Third Quarter Financial Results

On a quarterly basis, SICO’s consolidated net profit for the third quarter of 2020 was BD 1.6 million, marking a 119% increase compared to BD 708 thousand from the same quarter in 2019. Earnings per share (EPS) for the quarter were 4.20 Bahraini fils, compared to 1.91 Bahraini fils in the third quarter of 2019. Total comprehensive income for the third quarter of 2020 increased by 78% to BD 1.9 million from BD 1.1 million recorded in the same quarter of 2019.

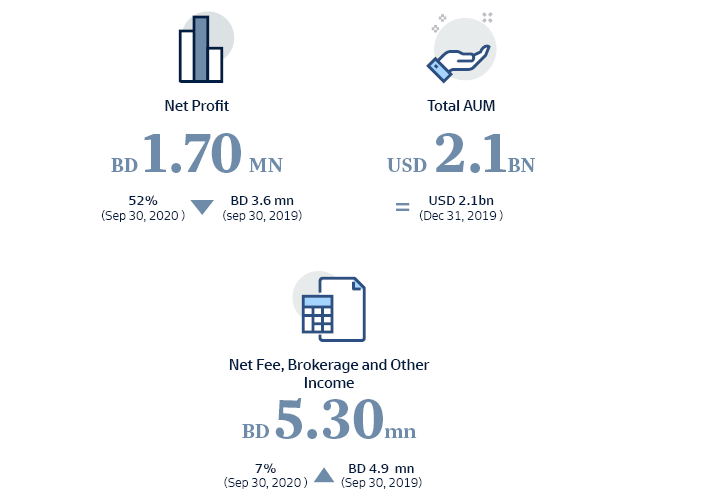

SICO recorded a consolidated net profit for the first nine months of 2020 amounting to BD 1.7 million, a decrease of 52% from BD 3.6 million recorded in the corresponding period of 2019. EPS were 4.63 Bahraini fils for the first nine months of 2020, compared to 9.67 Bahraini fils in the same period of 2019. SICO’s total comprehensive income amounted to BD 1.2 million in the first nine months of 2020. A decrease of 70% compared to BD 4.1 million recorded in the same period of 2019.

Total assets under management (AUMs) amounted to BD 792.5 million (USD 2.1 billion) compared to BD 808.7 million (USD 2.1 billion) recorded at year-end 2019. AUMs increased in the third quarter of 2020 by BD 133.2 million (USD 353.3 million) thanks to the asset management team’s active and successful fund raising, as well as improved market performance.

Assets under custody with the Bank’s wholly owned subsidiary, SICO Funds Services Company (SFS), stood at BD 2.8 billion (USD 7.4 billion) at 30 September 2020, remaining stable compared to the BD 2.8 billion at the end of 2019.

Commenting on SICO’s performance for the nine-month period, Chairman of the Board Shaikh Abdulla bin Khalifa Al Khalifa said: “SICO delivered a commendable performance during the nine-month period despite the challenging market conditions. In particular, our third quarter’s strong results were testament to our clients’ trust in our proven capabilities and further cemented SICO’s position as a leading regional investment house. Our diversified revenue stream together with our strong and liquid balance sheet enabled us to progress further with our strategic plans, even amid such turbulent times.

“Going forward, we remain cognizant of the challenges posed by a second wave of COVID-19 and its impact on market volatility, particularly oil prices. Nonetheless, the Board is confident in SICO’s ability to navigate the current challenges and continue delivering on its near- and long-term strategic plans to achieve further growth.”

SICO is listed on Bahrain Bourse (“BHB”) and its code is SICO-C. The press release and full set of financial statements are available on BHB website.