Research

SICO Research is a pioneer of sell-side research in the GCC, with a team that delivers in-depth products and insights that are utilized by a broad spectrum of clients within the GCC region and beyond. The division’s team is comprised of eight expert analysts, many of whom are CFA charter holders, all concerned with producing high quality research that covers over 80 companies across 13 key regional sectors. Through its offerings, the division also provides clients with valuable and timely advice that assists in strategic decision-making processes.

In 2022, the SICO Research team continued to deliver its objective research reports, company analyses, newsletters, and periodicals, through which the division’s analysts conveyed their insightful observations, revisions, and prudent viewpoints.

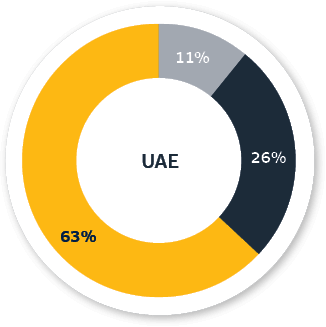

SICO Research’s highly regarded Top-20 Portfolio, an equally weighted portfolio which comprises 20 diversified GCC stocks, has generated a cumulative return of 140% since its launch in November 2017. The Top-20 product has consistently outperformed its benchmark, the S&P GCC Total Return Index, which on a comparative basis delivered returns at 70% during the period. SICO Research’s team has replicated a fundamentally strong diversified portfolio for its clients, with the Top-20 portfolio returning a positive 7.1% return versus a 4.8% decline for the S&P GCC benchmark index in 2022. The success of this product is a result of the team’s close monitoring at a macro and company-specific level, and decisions to churn the portfolio at the beginning of each month (excluding exceptions).

SICO Research invested in supporting client queries and requests regarding investment fundamentals, value, and market volatility. In addition, the team has been active in covering primary listings, providing objective timely valuations and recommendations, as the IPO scene in the GCC boomed in 2022. The team launched its new user-friendly research mobile appli cation, an easy-to-use app providing timely insights and easy access to all research products, investment ideas, and their top stock picks within the GCC. Several research products, including the SICO Research por tal, were also enhanced.

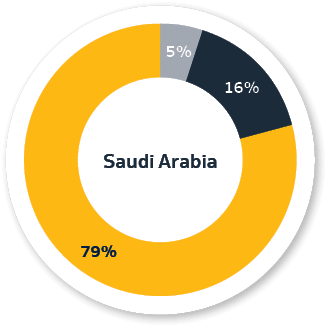

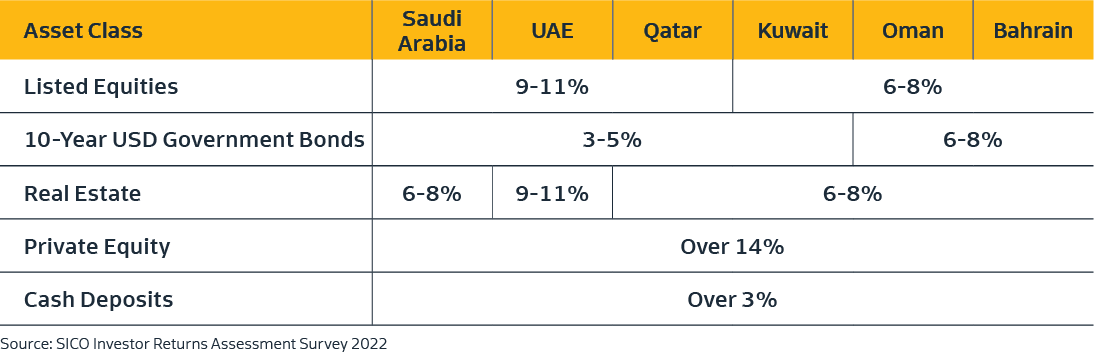

Research also conducted its second annual investor return assessment survey, a one-of-a-kind look into the economic and return expectations of investors across the GCC. This product serves as a point of reference, delivering empirical data and analysis for regional investor sentiment and expectations that will provide the division with an important pulse on the economies of the region.

SICO Research’s Environmental, Social, and Governance (ESG) ratings service, launched in 2020, offers clients added value by displaying the ESG metrics for companies under coverage, a feature that has become increasingly central to the strategy of many companies. As part of its contribution to the investment community, the Research team has launched “The SICO Research House View”, a podcast that acts as a platform to enhance client engagement and expand target audience. The team has also successfully hosted analyst and investor conference calls for listed companies across the GCC, furthering their reach within the investment community.

11

Industrials and Utilities

9

Telecom

22

Banks

6

Real Est. & Const.

11

Consumer

7

Logistics

16

Building Materials

8

Healthcare & Insurance

Reports Published

-

GCC Morning Call

Covers company updates, regional news, stock recommendations, and market performance.

-

GCC Market Watch

Published daily, provides and interprets latest market-related information.

-

Bahrain Daily

Published daily, provides and interprets information on the Bahrain equity market.

-

GCC Economics – The Numbers

Published periodically, analyzes data from the region’s central banks.

-

SICO Alerts and Newsletters

Published periodically, these timely reports cover company, sector, and macro events, as well as insightful and actionable calls.

-

Oil Markets Update

Published monthly, tracks important data points for this major industrial sector.

-

Company and Sector Reports

Published regularly, tracks actively traded companies and major sectors in the GCC.

-

SICO Top 20

Published monthly, provides a list of the top 20 stock picks in the GCC and benchmarks its performance against the broader S&P GCC.

-

Investor Returns Requirements in the GCC

Published annually, analyses the results of a survey to gauge expectations regarding investor returns in the GCC for various asset classes.

-

GCC Strategic Outlook Reports

Published periodically, provides SICO’s view and outlook on GCC markets.

-

GCC Equities – Quarterly Results Preview

Published quarterly, provides profit estimates for GCC companies under coverage.

-

GCC Equities – Results Snapshot in Charts

Published quarterly, analyzes quarterly profits of GCC companies under coverage in chart format.

-

Trading Activity

Provides monthly insight into trading activity across the region.

Investor Return Requirements in the GCC Report

SICO Research surveyed a group of C-Suite executives, investment and fund managers, business owners and institutional investors in the GCC on their expectations regarding investor returns for various asset classes in the fourth quarter of 2022.

Minimum Unleveraged Required Return by Asset Class in the GCC

9-11 %

Investor required annual return for Saudi Arabia, the UAE, and Qatar

>3 %

Investor required annual return for cash deposits across all GCC countries

Investors are broadly optimistic of the economies of Saudi Arabia, the UAE, and Qatar