Management Discussion & Analysis

SICO booked a consolidated net profit attributable to shareholders of BD 3.6 million (USD 9.4 million), reflecting a decline of 44% from the BD 6.4 million (USD 17 million) recorded at year-end 2021. SICO’s full-year performance was primarily weighed down by lower investment income due to the widespread selloffs in financial markets throughout the twelvemonth period. Despite a challenging environment, SICO continued to effectively leverage its diversified operational strategies and market leading position to deliver robust short-term results and solid progress on its longer-term growth strategy. Lower net profit for the year reflected in a 44% y-o-y drop in earnings per share, which recorded 8.45 Bahraini fils in 2022 from 15.18 Bahraini fils in 2021. SICO’s comprehensive income stood at BD 3.2 million (USD 8.5 million) in 2022, compared to BD 6.9 million (USD 18.4 million) in 2021, representing a 54% decline.

I. Appropriations

SICO’s Board of Directors has recommended a dividend of 5% of the share capital, aggregating to BD 2.2 million (USD 5.9 million) equivalent to 0.005 Bahraini fils per share, subject to the approval of the Central Bank of Bahrain and the General Assembly. The amount proposed by the Board of Directors for 2022 marked a decrease from the cash dividend of 8 Bahraini fils per share distributed for 2021.

II. Asset Management

SICO’s total Assets Under Management (AUMs) witnessed growth during the year on the back of new offerings and services expansions. On a gross basis (including leverage), SICO’s total AUMs increased by 6% to BD 1.8 billion (USD 4.8 billion) in 2022 compared to the BD 1.7 billion (USD 4.5 billion) recorded on 31 December 2021. On a net basis (excluding leverage), total AUMs increased by 2% to BD 1.6 billion (USD 4.2 billion) in 2022, compared to the BD 1.5 billion (USD 4.1 billion) recorded on 31 December 2021. Management fees booked BD 5.1 million in 2022, up from BD 3.9 million one year previously, however, performance fees declined to BD 2.1 million in 2022 compared to BD 3.6 million in 2021.

SICO Kingdom Equity Fund

Khaleej Equity Fund

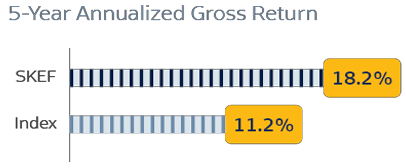

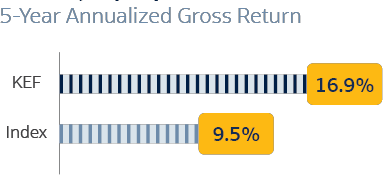

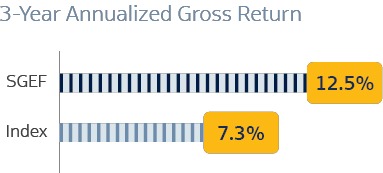

SICO’s flagship Khaleej Equity Fund recorded returns of 2% for 2022, maintaining its place as one of the best-performing GCC-focused funds. By year-end 2022, the Khaleej Equity Fund had yielded a five-year gross return of 16.9%, outperforming the benchmark by 7.4%. Meanwhile, SICO’s Kingdom Equity Fund, which invests in Saudi-listed equities, generated a return of 0.7% for the year, markedly outperforming the wider market. The Kingdom Equity fund has achieved a five-year annualized gross return of 18.2%, significantly exceeding the annualized benchmark return of 11.2% for the period. SICO’s Gulf Equity Fund, which invests in all GCC equity markets excluding Saudi Arabia, achieved gross returns of 1.5% in 2022, and three-year annualized returns of 12.5%.

The SICO Fixed Income Fund recorded a decline of 3.9% in 2022, an outperformance of 6.8% compared to its benchmark. Bond prices fell due to an aggressive hiking cycle that saw the US Federal Reserve increase interest rates by a total of 425 basis points in an effort to tame inflation. Moreover, the impact of the Russia-Ukraine conflict coupled with the extraordinary post-Covid growth at a global level caused a significant increase in commodity prices and inflation reached its highest levels in over 40 years. This unfavorable environment saw the Bloomberg GCC Bond Index record a decline of 10.7% in 2022. However, the SICO Fixed Income Fund booked a solid performance.

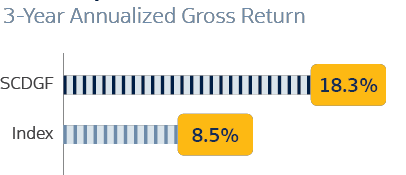

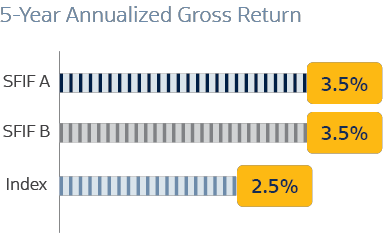

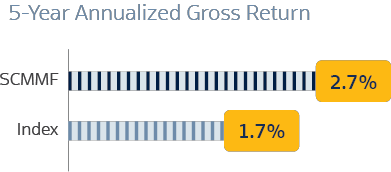

SICO Capital’s two funds, the Dividend Growth Fund (SCDGF) and the Capital Money Market Fund (SCMMF) have both yielded solid returns. The SCDGF achieved three-year annualized gross returns of 18.3%, largely outperforming the benchmark by 9.8%, while SCMMF generated five-year annualized gross returns of 2.7%, exceeding its benchmark by 1%.

SICO Gulf Equity Fund

SICO Capital Dividend Growth Fund

SICO Fixed Income Fund

SICO Capital Money Market Fund

III. Securities Brokerage

Despite challenging global market conditions characterized by aggressive monetary tightening and inflationary pressures, SICO’s Brokerage division continued to expand its product portfolio, widen its client base, and further cement its leading position in the Bahraini capital markets space. On this front, SICO Brokerage has, for the 24th consecutive year, ranked 1st place on the BHB, booking a market share of traded value at 50.89% in 2022.

The Brokerage division offers its services out of Bahrain and through its fully owned subsidiaries SICO Capital, based in Riyadh, Saudi Arabiya and SICO Financial Brokerage (SFB), based in Abu Dhabi, UAE and covers both the equity and fixed income markets. The division is dedicated to expanding its offering across key markets, including the UAE through SFB, as well as in the Kingdom of Saudi Arabia through SICO Capital.

SICO Brokerage’s income declined to BD 1.5 million in 2022 compared to BD 1.6 million one year previously. This was due to a decline in overall brokerage activities on the back of higher volatility, as well as lower turnover and liquidity in key GCC capital markets space over the course of the year.

The division is looking to further capitalize on its Global Markets division, which provides clients with access to international stocks, bonds, ETFs, options, and other liquid tradeable asset classes spanning more than 33 countries and over 135 exchanges to boost the division’s performance in the periods to come. Additionally, the division’s international trading platform SICO LIVE Global, is anticipated to further enhance the division’s performance as it continues to provide diversified and direct exposure to a variety of international asset classes, as well as benefit from the new functionalities it introduced in 2022 to provide a more seamless trading experience for users.

IV. Investment Banking and Real Estate

SICO’s Investment Banking division has further cemented its position as a market leader in Bahrain’s capital markets space and a powerhouse advisor that can execute transactions on various fronts, as well as tailor value-added services that perfectly cater to the needs of SICO’s clients. The division’s exceptional team of investment professionals has enabled SICO to manage initial public and secondary offerings, M&A deals, and advisory services across a wide spectrum of industries, covering both private and public entities.

The highlight of SICO’s Investment Banking division for 2022 was the successful execution of a landmark cross-border USD 10.9 billion deal. On this front, SICO acted as Bahrain receiving agent, Bahrain execution advisor, and cross-listing advisor on Kuwait Finance House’s (KFH) acquisition of Bahrain-based Ahli United Bank (AUB). The transaction marks the third largest banking acquisition in GCC history. This milestone transaction stands testament to the superior capabilities of SICO’s Investment Banking division to deliver on complex and high-profile mandates, as well as its position as the advisor of choice in the capital markets space.

During the year, the division also acted as an advisor for Bahrain Family Leisure Company B.S.C (BFLC) on a potential M&A deal with DGC Hospitality & Partners, the food and beverage investment arm of Dividend Gate Capital (DGC). Another mandate was advising Al Jazeera Tourism Company (AJTC) on the execution of a sale and purchase agreement for 100% of Novotel Al Dana Resort in Bahrain to Gulf Hotels Group.

In its efforts to further expand its presence in the Saudi capital markets space through SICO Capital, the Investment Banking division successfully completed advisory on the sale of a 75% stake in Saudi Innova Healthcare, a leading healthcare service provider in the KSA. Furthermore, the Investment Banking division advised a prominent international school on the sale of a 30% stake to a strategic investor/private equity firm.

V. Proprietary Investments

SICO’s proprietary investments are classed under three components: fair value through profit or loss (FVTPL), fair value through other comprehensive income (FVOCI), and amortized cost (AC). Proprietary investments generated net investment income of BD 1.0 million in 2022 against BD 4.4 million one year previously, due to unfavorable market conditions seen over the course of the year.

VI. Treasury

SICO’s Treasury division booked net interest income of BD 2.6 million in 2022, an increase of 44% from the BD 1.8 million booked one year previously. FX income contributed BD 917 thousand to overall net interest income for the year. The strength and liquidity of SICO’s balance sheet was evident in the Bank’s capital adequacy ratio of 75.4% booked at year-end 2022.

VII. Market Making

Despite a decline in overall market liquidity in the BHB due to multiple external factors, including higher interest rates and the acquisition of Ahli United Bank by Kuwait Finance House (KFH), SICO’s Market Making division booked solid results in 2022. The Bank recorded total market making income of BD 349 thousand in 2022, down from 459 thousand in 2021. BLF transactions contributed 36% of the total ADTV on the BHB in 2022, compared to 34% in the previous year. The challenging macroeconomic landscape saw the BLF generate returns of 1.98% in 2022, compared to 11.4% in 2021.

VIII. Securities Services

The division booked strong results during the year, recording a rise in total assets under custody to USD 8.8 billion from the USD 8.2 billion in 2021. Similarly, assets under administration increased to USD 2.5 billion in 2022 from USD 2.2 billion in the previous year. By asset type, assets under custody in 2022 stood at USD 6.9 million for equity, USD 1.8 million for fixed income, and USD 116 thousand for private equity.