News Highlights

Dallah AlBaraka Holding Company’s Voluntary Conditional Exit Offer for Al Baraka Group

SICO was appointed as the financial advisor and the receiving agent for Dallah AlBaraka’s conditional exit offer to acquire up to 100% of the issued and paid up ordinary shares of Al Baraka Group B.S.C. (“ABG”) for cash of USD 0.30 per ABG share (excluding those shares held by the Connected ABG Shareholders), which amount to 281,141,331 (22.62%) of the issued ordinary shares of ABG with the intention of a subsequent voluntary delisting of ABG’s shares from the Bahrain Bourse.

As of the final offer closing date, 104,450,557 shares of ABG were tendered in the offer. The percentage of ABG shares, excluding the connected ABG shareholders, tendered in the offer was at 37.15% and the percentage of total ABG shares tendered in the offer was at 8.40%.

OBIC IPO Advisory

SICO Capital acted as the receiving agent for Osool and Bakheet Investment IPO on the Saudi Parallel Market Nomu. The price for its initial public offering (IPO) on the Parallel Market (Nomu) of the Saudi Exchange (Tadawul) was set at SAR 45 per share. The company will float 1.50 million shares, which represent 18.51% of its share capital following the offering process and capital increase.

SICO Kingdom Equity Fund Launch in Saudi Arabia

SICO introduced the SICO Kingdom Equity Fund in SICO Capital Saudi Arabia, capitalizing on the dynamic growth of Saudi Arabia’s economy. The fund offers investors an opportunity to participate in Saudi Initial Public Offerings (IPOs), promising enhanced returns. Having successfully operated a similar strategy with the Kingdom Equity Fund in Bahrain since 2011, the same is now being launched in Saudi Arabia. The Saudi strategy generated a return of 57% in the last three years, 90% in the last five years, and close to 175% in the last 10 years. Furthermore, a USD 100,000 investment would have grown to USD 150,000 in three years, USD 190,000 in five years, and USD 275,000 in 10 years.

SICO’s Top-20 Outperformance

SICO Sell-side Research’s Top-20 portfolio continued its outperformance through 2023, with the fund returning 25.4%, implying an outperformance compared to its its benchmark, the S&P GCC Index, by 15.4% during the year. Despite the overall market volatility, the notable portfolio achieved impressive outperformance. The strategy behind the portfolio is supported by robust fundamental research on each listed company. Simultaneously, it aims to address the necessity of judiciously diversifying stock ideas across sectors and countries within the GCC region.

Launch of Asset Management Newsletter

SICO Asset Management launched its newsletter, designed exclusively for clients and potential clients. This dynamic publication delves into the division’s core investment strategy and provides a comprehensive market summary for the quarter. Clients can expect insightful discussions on key investment themes, offering a deeper understanding of the market landscape. The asset management newsletter is poised to become a valuable resource for those seeking a nuanced perspective on financial markets and investment opportunities.

Top Broker by Value of Trades for 25 Years

SICO has maintained its position as the Number One Broker on the Bahrain Bourse (BHB) for the 25th consecutive year, with a market share of 47.16%. SICO executed 12,510 transactions during 2023, involving 736.4 million shares, with a total value of BHD 191.9 million, while capturing the bulk of block trades during the year.

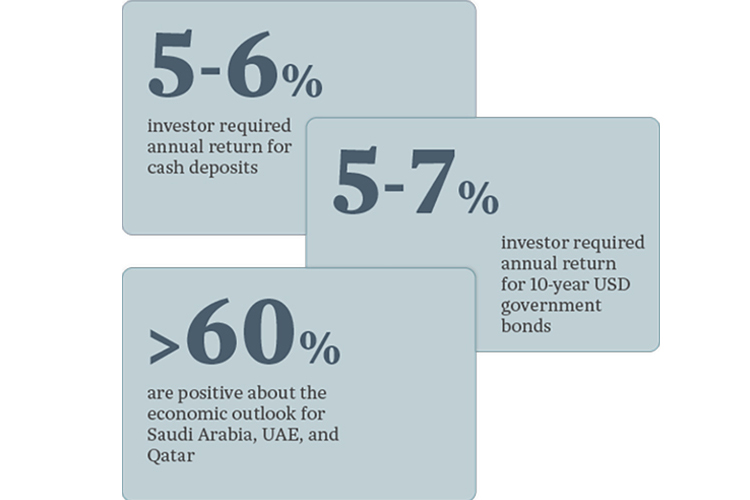

Investor Return Requirements in the GCC 2024

SICO published its third annual investor return assessment survey, offering an inside look into the economic and return expectations of investors across the GCC. The online survey kicked off in September this year, compiling data from C-Suite executives, investment and fund managers, business owners, and institutional investors representing a diverse mix of GCC enterprises, multinational companies (both listed and private), and government entities. The survey sought responses on the overall economic outlook and minimum unleveraged return requirements for various asset classes, including listed equities, government bonds, real estate, private equity, cash deposits and cryptocurrency for all six countries in the GCC. The survey also touched on the issues which are currently of the most concern to investors. This year, the survey gathered diverse viewpoints from 190 respondents across the GCC. Read the full report here.