GCC Market Snapshot

GCC markets performed strongly in 2019 in line with global markets. The S&P GCC price return index gained 8%, similar to 2018, led by Kuwait, which was a beneficiary of fund flows backed by the market’s inclusion on the FTSE EM and MSCI EM indices toward the end of 2019.

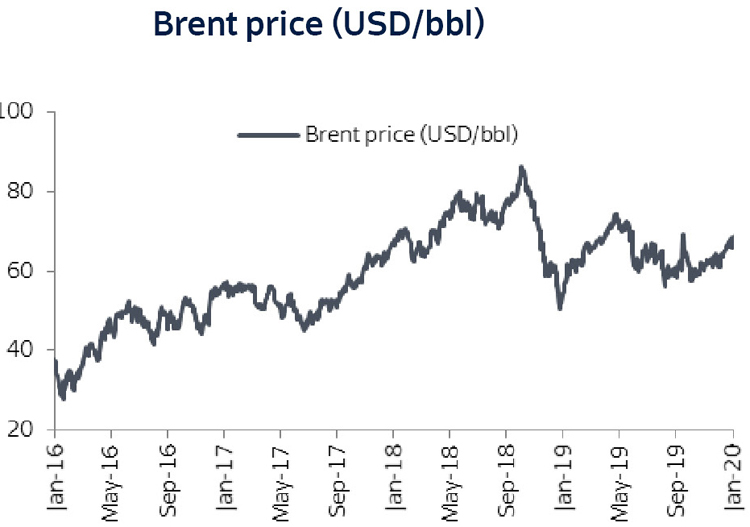

Bahrain was the second best performing market led by AUB, which rallied on the back of its merger with KFH. The biggest market, Saudi Arabia, saw market caps more than quadruple after the successful listing of Aramco at a valuation of USD 1.7 trillion. Tadawul also witnessed c. USD 27 billion in inflows from QFIs during 2019 backed by the market’s inclusion on both the MSCI EM and FTSE EM indices. The DFM gained 9% in 2019 led by a rally in index heavyweight Emirates NBD, which gained traction after announcing an increase in the FOL limit. Oman was the only market in the negative (-8%) for 2019 led by weak macros and stress on corporate earnings.

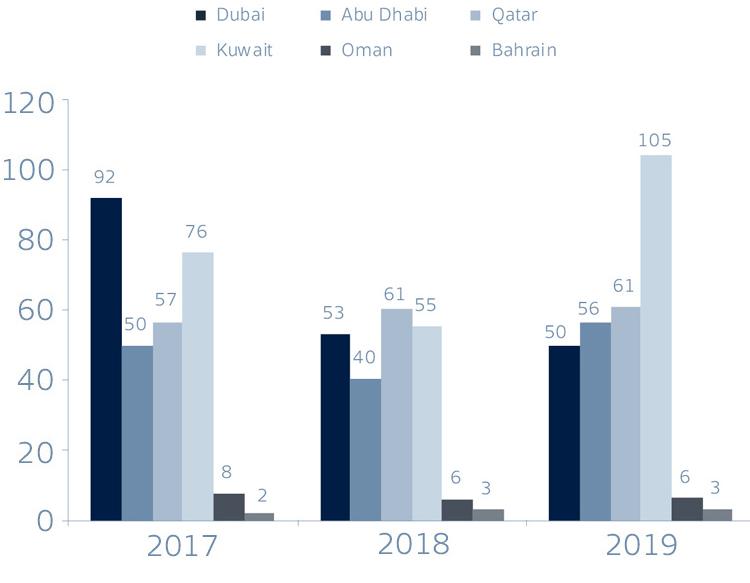

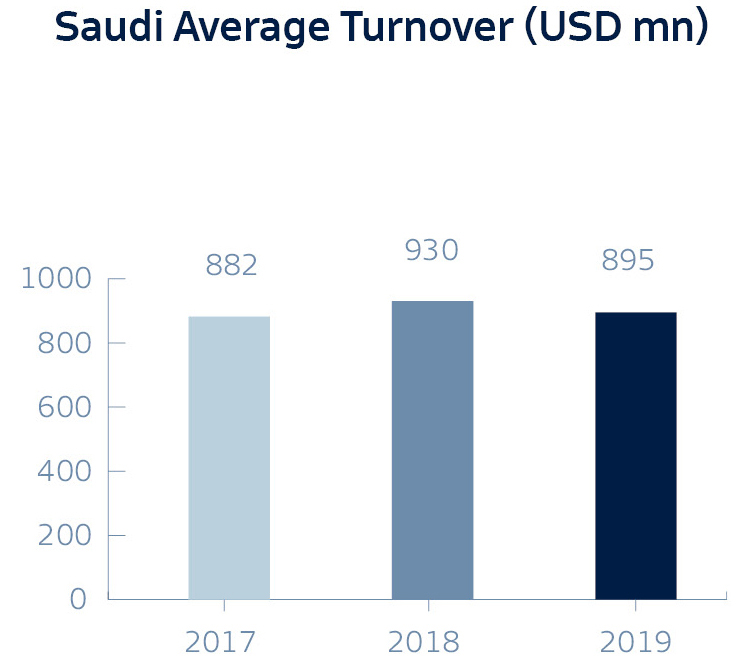

Turnover improved in Kuwait, gaining c. 90% on the back of the FTSE EM Index inclusion, as well as the ADX. Other GCC markets ended the year with turnover remaining flat or dipping slightly over the year before. Despite some improvement in Tadawul turnover after Aramco’s listing in December, broader market activity remained subdued during the year.

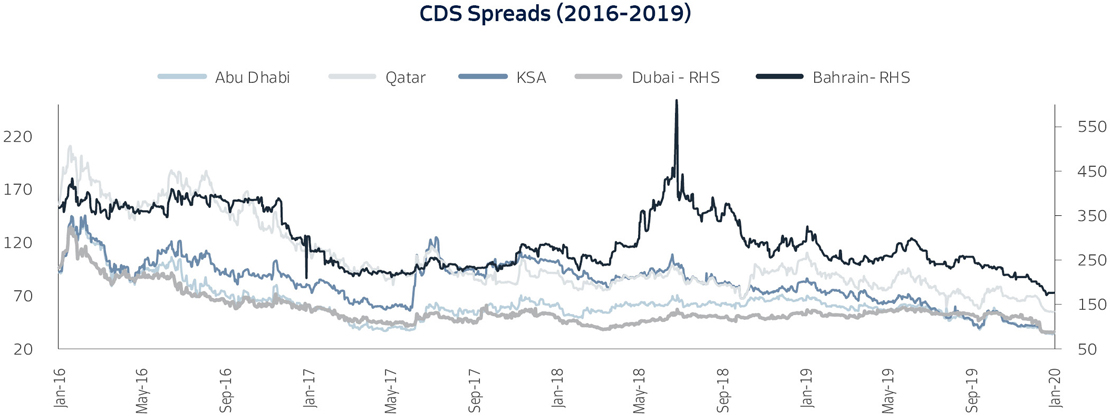

Another interesting trend across the region was compression of CDS spreads. Bahrain witnessed a maximum CDS spread compression of 115 bps, with other countries in the region following suit. Consequently yields tightened and investors chased high-yielding paper within the region as global yields compressed on the back of Fed rate cuts.

GCC Average Turnover (USD mn)