The fixed income markets have experienced a fascinating journey over the past twelve months, characterized by significant fluctuations in interest rates that reflect the evolving outlook for inflation and job growth. The landscape has shifted dramatically, with investors navigating a complex environment of changing economic indicators and Federal Reserve policies.

Yields have rebounded to yearly highs, with GCC yields now at 5.5%, approaching historical peaks.

At the beginning of 2024, high inflation dominated the narrative, consistently exceeding expectations. Inflation rates hovered above 3%, remaining significantly above the Federal Reserve’s target of 2%. This persistent inflation, coupled with a tight labor market, created a backdrop of uncertainty, leading to increased market volatility with markets pricing out any rate cut expectations. However, a notable shift occurred over the summer last year as unemployment ticked up from 3.9% to 4.2%, bringing job growth to the forefront of economic discussions and convinced the US Federal Reserve to cut rates for the first time since the outbreak of covid in March 2020.

The SICO Fixed Income Fund delivered a net return of 3.0%, while the Elzaad Sukuk Fund impressed with 5.5% in its inaugural year.

This was followed through by two additional 25 basis point cuts in November and December. These actions led investors to price in a total of up to ten rate cuts in the current cycle, resulting in a drop in 10-year Treasury yields to as low as 3.60% in September 2024. However, as economic strength persisted and inflation fears resurfaced, particularly following President Trump's reelection, yields increased by more than 100 basis points back to mid-4%. The return of inflation concerns, fueled by potential tariffs, tax cuts, and increased U.S. Treasury borrowings, added complexity to the fixed income landscape. The prospect of deregulation and trade wars raised questions about sustained economic growth and inflationary pressures, causing many investors to reassess their strategies.

The Fixed Income Fund boasts positive returns in 9 out of the last 10 years, highlighting a consistent track record

Despite these challenges, the current market environment presents a compelling opportunity for fixed income investors. Yields have rebounded to yearly highs, with GCC yields now at 5.5%, approaching historical peaks. This offers investors an attractive entry point, especially given the positive macro backdrop characterized by de-escalating geopolitical tensions, high oil prices, and improving balance sheets among GCC governments. The risk profile for fixed income investments has improved significantly compared to previous years, providing a more favorable environment for investors seeking yield and diversification. Today, the fixed income market offers a wealth of opportunities, and while there is potential for yields to rise further, the current valuations appear attractive from an “all-in” yield standpoint.

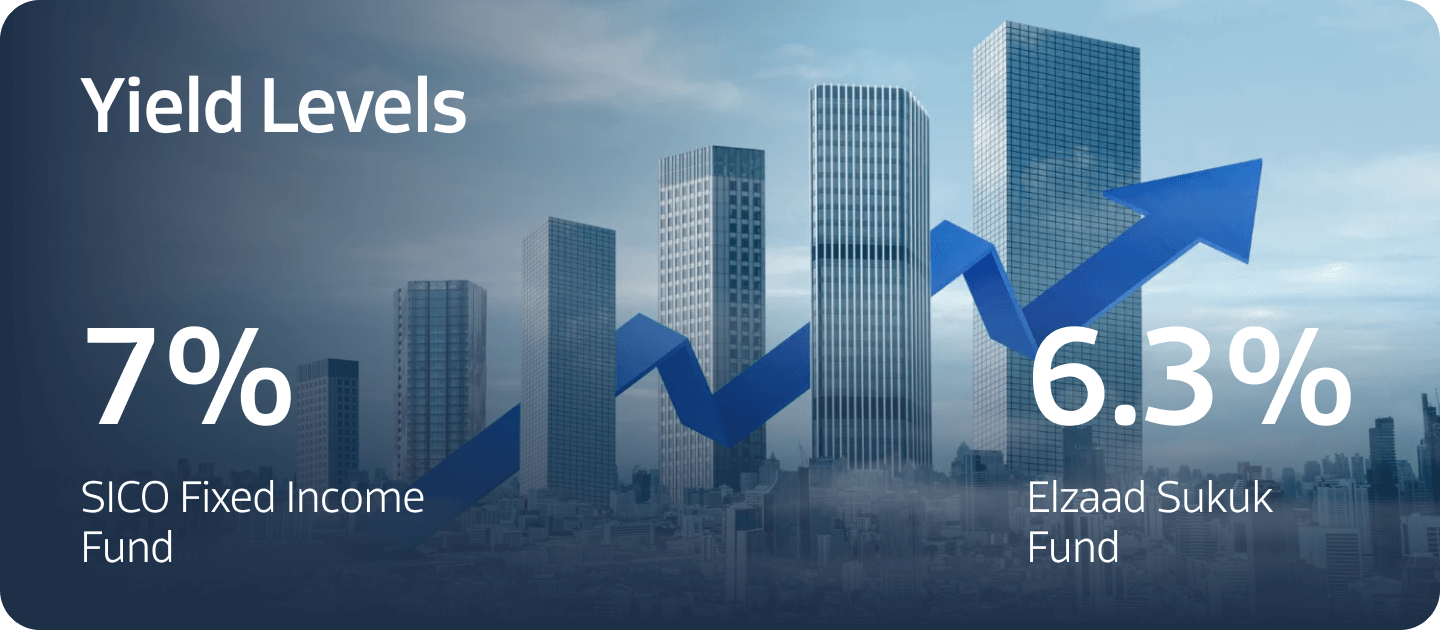

SICO Fixed Income Fund and Elzaad Sukuk Fund continue to set benchmarks in the fixed income investment space, offering robust returns, liquidity, and diversification opportunities for investors.

Both funds have demonstrated exceptional performance, topping their peer groups in 2024. The SICO Fixed Income Fund delivered a net return of 3.0%, while the Elzaad Sukuk Fund impressed with 5.5% in its inaugural year. The Fixed Income Fund boasts positive returns in 9 out of the last 10 years, highlighting a consistent track record.