GCC Market Snapshot

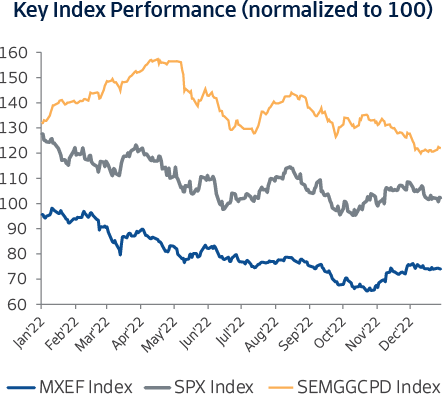

GCC markets experienced high levels of volatility in 2022, with markets initially rallying supported by strong oil prices and an investor perception that the region was somewhat of safe haven from the volatility of the Russia–Ukraine conflict. But the positive sentiment was short-lived and market performance began deteriorating after May. The Fed began consecutive cycles of aggressive tightening as inflationary concerns started spiking. Brent also declined from its peak of nearly USD 140/bbl to USD 75-80 levels by the end of FY22.

Index Returns - 2022 (%)

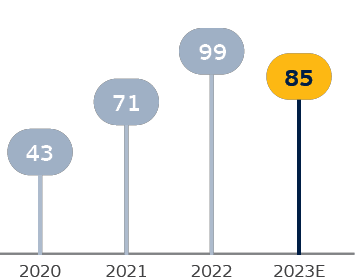

Brent Price (USD/bbl)

Despite the market weakness in the second half of the year, GCC markets still managed to outperform both emerging and developed markets in FY22. Saudi Arabia and Qatar were the only two markets to close 5% lower y-o-y, while the rest of the GCC ended the year on a high note, particularly Abu Dhabi and Oman, both up 23% y-o-y.

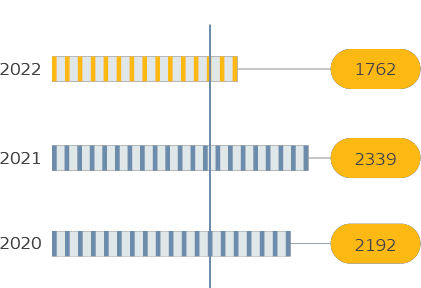

GCC Average Daily Turnover

Saudi Average Daily Turnover (USD mn)

However, the spike in interest rates led to a sharp decline in turnover during the second half with turnover across regional markets plunging 20-30% lower than it was in the first half of the year with the exception of Abu Dhabi. Within fixed income, GCC markets were down 10.9% as high duration and investment grade papers sold off in 2022.

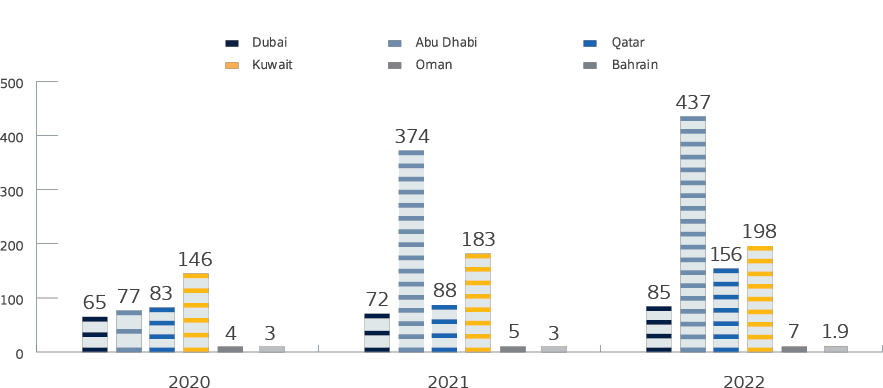

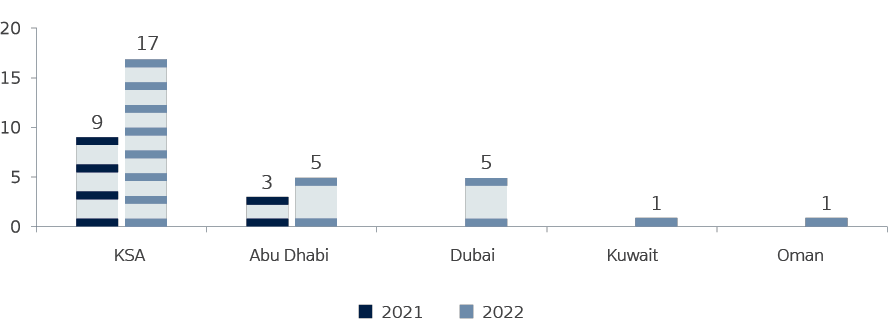

Primary markets were unusually active with a total of 28 IPOs successfully completed during the year. 70% of the region’s IPOs beat their respective benchmarks and generated positive returns for investors. The momentum is expected to continue in the coming year with a robust pipeline of offer- ings set to go public in 2023.

GCC Average Daily Turnover

Saudi Average Daily Turnover (USD mn)

GCC Average Daily Turnover (USD mn)

Expectations for 2023

We can expect 2023 to bring its own set of challenges and uncertainty. Higher interest rates will affect equity and fixed income markets differently, but markets will also be keeping a close eye on how much further central banks will raise rates to keep inflation under control. A delicate balance needs to be reached to avoid a significant recession given the slowdown in demand and capex that are the natural outcomes of higher rates.

IPOs in 2021 and 2022

GCC markets will need certain triggers to ensure investor appetite remains high. A robust IPO pipeline indicates that investors will have oppor- tunities to invest in a diversified new basket of offerings that are the first of their kind for some countries and sectors.

2023 seems to be a more promising year than 2022. While we believe that the Fed cycle is nearing a close in the first half, markets are underappreciating how long the Fed might have to stay restrictive. The conundrum that GCC fixed income markets will face is the prospect of lower treasury yields coupled with higher spreads and hence, we remain concerned that valuations are not compensating investors for the potential for recession-like conditions later this year.

All eyes will also be on how quickly and effectively governments can channel excess liquidity from oil revenues into real spending on the ground to create a trickle-down effect in the economy. Pursuing long-term reforms will be equally essential. The UAE has committed to introducing a new corporate tax in the second half of 2023, the impact of which remains to be seen. Governments across the GCC will also need to provide more clarity on energy reforms and pricing for industry.

Export-focused commodity industries and oil will no doubt face risks if the US and Europe enter any kind of significant recession but there is also upside from increased demand as China opens up post COVID restrictions.

A continuation of the OPEC+ agreement to manage supply and demand volatility will be essential to maintain strong oil prices during the year. However, there is broad market consensus that Brent will hover at the USD 80+ range in 2023. This implies that while we may experience an overall fiscal surplus decline y-o-y, GCC economies will remain in good shape with enough firepower to pursue critical projects. Accordingly, we believe in case of a broader sell-off in global markets, GCC markets are likely to outperform other EMs and global peers.

Average Daily Brent Crude Price (USD/bbl)