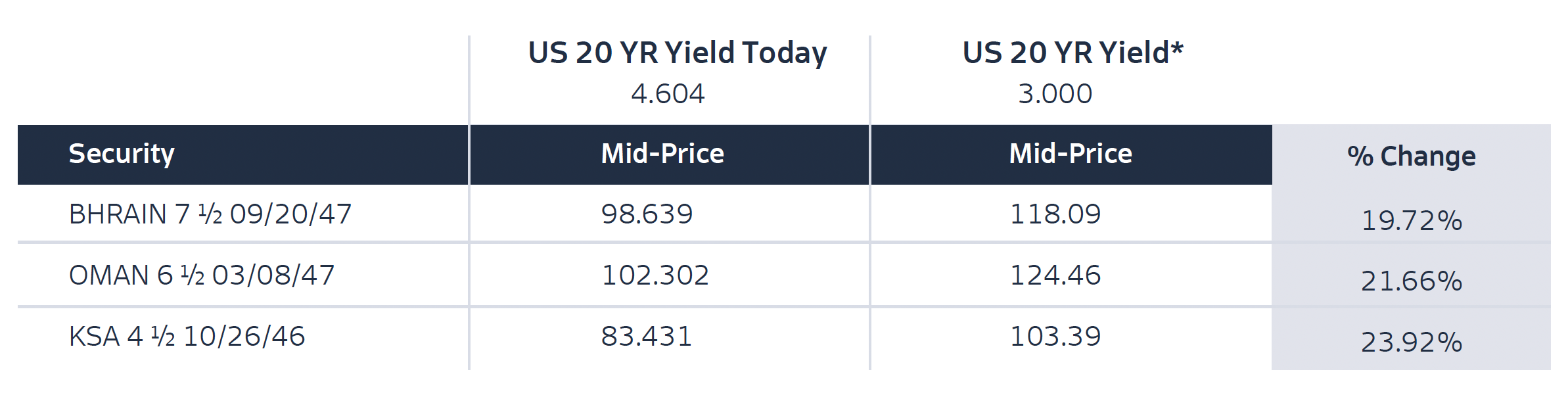

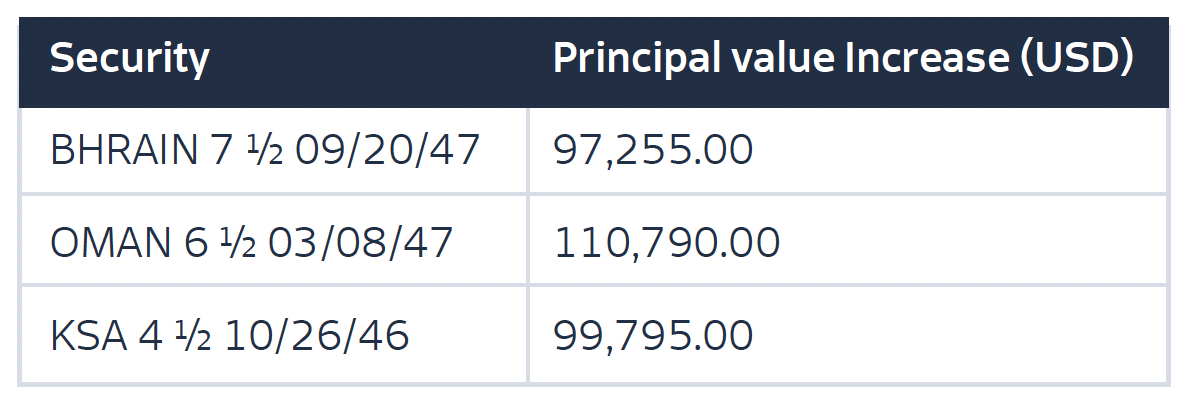

In the volatile market conditions the financial and economic environments have endured the past few months, it is important to evaluate Investment risks and sensitivities. Investors may assess bonds based on various factors, including interest rate movements, credit risk, and market conditions. US Treasury benchmarks are particularly influential, as their yields serve as a global benchmark for borrowing costs and economic outlook.

Understanding the relationship between sovereign bonds, US Treasury yields, credit ratings, and modified duration is insightful for evaluating risk and return in fixed-income investments.

This brief report explores the relationship of these factors, analyzing how US Treasury yields influence sovereign bond yields, the role of credit ratings in determining bond risk, and how modified duration measures a bond’s sensitivity to interest rate changes. By examining these relationships, the report aims to provide insights into pricing, risk assessment, and investment strategies related to sovereign bonds in various market conditions.

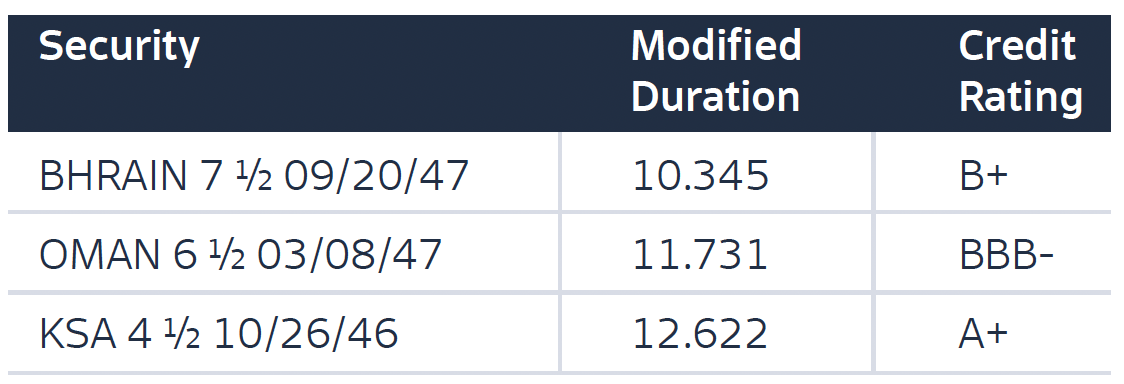

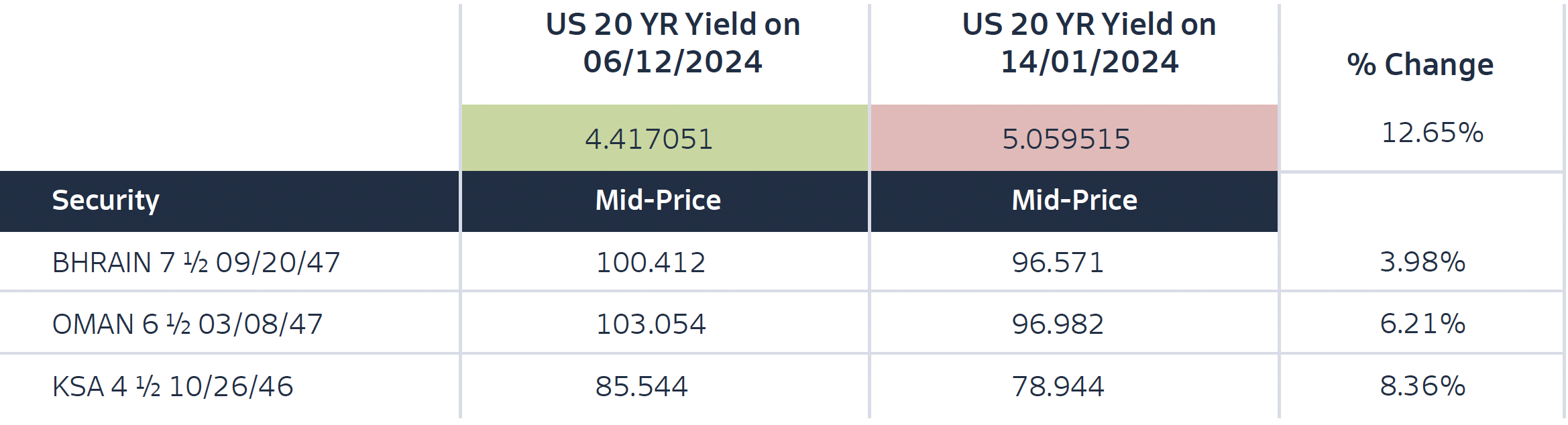

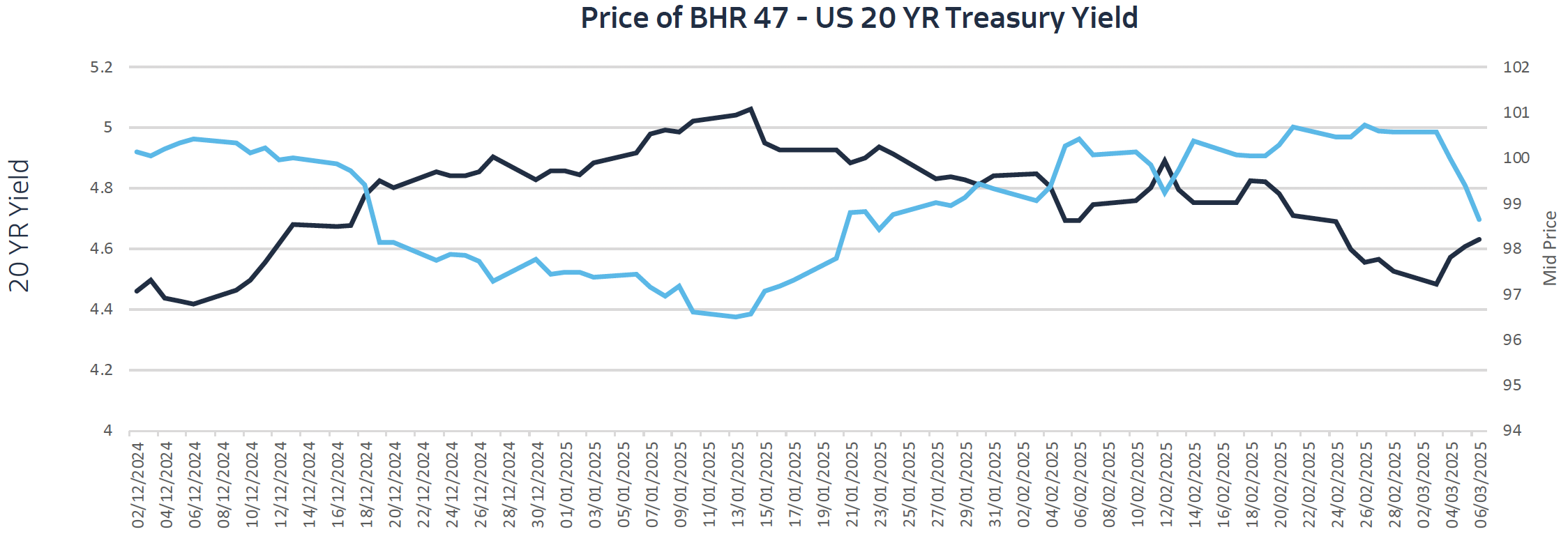

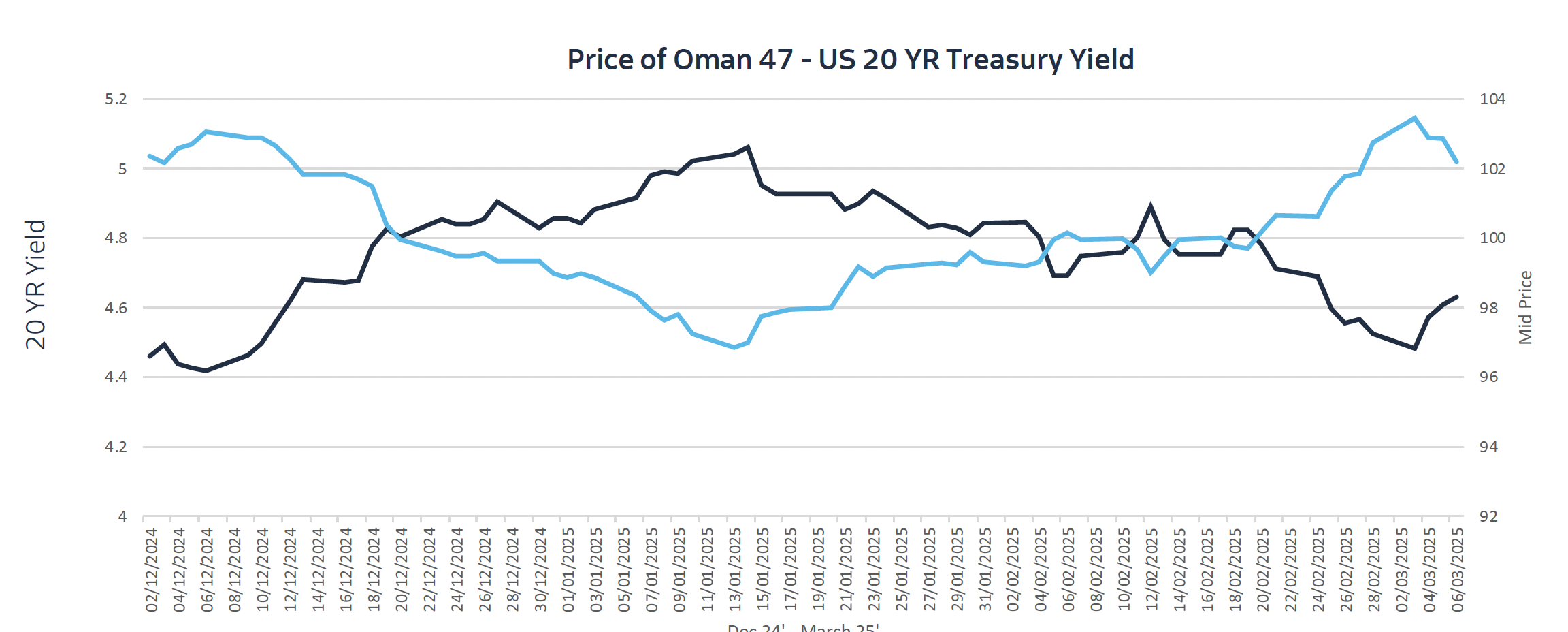

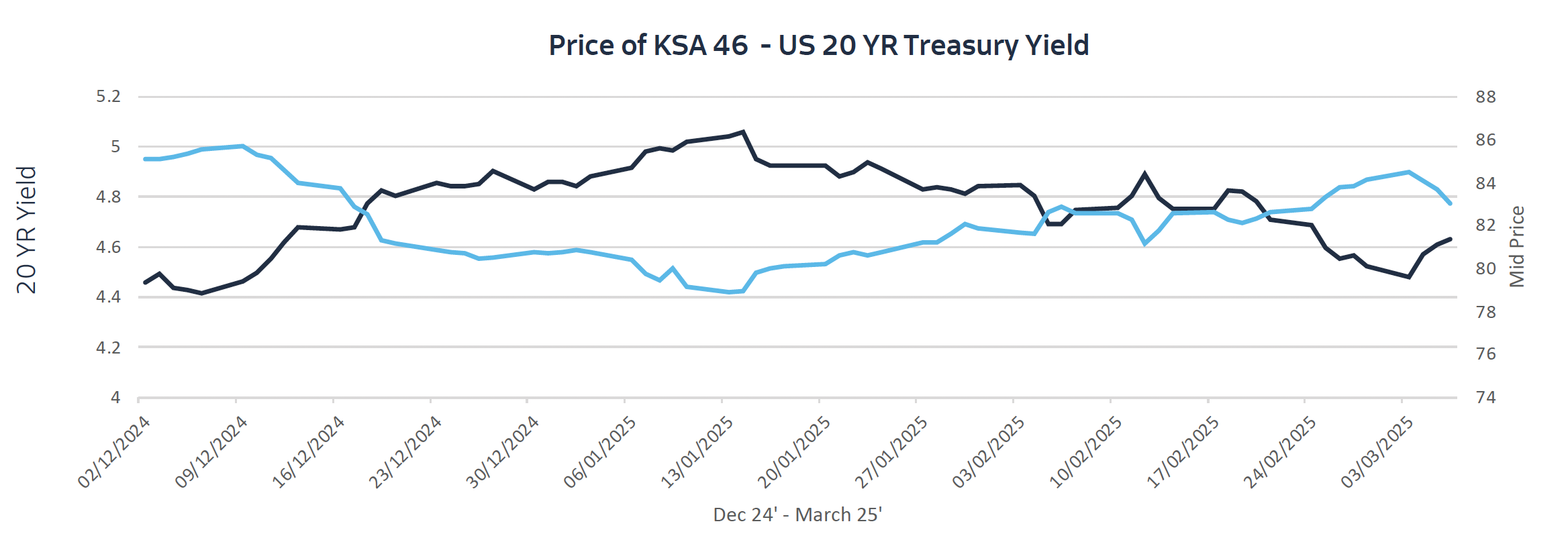

In this report, we will observe how different rated long duration sovereign bonds react to changes in US benchmark rates. We will utilize bonds maturing in 2047 issued by the Kingdom of Bahrain, the Sultanate of Oman and the Kingdom of Saudi Arabia to illustrate the impacts mentioned alongside their behavior towards in conjunction with movements of the US 20-year treasury benchmark.