Corporate Governance Review

Commitment

SICO is committed to upholding the highest standards of corporate governance. This entails complying with regulatory requirements, protecting the rights and interests of all stakeholders, enhancing shareholder value, and achieving organisational efficiency. The Bank has Board-approved policies for risk management, compliance and internal controls, in accordance with the rules and guidelines from the Central Bank of Bahrain (CBB).

The adoption and implementation of corporate governance is the direct responsibility of the Board of Directors. The Board is committed to excellence in corporate governance and adheres to rules of the High Level Controls Module (HC Module) of the Central Bank of Bahrain; and the principles of the Corporate Governance Code of the Kingdom of Bahrain issued by the Ministry of Industry, Commerce, and Tourism.

Shareholder Information

The Bank’s shares are listed on the Bahrain Bourse as a closed company. As of 31 December 2019, the Bank had issued 428,487,741 ordinary shares of Bahraini fils 100 each. The last Annual General Meeting was held on 25 March 2019.

Responsibilities of the Board of Directors

The Board is accountable to the shareholders for the creation and delivery of strong, sustainable financial performance and long-term shareholder value. The Board works as a team to provide strategic leadership to staff, maintain the organisation’s fitness for purpose, set the values and standards for the organisation and ensure that sufficient financial and human resources are available.

The Board’s role and responsibilities are outlined in the Board Charter of the Bank. The Board organizes a formal schedule of matters for its decision-making process to ensure that the direction and control of the Bank rests with the Board. This process includes strategic issues and planning, review of management structure and responsibilities, monitoring management performance, acquisition and disposal of assets, investment policies, capital expenditure, authority levels, treasury policies, risk management policies, the appointment of auditors and review of the financial statements, financing and borrowing activities, reviewing and approving the annual operating plan and budget, ensuring regulatory compliance and reviewing the adequacy and integrity of internal systems and controls framework.

The Chairman is responsible for leading the Board, ensuring its effectiveness, monitoring the performance of the Executive Management and maintaining a dialogue with the Bank’s shareholders. The Chairman also ensures that new Directors receive a formal and tailored induction to facilitate their contribution to the Board.

Without abdicating its overall responsibility, the Board delegates certain responsibilities to Board Committees. This is to ensure sound decision-making and facilitate the conduct of business without unnecessary impediment, since speed of decision-making in the Bank is crucial. When a Committee is formed, a specific Charter of the Committee is established to cover matters such as the purpose, composition and function of the Committee. The Board has three Committees to assist it in carrying out its responsibilities: The Investment Committee, the Audit and Risk Committee and the Nominations, Remuneration and Corporate Governance Committee. The Internal Audit, Compliance and Risk functions reports directly to the Board through the Audit and Risk Committee. From time to time, the Board receives reports and recommendations from Board Committees and Management on matters it considers to be of significance to the Bank.

Board Composition and Election

The Board’s composition is guided by the Bank’s Articles of Association. As of 31 December 2019, the Board consisted of nine Directors, three of which are Independent Directors and six are Executive Directors, including the Chairman and Vice-Chairman. The Bank recognises the need for the Board’s composition to reflect a range of skills and expertise. Profiles of Board Members are listed later in this Review. The Company Secretary is Matthew B. Hansen. The classification of ‘Executive’ Directors, ‘Non-executive’ Directors and ‘Independent’ Directors is per the definitions stipulated by the CBB. Directors are elected by the shareholders at the AGM, subject to prior approval by the CBB, for a period of three years, after which they shall be eligible for re-election for a further three-year period.

Independence of Directors

In line with the requirements of the CBB’s HC Module, the Bank has put in place Board-approved criteria to determine ‘Test of Independence’ using formal requirements as specified in the CBB rule book and other relevant requirements as assessed by the Board of SICO. The purpose of the Test is to determine whether the Director is ‘Independent of management, and any business or other relationships, which could materially interfere with the Director’s ability to exercise objective, unfettered, or independent judgement; or the Director’s ability to act in the best interests of SICO’. Based on an assessment carried out in 2019, the Board of Directors resolved that the three Non-executive Directors of SICO met the relevant requirements of the ‘Test of Independence’, and accordingly, they were classified as ‘Independent’ Directors and Committee members of SICO’s Board of Directors.

Board and Committee Evaluation

The Board performs a self-evaluation on an annual basis. The Board periodically reviews its Charter and its own effectiveness, while initiating suitable steps for any amendments. The Board also reviews self-evaluations of the individual Board members, Chairman and the Board Committees, and considers appropriately any recommendations arising out of such evaluation.

Remuneration of Directors Policy

The Board of Directors’ remuneration is governed by provisions of the Commercial Companies Law 2001 and the CBB. The Directors’ remuneration is approved by the shareholders at the annual general meeting. In addition, the members are paid sitting fees for the various sub committees of the Board. The Board’s remuneration is reviewed by the Nomination, Remuneration and Corporate Governance Committee as per the remuneration policy. Directors’ remuneration is accounted as an expense as per international accounting standards and CBB regulations.

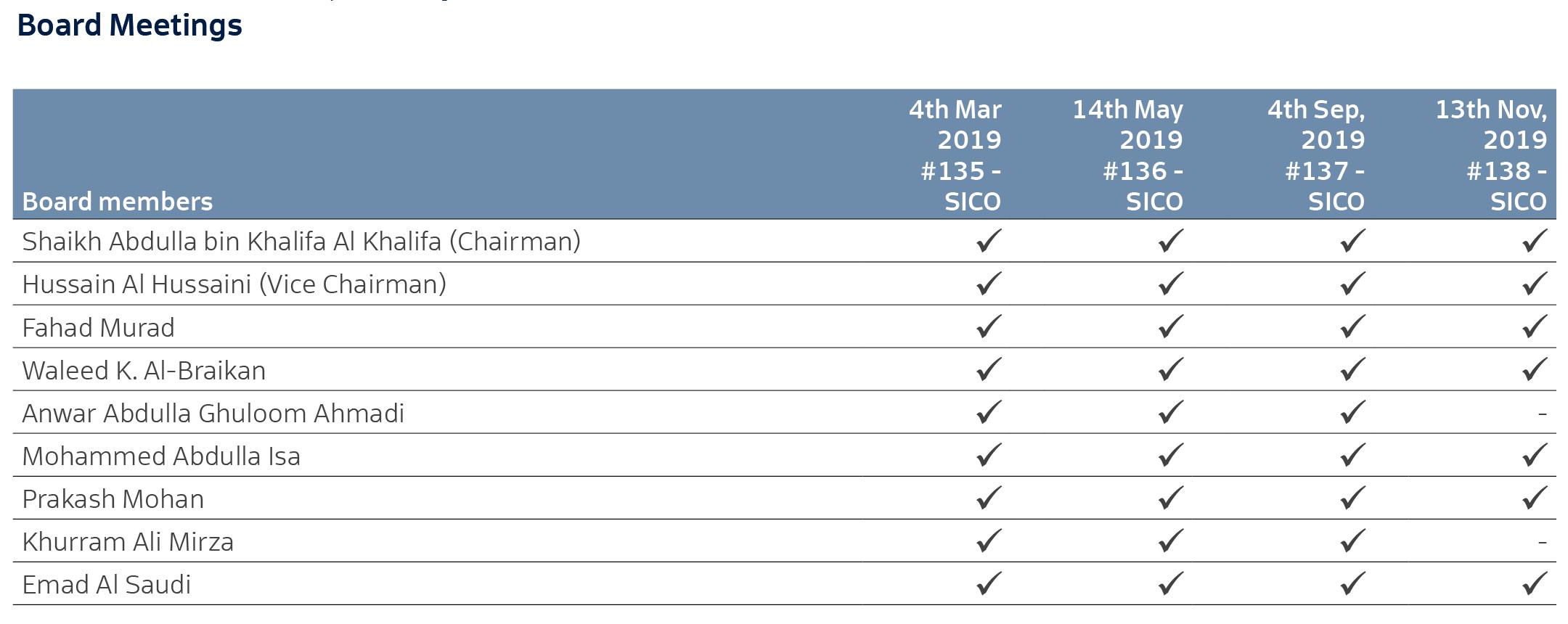

Board Meetings and Attendance

According to the Bahrain Commercial Companies Law and CBB rules, Board meetings will be conducted at least four times a year (on a quarterly basis). All Board members must attend at least 75% of all Board meetings within a calendar year. At least five Directors must attend each Board meeting, including the Chairman or the Vice-Chairman. During 2019, four Board meetings were held in Bahrain.

Directors’ Attendance: January to December 2019

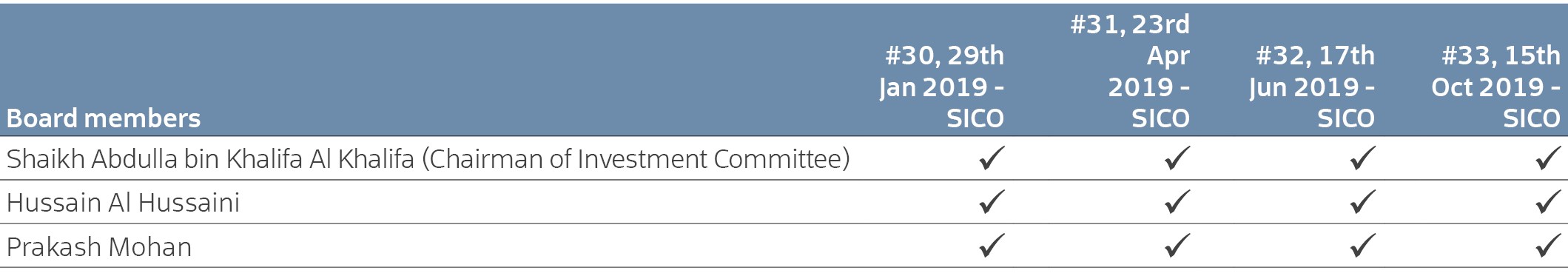

Investment Committee Meetings

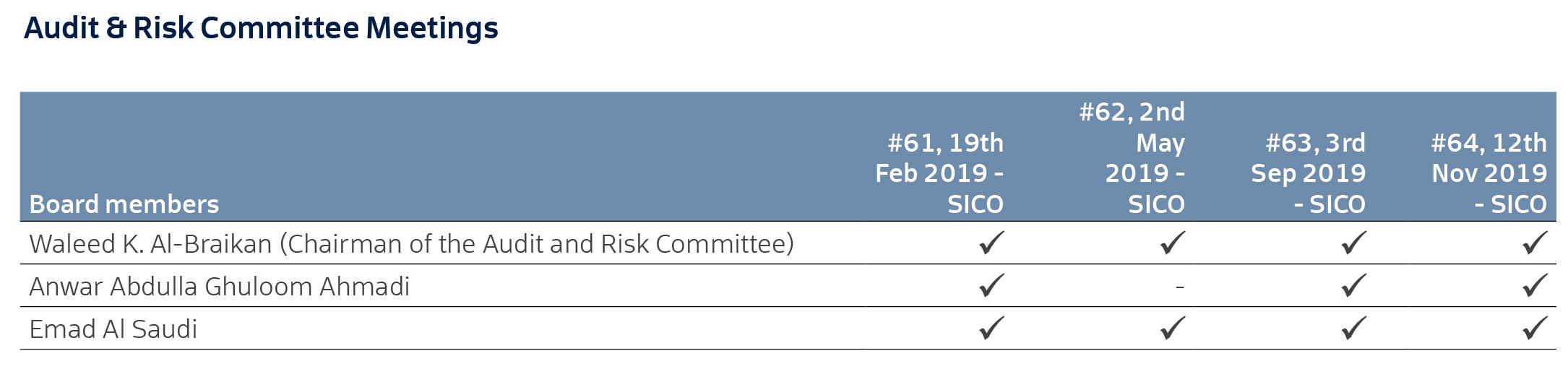

Audit & Risk Committee Meetings

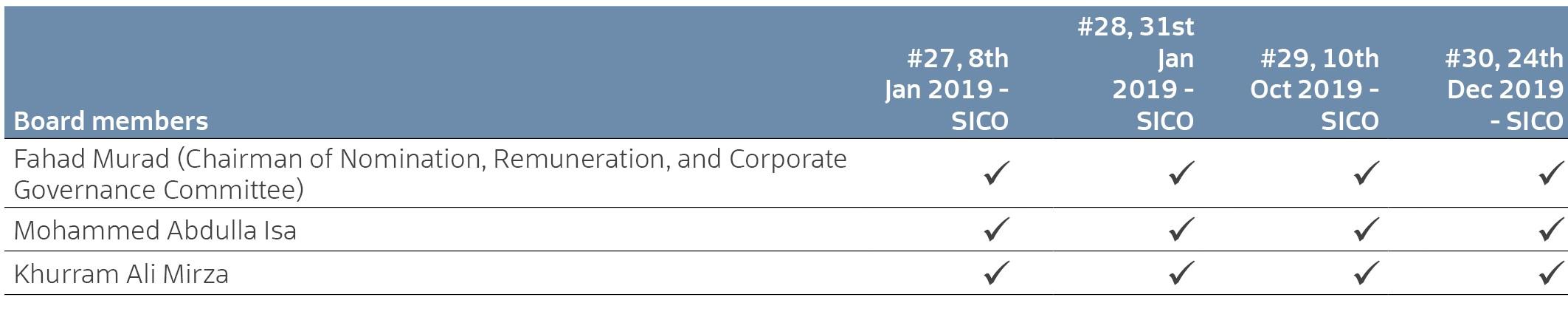

Nomination, Remuneration and Corporate Governance Committee Meetings

Board Committees

Investment Committee

Objective

- Review investment policies and procedures to monitor the application of, and compliance with, investment policies.

- Approve and recommend (where appropriate) to the Board relevant investment decisions (as defined in the Investment Policy Guidelines and Restrictions).

- Review strategic and budget business plans prior to submission to the Board.

- Review financial performance.

- Oversee the financial and investment affairs of the Bank.

- Review major organisational changes.

Audit and Risk Committee

Objective

- Review the Bank’s accounting and financial practices.

- Review the integrity of the Bank’s financial and internal controls and financial statements.

- Recommend the appointment, compensation and oversight of the Bank’s External Auditors.

- Recommend the appointment of the Internal Auditor.

- Review the Bank’s Compliance procedures and Regulatory matters.

- Provide active oversight on the risk management framework, approve risk policies and limits, and ensure adequacy of risk controls.

Nomination, Remuneration and Corporate Governance Committee

Objective

- Identify and screen suitable and qualified candidates as members of the Board of Directors, or Chief Executive Officer, Chief Financial Officer, Corporate Secretary and any other officers of the Bank considered appropriate by the Board, and as and when such positions become vacant; with the exception of the appointment of the heads of Internal Auditor, Compliance and Risk Management which shall be the responsibility of the Audit and Risk Committee

- Review the Bank’s remuneration policies for the approved persons and material risk-takers, which must be approved by the shareholders and be consistent with the corporate values and strategy of the Bank.

- Approve the remuneration policy and amounts for approved persons and material risk-takers, as well as the total variable remuneration to be distributed, taking account of total remuneration including salaries, fees, expenses, bonuses and other employee benefits.

- Approve, monitor and review the remuneration system to ensure the system operates as intended.

- Recommend Board members’ remuneration based on their attendance and performance, and in compliance with Article 188 of the Company Law.

- Review the Bank’s existing Corporate Governance policies and framework.

- Advise the Board on the Bank’s public reporting of information on Corporate Governance practices and issues.

- Provide a formal forum for communication between the Board and Management on Corporate Governance issues

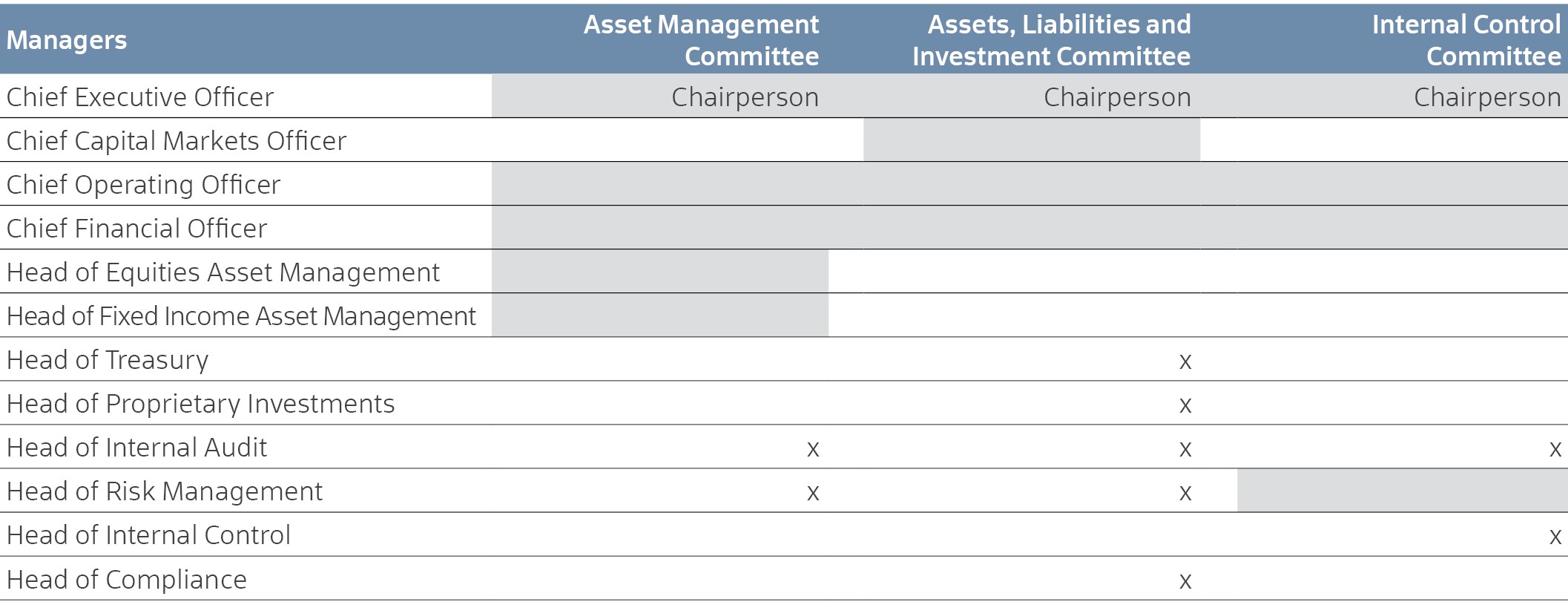

Management

The Board delegates the authority for the day-to-day management of the business to the Chief Executive Officer, who is supported by a qualified senior management team and three management committees: Asset Management Committee, Assets, Liabilities and Investments Committee (ALIC) and Internal Control Committee.

Management Committees

Asset Management Committee

Objective

- To oversee the fiduciary responsibilities carried out by the Asset Management Department in managing clients’ discretionary portfolios as well as the funds operated and managed by SICO. It also reviews the investment strategy of the Bank’s funds and portfolios,; reviews and approves portfolio performance; and reviews subscription, and redemptions, and compliance.

Assets, Liabilities, and Investments Committee (ALIC)

Objective

- ALIC acts as the principal policy-making body responsible for overseeing the Bank’s capital and financial resources. It is also responsible for managing the balance sheet and all proprietary investment activities, including investment strategy and asset, country and industry/sector allocations. The committee is specifically responsible for managing the balance sheet risk, capital and dividend planning, forecasting and monitoring interest rate risk positions, liquidity and funds management. The committee is also responsible for formulating and reviewing the Bank’s investment policies (subject to approval by the Board), strategies and performance measurement and assessment.’

Internal control committee (ICC)

Objective

- To oversee the Internal Control functions carried out in SICO by various departments. The remit of ICC is to look into strengthening the internal control culture throughout the company by ensuring that each department head takes ownership, responsibility and accountability for internal control. The Committee is entrusted with the responsibility to consult and advise the Board of Directors in the assessment and decision making concerning the Bank’s system of risk management, internal control and corporate governance.

Management Profiles

Najla Al Shirawi

Chief Executive Officer

Najla Al Shirawi has more than 22 years of investment banking experience. Having been part of SICO since 1997, she was appointed CEO in 2014 following her appointment as deputy CEO in 2013. Najla served with Geneva-based Dar Al-Maal Al- Islami Trust, where she established private banking operations for the Group in the Gulf region. Najla is a Board member at the Bahrain Economic Board (EDB) and a Chairperson on the Board of Directors for two SICO subsidiaries: SICO Funds Services Company (SFS) in Bahrain and SICO Financial Brokerage in Abu Dhabi. She is also an Independent Board Member of Eskan Bank BSC(c), Bahrain and a Board Member of the Deposit Protection Scheme, Bahrain, the Bahrain Associations of Banks, and the Bahrain Institute of Banking and Finance. She holds an MBA from the American College in London and a BA in Civil Engineering from University of Bahrain.

Fadhel Makhlooq

Chief Capital Markets Officer

With over 37 years of professional experience, Fadhel Makhlooq joined SICO in 2004 as Head of Brokerage before being appointed Head of Investments & Treasury in 2008. He was re-appointed Head of Brokerage in 2010 and then assumed the position of Chief Capital Markets Officer in 2018. Prior to joining SICO, he worked for a number of leading financial institutions including Investcorp and Chemical Bank (now JPM Morgan Chase). He currently also serves as Board Member of SICO Financial Brokerage. Fadhel holds an MBA from Glamorgan University, UK.

Anantha Narayanan

Chief Operating Officer

With over 29 years of diversified experience in the areas of operations, audit, and risk in the banking industry, Anantha joined SICO in 2008. Prior to joining SICO, he worked for Credit Agricole, BBK, Commercial Bank of Oman/Bank Muscat, and PricewaterhouseCoopers. Anantha is a Chartered Accountant and Cost Accountant (India), a Certified Information Systems Auditor (USA), Financial Risk Manager (USA), and an Associate Member of the Institute of Financial Studies (UK). He holds a BSc Honours from the University of Manchester, UK.

K. Shyam Krishnan

Chief Financial Officer

K. Shyam Krishnan has 29 years of experience in finance, accounting, audit, investments and risk management, with the majority of his career spent in conventional and Sharia-compliant banking. Shyam currently also serves as a Board Member of SICO Financial Brokerage. Prior to joining SICO in 2015, he was Group Head of Finance at Al Salam Bank-Bahrain. Before this, he was Head of Hedge Funds’ Operational Risk Management at Investcorp, Bahrain and Audit Supervisor at the Bahrain office of Ernst & Young. He is a Chartered Accountant and Management Accountant from India and a Chartered Financial Analyst, Certified Internal Auditor and also a Certified Information Systems Auditor. He holds a Bachelor of Commerce from Madras University, India.

Shakeel Sarwar

Head of Equities Asset Management

Shakeel Sarwar joined SICO in 2004 and, over the length of his career, has accumulated over 25 years of investment industry experience in the UK, Pakistan and the Middle East. Prior to joining SICO, he worked with Riyad Bank’s Asset Management Division and was part of a team that managed over USD 3 billion in Saudi equities. He has also held positions with ABN Amro Asia Securities in the UK and Pakistan. Shakeel holds an MBA in Banking and Finance from IBA, Karachi, Pakistan.

Ali Marshad

Head of Fixed Income Asset Management

Ali Marshad has over 14 years of experience in asset management, investments, treasury and brokerage. Joining SICO in 2008 as an Analyst in the Investments & Treasury division, Ali then headed up the newly established Fixed Income Desk in 2012 before being promoted to Head of Fixed Income in 2015. Prior to joining SICO, he worked in the UK as an Analyst with Mercer Investment Consulting and as a Performance Analyst with UBS Global Asset Management - London. A Chartered Financial Analyst, Ali holds a BSc (Honours) in Banking, Finance & Management from Loughborough University, UK.

Wissam Haddad

Head of Investment Banking and Real Estate

Wissam Haddad has 18 years of experience in investment banking, private equity and corporate finance. Prior to joining SICO in 2014, he was a Director with Gate Capital in Dubai and had previously held senior positions with UAE-based Najd Investments, Unicorn Capital, Emirates NBD’s NBD Sana Capital, Saudi National Commercial Bank’s NCB Capital, and Eastgate Capital among others. Wissam holds a BCom degree from Concordia University, Canada.

Jithesh K. Gopi

Head of Proprietary Investments

Jithesh Gopi has over 25 years of experience in investment management, research and analytics. Since 2013, he worked with Al Rajhi Capital in Riyadh as Head of Research, Head of Asset Management, Director of Research and Financial Institutions, and Director of Corporate Development and Proprietary Investments. In 2006, he joined SICO as Senior Analyst and as Head of Research covering over 50 companies in major sectors. Jithesh holds B.Sc. in Mechanical Engineering from the College of Engineering, Trivandrum, India and an MBA from the Asian Institute of Management in Manila, Philippines. He is also a CFA charterholder and has completed the Asian International Executive Program at INSEAD Singapore.

Mariam Isa

Head of Brokerage

Mariam Isa has 15 years of experience in regional equity trading and sales. She joined SICO in 2005. Before becoming the Head of Brokerage, she held the positions of Chief Broker. Mariam has also worked as a Senior Officer in the Placement Department at Gulf Finance House. She holds an MBA in Islamic Finance from University College of Bahrain and has a n Associate Diploma in Accounting from University of Bahrain; and a Treasury & Capital Market Diploma from BIBF, and has completed the Leadership Development Program, University of Virginia, USA.

Salman Al Sairafi

Head of Global Markets

With more than 17 years of experience in financial services and technology, Salman Al Sairafi joined SICO in 2020 as head of the newly established Global Markets division. Prior to joining SICO, he held the role of Chief Investment Officer and Board Member at Capital Growth Management in Bahrain and was Senior Investment Advisor at United Consulting Group in Saudi Arabia. Prior to that, he headed the Fixed Income and Money Markets desk at NCB Capital in Saudi Arabia. Salman has also held various other positions in Bahrain and the UK in the fields of consulting and R&D. Salman is Chairman of the Board at Dar Al Ma’rifa in Bahrain and is both a Chartered Financial Analyst and Chartered Alternative Investment Analyst. He holds a B.Eng in Information Systems Engineering and an M.Sc in Advanced Computing from Imperial College London and is a former Chevening Scholar.

Shaikha Mohammed Kamal

Head of Market Making

Shaikha Kamal has over 16 years of professional experience in Treasury at SICO, which she leverages in her current role as Head of Market Making. Shaikha joined SICO in 2004 as a Senior Dealer with the Treasury Department before being appointed Portfolio Manager in 2011. Her responsibilities include proprietary investment, where she specialized in various asset classes such as equities and fixed income in addition to the Market Making function, managing various mandates and proposed services to several clients across the GCC region. She holds an MSc. in Finance from DePaul University in Chicago in addition to a BSc. in Business Information System from the University of Bahrain.

Nishit Lakhotia

Head of Research

Nishit Lakhotia has nearly 16 years of experience in the fields of investment research, risk management, hedge funds and private equity. He has been involved in sell side Research in SICO since 2009 actively covering sectors such as telecommunications, consumers, aviation, and construction across the GCC. Previously, Nishit worked for an Iceland-based private equity firm focusing on India’s infrastructure sector and a US-based global hedge fund. Nishit is a Chartered Financial Analyst, a Chartered Alternative Investment Analyst, and a Financial Risk Manager from the Global Association of Risk Professionals. He holds an MBA in Finance from the Narsee Monjee Institute of Management Studies, Mumbai, India.

Husain Najati

Head of Treasury

Husain Najati has over 15 years of experience in financial control, fixed income and foreign exchange trading. Husain joined SICO in 2006 as a Financial Controller where he was responsible for accounting support for operational management. In 2008, Husain became a Senior Dealer in the Investment and Treasury Department, responsible for money market, FX, and fixed income management and monitoring investments across primary and secondary markets. Husain holds a Dealing Certificate from the ACI Financial Markets Association in addition to a Treasury and Capital Markets Diploma from the Bahrain Institute for Banking & Finance. He also holds a B.Sc. in Banking and Finance form the University of Bahrain.

Nadeen Oweis

Head of Corporate Communications

Nadeen Oweis joined SICO in 2008 and has accumulated over 20 years of professional experience. Prior to joining SICO, Nadeen oversaw corporate communications and public relations for Microsoft in Bahrain. Before this, she handled regional accounts for Lowe Contexture. She also held posts at Proctor & Gamble Jordan and managed the advertising and promotions account for Radio Fann FM in Jordan. Nadeen holds an MA in Diplomatic Studies from the Jordan Institute of Diplomacy, a BA in Law from the University of Jordan, and a Certificate of Digital Marketing from Columbia Business School.

Haitham K. Haji

Head of Distribution and Business Development

Haitham Haji holds over 21 years of experience within the fields of investment, treasury, research and business development. Previously, Haitham was CEO of Investrade Company B.S.C.. Haitham served as a consultant with Gatehouse Bank in the UK advising on GCC-based investments, Director and Senior Relationship manager for Credit Suisse Bahrain, and Investment Placement Director with ARCAPITA Bank. Haitham began his career with Bank of Bahrain and Kuwait in Operations, Research and Business Development and as Treasury and Investment Manager. Haitham holds a BA in Public Administration from the University of Kent and an MBA from Durham Business School.

Fatima Mansoor

Head of Client Relations

With more than 14 years of experience in regional equity trading and client relations, Fatima Mansoor joined SICO in 2006 as a broker, assuming the role of senior broker in 2008. She moved to the Client Relations Department in 2017 and was appointed head of the department in 2019. Fatima holds a B.SC in Banking and Finance from the University of Bahrain and an MBA in Finance from the New York Institute of Technology.

Nadia Albinkhalil

Head of HR & Administration

Nadia Albinkhalil more than 25 years of experience and has been with SICO since inception, during which time she established the HR & Administration Department and had been responsible for Board meeting administration. Prior to joining SICO, she provided administrative support for the Private Banking Unit of Chase Manhattan Bank. Nadia holds a Diploma in Office Management from Bahrain University.

Husain Ahmed

Head of Operations

Husain has 14 years of banking experience, having joined SICO in 2006. Before becoming Acting Head of Operations in 2019, he held the position of Vice President of Operations at SICO. Husain holds an MBA from Arabian Gulf University and a BSc in Business Informatics from AMA University. Husain has also received numerous anti-money laundering and backoffice operation training certifications.

Mohammed Ibrahim

Head of Information Technology

Mohammed Ibrahim has over 19 years of experience in the field of information technology (IT) including IT project management, business analysis, complex system builds and interfaces, business continuity planning, and information security. Prior to joining SICO in 2007 he was Training Head and Technical Consultants Team Lead at the Bahrain Institute of Technology and Technical and Training Manager at YAT Group, Egypt. Mohammed is a Certified Information Systems Security Professional (CISSIP), a Master Certified Internet Web Professional (MCIW), a Microsoft Certified Solutions Expert, and a Microsoft Certified Trainer. He holds a Bachelor of Science and Education degree and a Postgraduate Diploma in Science and Education from Alexandria University, Egypt.

Simone Del Nevo

Head of Legal

Simone Del Nevo joined SICO as Head of Legal in 2018 and has 13 years of experience in law. Before joining SICO, Simone was an Associate with international law firm Baker & McKenzie in Europe and Japan where he specialized in banking, finance and securities law. In 2012, he practiced as in-house finance counsel to a major European gas infrastructure company in an award-winning multi-billion-Euro refinancing. Simone relocated to Bahrain in 2014 working as Senior Associate in the leading regional firm ASAR - Al Ruwayeh & Partners. He received his Law Degree from Bocconi University of Milan in 2004 and was admitted to the Milan Bar Association as a qualified lawyer in 2007.

Mohammed Juma

Head of Compliance and MLRO

Mohammed Juma holds over 16 years of experience in compliance, investment and operations management. Mohammed joined SICO in 2016 as Head of Compliance and MLRO where he is responsible for monitoring SICO Group’s operational adherence with the guidelines of regulatory authorities. Previously, Mohammed was Head of Compliance and MLRO with the International Investment Bank and JS Bank Limited in Bahrain. Mohammed holds a BA in Banking and Finance from the University of Bahrain and has completed the Leadership Grooming Executive Program with the Ivy Business School in Canada and Hong Kong. He is a Certified Compliance Professional and a Certified Anti-Money Laundering Specialist.

Joseph Thomas

Head of Internal Audit

Joseph Thomas has over 17 years of experience in internal audits, assurance engagements, and other financial advisory services. Joseph joined SICO in 2015 after having been Head of Internal Audit at Global Banking Corporation and holding a post with the Risk Consulting division of KPMG Bahrain. He began his career with Bharat Overseas Bank in India, followed by an internal audit role at the South Indian Bank. He later served as Audit Manager and Partner at a Dubai-based auditing firm. Joseph is a Chartered Accountant and a Certified Internal Auditor. He holds a Bachelor of Commerce degree from Mahatma Gandhi University in India.

Srikanth Sethuraman

Acting Head of Risk

Srikanth Sethuraman has over 26 years of experience in Risk Management, Finance, accounting and audit, with the majority of his career spent in credit, operational and market risk management. Prior to joining SICO in September 2019, he was Head of Finance and Credit Operations at Standard Chartered Global Finance Services, India. Prior to that, he was Head of Alternative Investments’ Risk Information Management at Investcorp, Bahrain and Audit Supervisor at the Bahrain office of Ernst & Young. He is a Chartered Accountant and Management Accountant from India and a Chartered Financial Analyst and also a Certified Information Systems Auditor. He holds a Bachelor of Commerce from Madras University, India.

Matthew Hansen

Corporate Secretary

Matthew Hansen became a consultant for SICO in 2013, and he has served as the Corporate Secretary for SICO's Board of Directors since 2015. He is the General Manager of Peak Consultancy W.L.L., which is a business advisory firm in Bahrain. From 2004 to 2013 he was the Chief Legal Counsel for The Family Office BSC (c), the first multi-family office company in the Middle East. Matthew was the Legal Counsel for Bahrain Middle East Bank E.C. He has also been an associate attorney at the law firms of Baker & McKenzie (Bahrain), Hughes Hubbard & Reed LLP (New York), and Hawkins Delafield & Wood LLP (New York). Matthew received his Bachelor of Arts from Haverford College in Pennsylvania, and his Juris Doctor from St. John's University School of Law in New York. He has been a member of the New York State Bar Association since 1995.

Naser Obaid

Chief Executive Officer SICO Funds Services Company BSC (c) (SFS)

Naser Obaid has over 23 years of experience in the financial services industry across the region. Prior to joining SFS in 2019, he was a Financial Advisor to the Chairman at NBB Capital and BBIH Group. Naser previously held positions at a number of leading trust and fund service providers including Chief Executive Officer at Crestbridge Bahrain, Executive Director and Member of Senior Management at Ohad Trust, and Assistant Vice President at TAIB Bank. He has also held positions in Deloitte & Touche and KPMG in Bahrain and Yemen respectively. Naser holds a BA in Commerce from Osmania University as well as an MA in Accountancy and Management Audit from Bangalore University.

Bassam A. Khoury

General Manager SICO Financial Brokerage LLC

Bassam A. Khoury has over 34 years of international experience in brokerage, investments, and financial consultancy. He joined SICO in 2008 as Head of Brokerage before leaving in 2010 to join QInvest, Qatar as Head of Regional Brokerage. Prior to re-joining SICO in 2013 as General Manager of SICO Financial Brokerage, Bassam was Chief Executive Officer of Bahrainbased ABC Securities. Previously, he worked with Banque Saudi Fransi in Saudi Arabia, BMB Investment Bank and Lehman Brothers in Bahrain, a private family office in Paris, and M Sternburg & Company in the USA. Bassam holds a BSc degree in Business Administration & Economics from King’s College, New York, USA.

Governance Framework

SICO’s Corporate Governance framework comprises of Board and Committee Charters, Code of Business Conduct, operational policies and procedures, internal controls and risk management systems, compliance procedures, delegated authority limits (DAL), internal and external audit, effective communications and transparent disclosure and measurement and accountability.

Code of Business Conduct

SICO conducts itself in accordance with the highest standards of ethical behaviour. A Code of Conduct for SICO Staff has been developed to govern the personal and professional conduct of all employees. The Code of Conduct outlines areas of conflict of interest, confidentiality, fair and equitable treatment, ethics and acting responsibly, honestly, fairly and ethically; and managing customer complaints. A Whistleblowing Policy and Procedures is included within the Code of Conduct for SICO Staff.

Recruitment of Relatives Policy

The Bank has in place policies that govern the recruitment and appointment of relatives to the Bank. Existing employees are required to alert the Human Resource Department of any relatives, or relationship of other employees or candidates being interviewed. Failure to do so will be seen as a breach of conduct and subject to disciplinary action as per the Bank’s policy.

Compliance and Anti-Money Laundering

As a licensed conventional wholesale bank and listed company, SICO has in place comprehensive policies and procedures to ensure full compliance with the relevant rules and regulations of the CBB and the Bahrain Bourse. The Bank has an independent Compliance Department in keeping with Basel and CBB guidelines. The Compliance Department acts as the central coordinator for all matters relating to regulatory reporting and other requirements.

Anti-money laundering measures are also an important area for the Compliance Department, with a designated Money Laundering Reporting Officer (MLRO) and Deputy MLRO. The Bank has documented anti-money laundering and combating the financing of terrorism procedures in conformity to the regulatory requirements in the Kingdom of Bahrain. SICO has implemented a risk-based automated transaction monitoring system, which further enhances the Bank’s anti-money laundering measures in line with the regulations of the CBB.

Corporate Communications

SICO conducts all communications with its stakeholders in a professional, honest, transparent, understandable, accurate and timely manner. Main communications channels include an annual report, corporate website and regular announcements in the appropriate local media. To ensure disclosure of relevant information to all shareholders on a timely basis, the Bank publishes its annual report and the past ten years’ financial statements on the corporate website .

Related Party Transactions & Conflict of Interest

The Directors make every practicable effort to arrange their personal and business affairs to avoid a conflict of interest with the Bank. The Directors disclose their interests in other entities or activities to the NRCG committee on an annual basis, inform the Bank of any conflict of interest whenever it arises and abstain from voting on any related subject matter. The Bank reviewed all such transactions during 2019 and there were no transactions involving potential conflicts of interest which need to be brought to the shareholders’ attention. The related party transaction details are disclosed in Note 26 of the Consolidated Financial Statements.

Remuneration of Board Members and Senior Management, and Fees Paid to External Auditors

The remuneration paid to Board members and senior management personnel are disclosed in Note 26 of the Consolidated Financial Statements. The information on fees paid to External Auditors for audit and other services will be available to the CBB and shareholders upon request, provided such disclosure does not impact the interest of Bank.

Compliance with the CBB’s High-Level Controls Module

Every conventional bank licensee is expected to comply with rules and guidance mentioned in the High-Level Controls Module issued by the CBB under Rulebook Volume 1. Any non-compliance with the Module needs to be explained by disclosure in the annual report to shareholders and the CBB.

SICO is in compliance with the module except for the following:

HC-1.4.6 and HC-1.4.8, which stipulate that the chairman of the Board of Directors should be an independent director, SICO Chairman Shaikh Abdulla bin Khalifa Al Khalifa is considered an Executive Director as he represents SICO’s major shareholder. However, this does not compromise the high standards of corporate governance as the bank follows strict policies to manage conflict of interest in Board decisions.

HC-1.8.2, HC-4.2.2 and HC-5.3.2 state that the Corporate Governance Committee, Nomination Committee and Remuneration Committee must include only 3 independent directors. The Chairman of the Nomination, Remuneration and Corporate Governance Committee is an independent director, however, the remaining two members are executive directors. The bank is of the opinion that this does not compromise the high standards of corporate governance as the bank has implemented measures to manage potential conflict of interest.

HC-6.5.49 stipulates that every 5 years, the audit committee must commission an independent external quality assurance review of the internal audit function. Currently, SICO plans for the same before the end of 2020.

HC-6.5.51, requires senior management to ensure that all internal audit findings and recommendations are resolved within six months for high risk issues and twelve months for others from the issue date of the subject internal audit report. Some of the findings have not been resolved within the stipulated time frame, however, relevant management is working on addressing this issue.