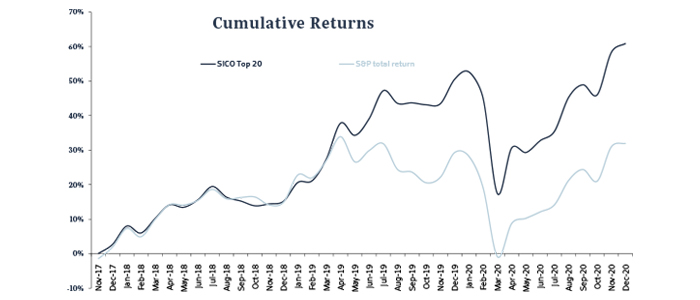

Research Top 20 Picks

SICO Research’s Top 20 monthly product is a diversified universe of 20 stocks (model portfolio) provided by the sell-side research unit to its clients on a monthly basis recommending stock ideas across sectors within GCC markets. The recommendations come out of SICO Research's comprehensive GCC-wide stock coverage of 80+ listed companies across 13 sectors. With limited churn each month, the portfolio is an ideal benchmark for any client investing in the region seeking to replicate and benefit from investing in top stock ideas within the GCC stock universe. During 2020, the portfolio a return of 6.9% (simple weighted average) versus its benchmark S&P GCC total return index performance of 2.1%, generating an alpha of nearly 5% during the year. The portfolio has achieved returns of 60.9% vs. the S&P GCC return of 32% since its launch in November 2017 through to the end of 2020.

The positive returns were generated by a combination of timely calls as well as in-depth research and quality analysis by the Research team, which has enabled them to consistently beat the benchmark index and generate higher returns for its clients.

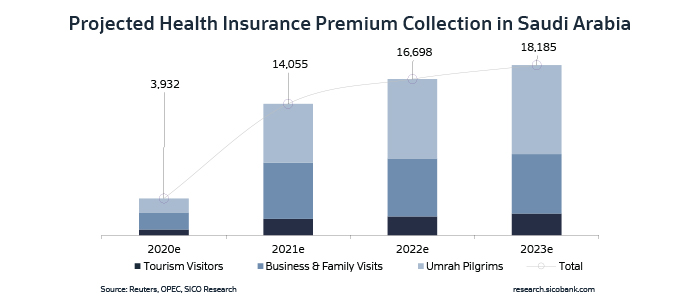

SICO Reinitiates Insurance Sector Coverage with Bullish Outlook

SICO’s Research department reinitiated its coverage of the Saudi insurance sector in August 2020 with a significantly more bullish outlook than the market. This added to the diversity of the department’s coverage and offered recommendations to clients on a sector believed likely to benefit from lower claims during the COVID-19 lockdown while favorable regulatory changes and demographics support its long-term growth story. The sector had surged by more than 70% at the end of November 2020 from its 1Q20 lows, a trend expected to continue playing out in the near-term.