News Highlights

SICO Launches Its New Saudi-based Investment Bank SICO Capital

SICO launched its newest subsidiary, SICO Capital, a full-fledged capital markets services provider based in Saudi Arabia. The launch of operations comes following the completion of the company’s acquisition from Bank Muscat by way of a share swap completed in March 2021 and its subsequent rebranding from Muscat Capital. The company named Hassan AlShuaiby as Chairman of the Board and Sultan Al Nugali as CEO.

Since the completion of the acquisition in March of this year, the company has worked to obtain all necessary approvals by relevant regulatory authorities as well as undergoing a complete brand overhaul from Muscat Capital to SICO Capital and finalizing its integration into the SICO network. In addition, the company has completed the appointment of its new board and management team.

SICO Capital offers a comprehensive range of financial services to individual, institutional, and corporate clients. With multiple licenses by the Saudi Capital Markets Authority including asset management, investment banking, and brokerage, the company offers SICO an ideal platform to offer a diversified suite of services to a wider client base in Saudi Arabia, the region’s largest capital market.

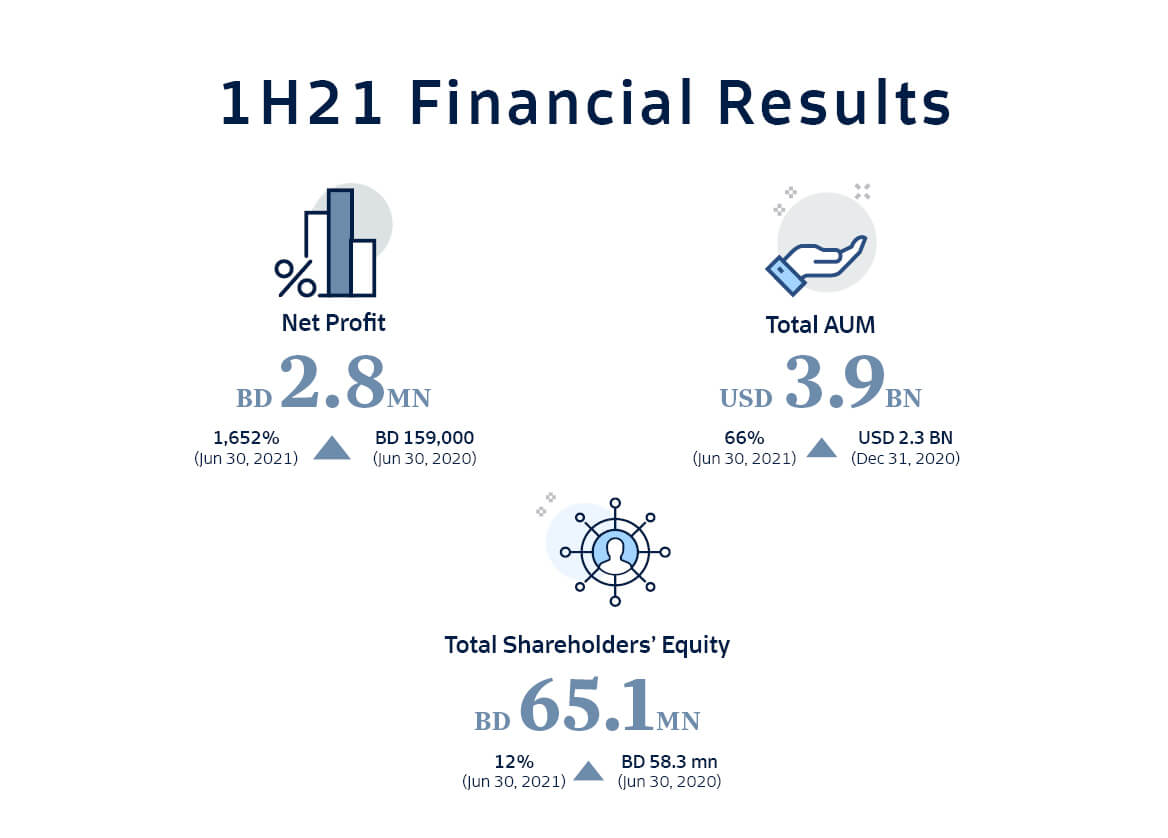

SICO Reports BD 2.8 million Net Profit in the First Half of 2021

In the first six months of 2021, SICO recorded a consolidated net profit amounting to BD 2.8 million, an increase of 1,635% compared to the first half of 2020. EPS were 7.09 Bahraini fils for the first half of 2021 compared to 0.43 Bahraini fils for the same period of 2020. SICO reported a total comprehensive income of BD 3.2 million for the first half of 2021, as compared to the comprehensive loss of BD 666 thousand booked for the first six months of 2020.

Commenting on SICO's performance for the first half of 2021, Chairman of the Board Shaikh Abdulla bin Khalifa Al Khalifa said: “Halfway through 2021, SICO is firmly on the path to leveraging the ongoing recovery in our broader market and to create sustainable value for the firm's clients. The Board of Directors is pleased with the strength we are witnessing across SICO's lines of business as the firm expands its geographic and operational footprint. Our existing operations continue to generate rapid organic growth, leaving us in a strong position to make the most of new opportunities and to deliver on our strategic initiatives.”

SICO's total assets and total equity attributed to shareholders increased by 26% and 12% respectively, to stand at BD 229.4 million and BD 65.1 million in the first half of 2021 compared to BD 181.8 million and BD 58.3 million recorded at year-end 2020. The increase in assets and shareholders' equity was driven by the share swap-based acquisition of Muscat Capital, which has been rebranded as SICO Capital,and the addition of a new shareholder (Bank Muscat).

SICO's net investment income, net fee income and net other interest income grew in 1H-2021, reaching BD 2.7 million, BD 2.3 million and BD 846 thousand respectively. Meanwhile, brokerage income decreased by 28% to come in at BD 1.5 million for 1H-2021. This decline was driven by a slowdown in fixed-income trading volumes compared to the extraordinary activity witnessed last year.

SICO Funds Continue to Advance in 2021

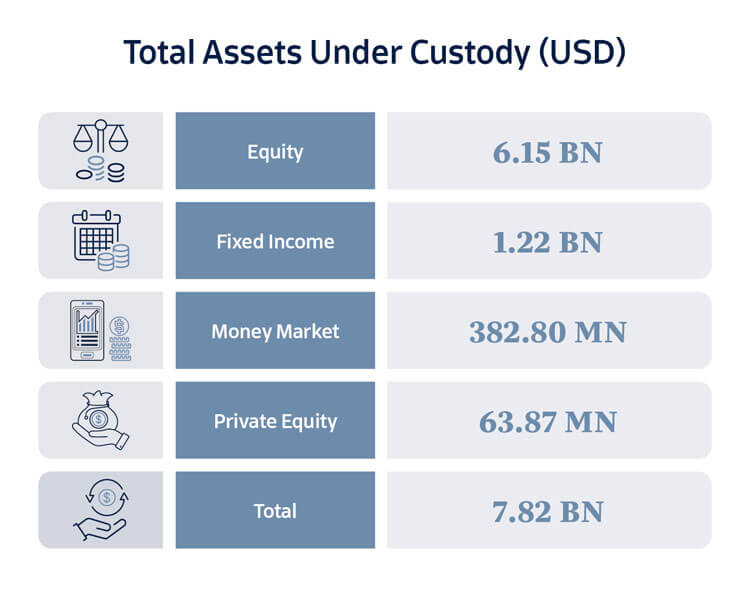

SICO AUMs grew to USD 4 billion in the first half of 2021 with mandates covering conventional and Sharia-compliant equities, money market and fixed income securities as well real estate. Following the completion of the acquisition of SICO Capital, SICO’s total assets under management (AUMs) grew to USD 4,067 billion with total equity AUMs amounting to USD 2,335 million; total fixed income and money market AUMs of USD 1,242 million; total real estate AUMs of USD 336 million; and total market making and other AUMs of USD 154 million.

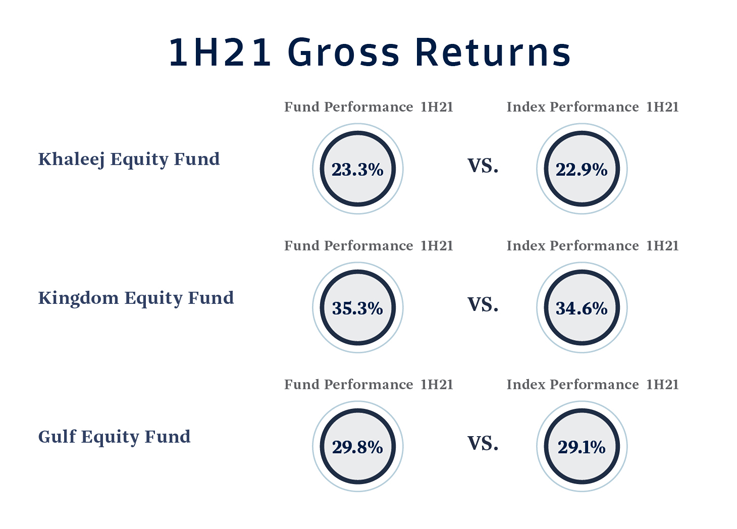

Regional markets have continued to rally in 2021, with the S&P pan-Arab index advancing by 29.1%, mostly driven by Saudi Arabia and the UAE owing mostly to gains in the petrochemical and financial sectors. The boom in commodity prices boosted the performance of the petrochemical sector while the growth in mortgage loans in Saudi, coupled with anticipated rate rises, contributed to gains in the financial sector.

In the first half of the year, SICO’s flagship Khaleej Equity Fund (KEF) generated a gross return of 29.8% as compared to benchmark of 29.1%. Stemming from a belief that the steep gains in the market drove many companies to trade at a significant premium to their underlying fundamentals, the bank opted to gradually book profits instead of chasing market momentum. Meanwhile, SICO’s Kingdom Equity Fund and SICO Gulf Equity Fund generated gross returns of 35.3% and 23.3% respectively, while the corresponding benchmarks gained 34.6% and 22.9% respectively.

During the same period, total assets under management (AUMs) of the Asset Management Equities department increased by USD 0.5 billion to USD 1.8 billion, reinforcing SICO’s standing as one of the largest institutional equity asset managers in the region.

SICO Successfully Completes Mandate as Receiving Agent and Delisting Agent for Investcorp Holdings B.S.C Voluntary Exit Offer and Subsequent De-listing from the Bahrain Bourse

SICO successfully completed its mandate by Investcorp Holdings B.S.C. (Investcorp) as receiving and delisting agent in relation to the voluntary exit offer provided to the ordinary shareholders of Investcorp and the subsequent delisting of the company’s ordinary shares from the Bahrain Bourse (BHB). As part of the transaction, Investcorp offered to repurchase from all shareholders desiring to fully exit from all of their ordinary shares at a price of US$ 11.50, which was higher than the closing market price on the last trading day prior to Investcorp’s Extraordinary General Meeting as well as the most recent audited book value of US$10.07 (as at 30 June 2020).

The final redemption date was announced to be July 1, 2021, with shareholders exiting Investcorp set to receive their payment in cash on the settlement and de-listing date of July 5, 2021. All shareholders that did not accept the offer will continue as shareholders in the closed company and their rights and obligations will be governed by the amended and restated memorandum and articles of association.

Investcorp has cited that converting the company into a closed joint stock company is the most appropriate ownership structure for the company going forward and will serve the interests of all stakeholders. The transaction comes amid de-listing activity witnessed regionally to optimize ownership structure.

SICO Appointed as Financial Advisor for Potential Consolidation of General Poultry Company and Delmon Poultry Company

SICO has been appointed by Mumtalakat, Bahrain’s sovereign wealth fund, to act as financial advisor for the potential consolidation of General Poultry Company (GPC) and Delmon Poultry Company (DPC). Mumtalakat currently holds cross-ownership positions in the two poultry companies, with a 100% stake in GPC and 15% in DPC.

GPC is the largest supplier of locally produced fresh eggs while DPC is one of the leading local suppliers of fresh chicken in the Kingdom of Bahrain with an estimated market capitalization of BHD 7.5 million. If successful, the consolidation of the two parties is expected to bring a range of revenue and cost synergies in the national poultry sector.

SFS Receives CBB Approval to Offer Operator Services

SICO’s wholly owned Bahrain-based subsidiary, SICO Funds Services Company (SFS) received approval from Center Bank of Bahrain (CBB) to provide operator services for Private Investment Undertakings (PIU).

The operator is responsible for undertaking the functions of establishing, operating, and winding-up including having full oversight of the corporate governance of investment funds. This allows its clients to focus on managing their investments by lifting operational burdens. With this approval, SFS becomes a one-stop-shop offering all fund-related services under one roof, namely operator, fund administration, custody, registrar and corporate services.