Corporate Governance

Commitment

SICO is committed to upholding the highest standards of corporate governance. This entails complying with regulatory requirements, protecting the rights and interests of all stakeholders, enhancing shareholder value and achieving organizational efficiency. The Bank has Board-approved policies for risk management, compliance, and internal controls, in accordance with the rules and guidelines from the Central Bank of Bahrain (CBB).

The adoption and implementation of corporate governance is the direct responsibility of the Board of Directors. The Board is committed to excellence in corporate governance and adheres to rules of the High Level Controls Module (HC Module) of the CBB and the principles of the Corporate Governance Code of the Kingdom of Bahrain issued by the Ministry of Industry, Commerce, and Tourism.

Shareholder Information

The Bank’s shares are listed on the BHB as a closed company. As of 31 December 2022, the Bank had issued 441,342,373 ordinary shares of Bahraini fils 100 each. The last Annual General Meeting was held on 23 March 2022.

Responsibilities of the Board of Directors

The Board is accountable to the shareholders for the creation and delivery of strong, sustainable financial performance and long-term shareholder value. The Board works as a team to provide strategic leadership to staff, maintain the organization’s fitness for purpose, set the values and standards for the organization and ensure that sufficient financial and human resources are available.

The Board’s roles and responsibilities are outlined in the Board Charter of the Bank. The Board organizes a formal schedule of matters for its decision-making process to ensure that the direction and control of the Bank rests with the Board. This process includes strategic issues and planning, review of management structure and responsibilities, monitoring management performance, acquisition and disposal of assets, investment policies, capital expenditure, authority levels, treasury policies, risk management policies, the appointment of auditors and review of financial statements, financing and borrowing activities, reviewing and approving the annual operating plan and budget, ensuring regulatory compliance, and reviewing the adequacy and integrity of internal systems and controls framework.

The Chairman is responsible for leading the Board, ensuring its effectiveness, monitoring the performance of the Executive Management, and maintaining a dialogue with the Bank’s shareholders. The Chairman also ensures that new Directors receive a formal and tailored induction to facilitate their contribution to the Board.

Without abdicating its overall responsibility, the Board delegates certain responsibilities to Board Committees. This is to ensure sound decision-making and facilitate the conduct of business without unnecessary impediment, since speed of decision- making in the Bank is crucial. When a Committee is formed, a specific Charter of the Committee is established to cover matters such as the purpose, composition, and function of the Committee. The Board has three Committees to assist it in carrying out its responsibilities: The Investment Committee; the Audit, Risk, and Compliance Committee; and the Nominations, Remuneration, and Corporate Governance Committee. The Internal Audit, Compliance, and Risk functions report directly to the Board through the Audit, Risk, and Compliance Committee.

The Board receives reports and recommendations from Board Committees and Management on matters it considers to be of significance to the Bank.

Board Composition and Election

The Board’s composition is guided by the Bank’s Articles of Association. As of 31 December 2022, the Board consisted of ten Directors, one of which is an Independent Director, two are Non-Executive Directors, and seven are Executive Directors, including the Chairman and Vice-Chairman. The Bank recognizes the need for Board composition to reflect a range of skills and expertise. The profiles of Board Members are listed later in this Review. The Company Secretary is Simone Del Nevo. The classification of Executive, ‘Non-executive, and Independent Directors is per the definitions stipulated by the CBB. Directors are elected by the shareholders at the AGM, subject to prior approval by the CBB, for a period of three years, after which they shall be eligible for re-election for a further three-year period.

Independence of Directors

In line with the requirements of the CBB’s HC Module, the Bank has put in place Board-approved criteria to determine “Test of Independence” using formal requirements as specified in the CBB rule book and other relevant requirements as assessed by the Board of SICO. The purpose of the test is to determine whether the Director is “Independent” of management, and any business or other relationships, that could materially interfere with the Director’s ability to exercise objective, unfettered, or independent judgment. The test also assesses the Director’s ability to act in the best interests of SICO. Based on an assessment carried out in 2022, the Board of Directors resolved that one of the Non-executive Directors of SICO met the relevant requirements of the “Test of Independence”, and accordingly, the Director was classified as an “Independent” Director.

Board and Committee Evaluation

The Board performs a self-evaluation on an annual basis. The Board periodically reviews its Charter and its own effectiveness, while initiating suitable steps for any amendments. The Board also reviews self-evaluations of the individual Board members, Chairman, and the Board Committees, and it considers appropriately any recommendations arising out of such evaluation.

Remuneration of Directors Policy

The Board of Directors’ remuneration is governed by provisions of the Commercial Companies Law 2001 and the CBB. The Directors’ remuneration is approved by the shareholders at the Annual General Meeting. In addition, the members are paid sitting fees for board and committee meetings. The Board’s remuneration is reviewed by the Nomination, Remuneration, and Corporate Governance Committee, as per the remuneration policy. Directors’ remuneration is accounted as an expense, as per international accounting standards and CBB regulations.

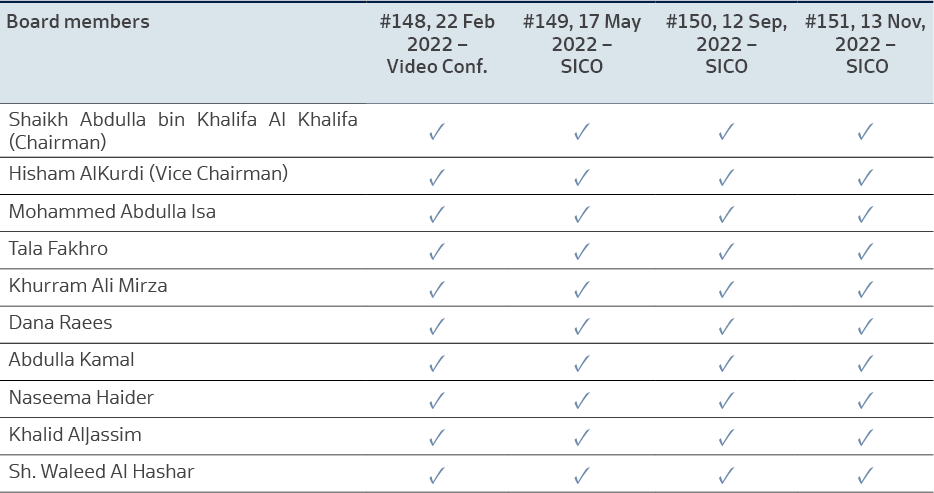

Board Meetings and Attendance

According to the Bahrain Commercial Companies Law and CBB rules, Board meetings will be conducted at least four times a year (on a quarterly basis). All Board members must attend at least 75% of all Board meetings within a calendar year. At least five Directors must attend each Board meeting, including the Chairman or the Vice-Chairman. During 2022, four Board meetings were held in Bahrain.

Board Meetings

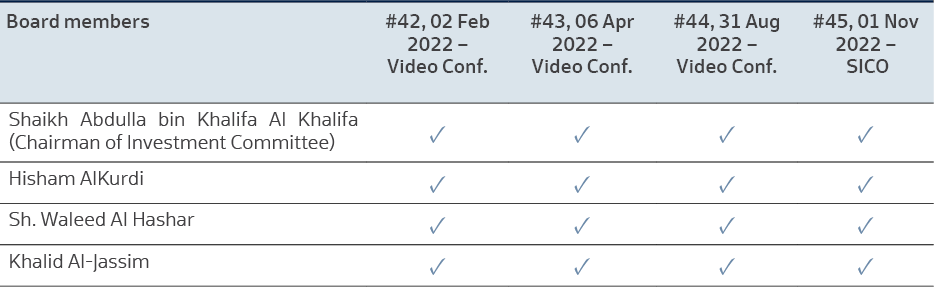

Investment Committee Meetings

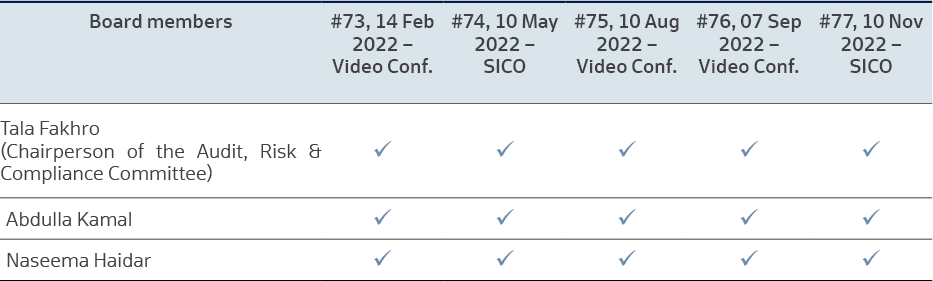

Audit, Risk & Compliance Committee Meetings

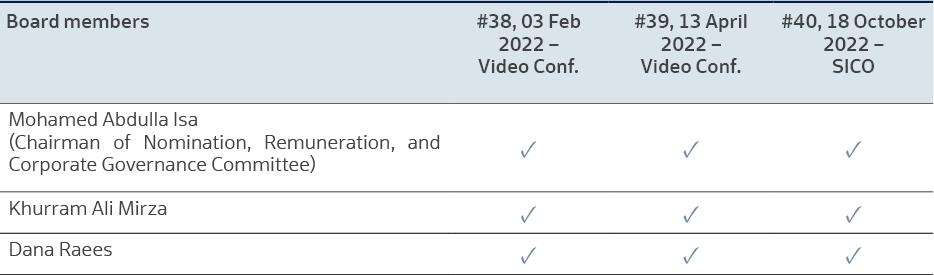

Nomination, Remuneration and Corporate Governance Committee Meetings

Board Committees

Investment Committee

Objective-

- Review investment policies and procedures to monitor the application of, and compliance with, investment policies.

- Approve and recommend (where appropriate) to the Board relevant investment decisions (as defined in the Investment Policy Guidelines and Restrictions).

- Review strategy and budget business plans prior to submission to the Board.

- Monitor financial performance.

- Oversee the financial and investment affairs of the Bank.

Audit, Risk, and Compliance Committee

Objective-

- Review the Bank’s accounting and financial practices.

- Review the integrity of the Bank’s financial and internal controls and financial statements.

- Recommend the appointment, compensation, and oversight of the Bank’s External Auditors.

- Recommend the appointment of the Head of Internal Audit, Head of Compliance, and Head of Risk.

- Review the Bank’s compliance procedures and regulatory matters.

- Provide active oversight on the risk management framework, approve risk policies and Delegated Authority Limits (DAL), and ensure adequacy of risk controls.

Nomination, Remuneration, and Corporate Governance Committee

Objective-

- Identify and screen suitable and qualified candidates as members of the Board of Directors, or for the roles of Chief Executive Officer, Chief Financial Officer, Corporate Secretary, and any other officers of the Bank considered appropriate by the Board. If and when such positions become vacant, with the exception of the appointment of the Heads of Internal Auditor, Compliance, and Risk Management, which shall be the responsibility of the Audit, Risk, and Compliance Committee.

- Submit its recommendations, including candidates for Board membership, to the whole Board of Directors, which should, in turn, include them in the agenda for the following Annual Shareholder Meeting.

- Review the Bank’s remuneration policies for the approved persons and material risk-takers, which must be approved by the shareholders and be consistent with the Bank’s corporate values and strategy.

- Approve the remuneration policy and amounts for approved persons and material risk-takers, as well as the total variable remuneration to be distributed, taking account of total remuneration, including salaries, fees, expenses, bonuses, and other employee benefits.

- Approve, monitor, and review the remuneration system to ensure the system operates as intended.

- Recommend Board Members’ remuneration based on their attendance and performance, and in compliance with Article 188 of the Company Law.

- Review the Bank’s existing Corporate Governance policies and framework.

- Advise the Board on the Bank’s public reporting of information on Corporate Governance practices and issues.

- Provide a formal forum for communication between the Board and Management on Corporate Governance issues.

Management

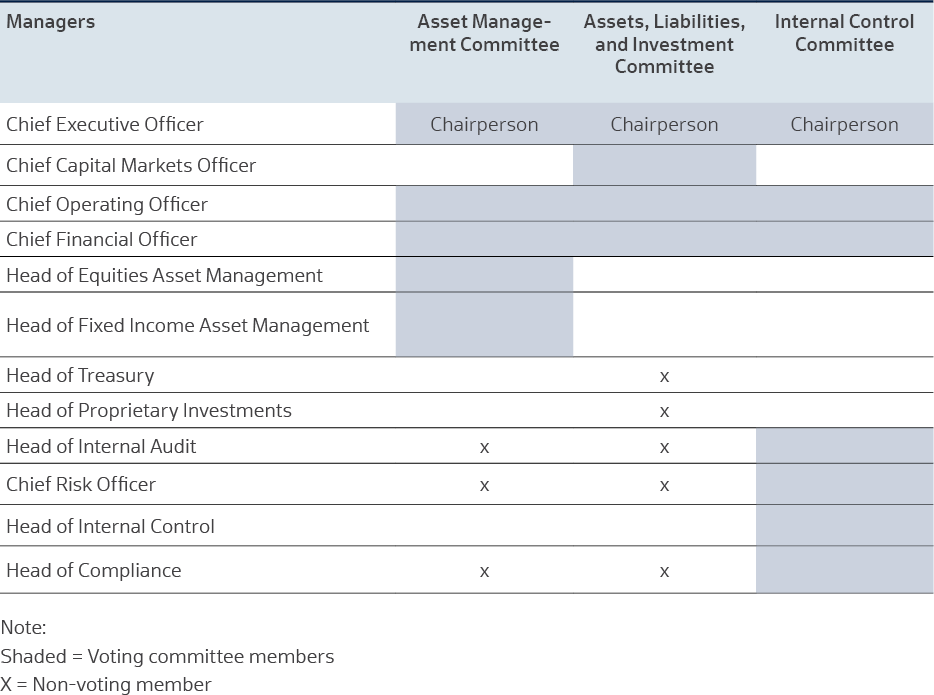

The Board delegates the authority for the day-to-day management of the business to the Chief Executive Officer, who is supported by a qualified senior management team and three management committees: Asset Management Committee; Assets, Liabilities, and Investments Committee (ALIC); and Internal Control Committee.

Management Committees

Asset Management Committee

Objective-

- Oversee the fiduciary responsibilities carried out by the Asset Management Department in managing clients’ discretionary portfolios and the funds operated and managed by SICO. It also reviews the investment strategy of the Bank’s funds and portfolios, reviews portfolio performance, and reviews subscription, redemptions, and compliance.

Assets, Liabilities, and Investments Committee (ALIC)

Objective-

- ALIC acts as the principal policy-making body responsible for overseeing the Bank’s capital and financial resources. It is also responsible for managing the balance sheet and all proprietary investment activities, including investment strategy and asset, country, and industry/sector allocations. The committee is specifically responsible for managing the balance sheet risk, capital and dividend planning, forecasting and monitoring interest rate risk positions, and liquidity and funds management. The committee is also responsible for formulating and reviewing the Bank’s investment policies (subject to approval by the Board), strategies and performance measurement and assessment.

Internal control committee (ICC)

Objective-

- Oversee the Internal Control functions carried out in SICO by various departments. The scope of ICC is to look into strengthening the internal control culture throughout the company by ensuring that each department head takes ownership, responsibility, and accountability for internal control. The Committee is entrusted with the responsibility to consult and advise the Board of Directors in the assessment and decision-making concerning the Bank’s system of risk management, internal control, and corporate governance.

Management Profiles

Najla Al Shirawi

Chief Executive Officer

Najla Al Shirawi has more than 25 years of investment banking experience. Having been part of SICO since 1997, she was appointed CEO in 2014, following her appointment as deputy CEO in 2013. Najla served with Geneva-based Dar Al-Maal Al-Islami Trust, where she established private banking operations for the Group in the Gulf region. Najla is a Board member at the Bahrain Economic Development Board (EDB); a Chairperson on the Board of Directors for two SICO subsidiaries, SICO Funds Services Company (SFS) in Bahrain and SICO Financial Brokerage in Abu Dhabi, UAE; and the Vice Chairperson of SICO Capital in Riyadh, KSA. She is also an Independent Board Member of Eskan Bank BSC(c), Bahrain, and a Board Member of the Deposit Protection Scheme, Bahrain; the Future Generations Reserve Council; the Bahrain Associations of Banks; and the Bahrain Institute of Banking and Finance. She holds a Master of Business Administration and Finance from the American College in London and a Bachelor’s Degree in Civil Engineering from the University of Bahrain.

Fadhel Makhlooq

Chief Capital Markets Officer

Chief Executive Officer of SICO Capital

With over 40 years of professional experience, Fadhel Makhlooq joined SICO in 2004 as Head of Brokerage before being appointed Head of Investments and Treasury in 2008. He was re-appointed Head of Brokerage in 2010 and then assumed the position of Chief Capital Markets Officer in 2018. Prior to joining SICO, he worked for a number of leading financial institutions, including Investcorp and Chemical Bank (now JPM Morgan Chase). He currently also serves as Board Director and Chief Executive Officer of SICO Capital in Saudi Arabia and as a Board Member of SICO Financial Brokerage in UAE. Fadhel holds a Master of Business Administration from the University of Glamorgan, UK.

K. Shyam Krishnan

Chief Financial Officer

K. Shyam Krishnan has 32 years of experience in finance, accounting, audit, investments, and risk management, with the majority of his career spent in conventional and Sharia-compliant banking. Shyam currently also serves as a Board Member at SICO Financial Brokerage, UAE. Prior to joining SICO in 2015, he was Group Head of Finance at Al Salam Bank-Bahrain. Before this, he was Head of Hedge Funds’ Operational Risk Management at Investcorp, Bahrain, and Audit Supervisor at the Bahrain office of Ernst & Young. He is a Chartered Accountant and Management Accountant from India and a Chartered Financial Analyst, Certified Internal Auditor, and a Certified Information Systems Auditor. He holds a Bachelor of Commerce from Madras University, India.

Anantha Narayanan

Chief Operating Officer

With over 32 years of diversified experience in the areas of operations, audit, and risk in the banking industry, Anantha joined SICO in 2008. Prior to joining SICO, he worked for Credit Agricole, BBK, Commercial Bank of Oman/Bank Muscat, and Pricewaterhouse Coopers. He is currently the Vice Chairman of SICO Financial Brokerage, UAE, and a Board Member at SFS. Anantha is a Chartered Accountant and Cost Accountant (India), a Certified Information Systems Auditor (USA), Financial Risk Manager (USA), and an Associate Member of the Institute of Financial Studies (UK). He holds a Bachelor of Science (Honours) from the University of Manchester, UK.

Owen Vallis

Chief Risk Officer

Owen Vallis entered his role as Chief Risk Officer at SICO with over 19 years of experience in risk management under his belt. Prior to joining SICO, Owen was the UK Head of Asset Management Risk at Credit Suisse Group in London for ten years, where he played a critical role in the investment businesses of the group. He additionally held the position of Vice President of JP Morgan for two years, strategically designing and developing a new Risk function.

Owen also previously worked at Morgan Stanley and Kleinwort Benson. He holds a BSc. in Disaster Risk Management from the University of Portsmouth, UK.

Shakeel Sarwar

Head of Equities Asset Management

Shakeel Sarwar joined SICO in 2004 and, over the length of his career, has accumulated over 28 years of investment industry experience in the UK, Pakistan, and the Middle East. Prior to joining SICO, he worked with Riyad Bank’s Asset Management Division and was part of a team that managed over USD 3 billion in Saudi equities. He has also held positions with ABN Amro Asia Securities in the UK and Pakistan. Shakeel holds a Master of Business Administration in Banking and Finance from IBA, Karachi, Pakistan.

Ali Marshad

Head of Fixed Income Asset Management

Ali Marshad has over 17 years of experience in asset management, investments, treasury, and brokerage. After joining SICO in 2008 as an Analyst in the Investments and Treasury division, Ali then headed up the newly established Fixed Income Desk in 2012 before being promoted to Head of Fixed Income in 2015. Prior to joining SICO, he worked in the UK as an Analyst with Mercer Investment Consulting and as a Performance Analyst with UBS Global Asset Management, London. A Chartered Financial Analyst, Ali holds a Bachelor of Science (Honours) in Banking, Finance, and Management from Loughborough University, UK.

Wissam Haddad

Head of Investment Banking and Real Estate

Wissam Haddad has 21 years of experience in investment banking, private equity, and corporate finance. Prior to joining SICO in 2014, he was a Director with Gate Capital in Dubai and had previously held senior positions with UAE-based Najd Investments, Unicorn Capital, Emirates NBD’s NBD Sana Capital, Saudi National Commercial Bank’s NCB Capital, and Eastgate Capital, among others. Wissam holds a Bachelor of Commerce from Concordia University, Canada.

Jithesh K. Gopi

Head of Strategy and Proprietary Investments

Head of Strategy and Proprietary Investments Jithesh Gopi has over 28 years of experience in investment management, research, and analytics. Since 2013, he has worked with Al Rajhi Capital in Riyadh as Head of Research, Head of Asset Management, Director of Research and Financial Institutions, and Director of Corporate Development and Proprietary Investments. In 2006, he joined SICO as Senior Analyst and as Head of Research, covering over 50 companies in major sectors, and he is currently a Board Member at SICO Capital, KSA. Jithesh holds a Bachelor of Science in Mechanical Engineering from the College of Engineering, Trivandrum, India, and a Master of Business Administration from the Asian Institute of Management in Manila, Philippines. He is also a CFA charterholder, and he has completed the Asian International Executive Program at INSEAD Singapore.

Mariam Isa

Head of Brokerage

Mariam Isa has 18 years of experience in regional equity trading and sales. She joined SICO in 2005. Before becoming the Head of Brokerage, she held the position of Chief Broker. Mariam has also worked as a Senior Officer in the Placement Department at Gulf Finance House. She holds a Master of Business Administration in Islamic Finance from the University College of Bahrain, an Associate Diploma in Accounting from the University of Bahrain, and a Treasury and Capital Market Diploma from BIBF. She has also completed the Leadership Development Program at the University of Virginia, USA.

Salman Al Sairafi

Head of Global Markets

With more than 20 years of experience in financial services and technology, Salman Al Sairafi joined SICO in 2020 as the Head of the newly established Global Markets division. Prior to joining SICO, he held the role of Chief Investment Officer and Board Member at Capital Growth Management in Bahrain and was a Senior Investment Advisor at United Consulting Group in KSA. Prior to that, he headed the Fixed Income and Money Markets desk at NCB Capital in KSA. Salman has also held various other positions in Bahrain and the UK in the fields of consulting and R&D. Salman is Chairman of the Board at Dar Al Ma’rifa in Bahrain and is both a Chartered Financial Analyst and a Chartered Alternative Investment Analyst. A former Chevening Scholar, Salman holds a Bachelor of Engineering in Information Systems Engineering and a Master of Science in Advanced Computing from Imperial College London.

Shaikha Mohammed Kamal

Head of Market Making

Shaikha Kamal has over 19 years of professional experience in Treasury at SICO, which she leverages in her current role as Head of Market Making. Shaikha joined SICO in 2004 as a Senior Dealer with the Treasury Department before being appointed Portfolio Manager in 2011. Her responsibilities include proprietary investment, where she specialized in various asset classes, such as equities and fixed income in addition to the Market Making function, managing various mandates and proposed services to several clients across the GCC region. She holds a Master of Science in Finance from DePaul University in Chicago and a Bachelor of Science in Business Information System from the University of Bahrain.

Nishit Lakhotia

Head of Research

Nishit Lakhotia has nearly 19 years of experience in the fields of investment research, risk management, hedge funds, and private equity. He has been involved in sell side Research in SICO since 2009, actively covering sectors such as telecommunications, consumers, aviation, and construction across the GCC. Previously, Nishit worked for an Iceland-based private equity firm focusing on India’s infrastructure sector and a US-based global hedge fund. Nishit is a Chartered Financial Analyst, a Chartered Alternative Investment Analyst, and a Financial Risk Manager from the Global Association of Risk Professionals. He holds a Master of Business Administration in Finance from the Narsee Monjee Institute of Management Studies, Mumbai, India.

Husain Najati

Head of Treasury

Husain Najati has over 18 years of experience in financial control, fixed income, and foreign exchange trading. Husain joined SICO in 2006 as a Financial Controller, a role in which he was responsible for accounting support for operational management. In 2008, he became a Senior Dealer in the Investment and Treasury Department, responsible for money market, FX, fixed income management, and monitoring investments across primary and secondary markets. Husain holds a Dealing Certificate from the ACI Financial Markets Association and a Treasury and Capital Markets Diploma from the Bahrain Institute for Banking and Finance. He also holds a Bachelor of Science in Banking and Finance from the University of Bahrain.

Nimita Nazer

Head of Middle Office

Nimita Nazer has over 16 years’ experience within international conventional banks and financial services in the Kingdom of Bahrain. Nimita joined SICO in 2018 as Portfolio Administrator of the Asset Management Equities Department and was responsible for managing the non-investment activities of the department. She previously held the position of Client Services Manager with HSBC Securities Services in Bahrain for seven years. She is a Chartered accountant and member of the Association of Chartered Certified Accountants (ACCA) and Chartered Institute for Securities and Investment (CISI), UK period

Nadeen Oweis

Head of Sustainability and Corporate Communications

Nadeen Oweis joined SICO in 2008 and has accumulated over 22 years of professional experience. Prior to joining SICO, Nadeen oversaw corporate communications and public relations for Microsoft in Bahrain. Before this, she handled regional accounts for Lowe Contexture. She also held posts at Procter and Gamble in Jordan and managed the advertising and promotions account for Radio Fann FM in Jordan. Nadeen holds a Master’s Degree in Diplomatic Studies from the Jordan Institute of Diplomacy, a Bachelor’s Degree in Law from the University of Jordan, and a Certificate of Digital Marketing from Columbia Business School.

Mohamed Alabbas

Head of Distribution and Business Development

Mohamed Alabbas has more than 16 years of experience in the banking sector across the region. He joined SICO in 2015 as Senior Research Manager before becoming Head of Distribution. Prior to joining SICO, Mohamed served as Head of Client Relationship Management at Tamkeen. He also held positions at several established institutions, including Director of Business Development at Clearview M&A Advisors, Private Banker (Head of Qatar Market) at Oasis Capital Bank, and Branch Manager at BBK, among others. Mohamed holds a Bachelor’s Degree in Business Economics and a minor in Human Relations from St. Cloud State University, Minnesota. He also holds the International Wealth Manager certification from the Chartered Institute for Securities & Investment, as well as a CFA Level II certificate.

Fatima Mansoor

Head of Client Relations

With more than 17 years of experience in regional equity trading and client relations, Fatima Mansoor joined SICO in 2006 as a Broker, assuming the role of Senior Broker in 2008. She moved to the Client Relations Department in 2017 and was appointed Head of the department in 2019. Fatima holds a Bachelor of Science in Banking and Finance from the University of Bahrain and a Master of Business and Administration in Finance from the New York Institute of Technology.

Haifa Ajlan

Head of HR & Administration

Haifa has more than 21 years of experience in the field of Human Resources. She first joined SICO in 2004, holding the position of Assistant Vice President before now being appointed as Head of Human Resources and Administration. Haifa holds a master’s degree in Business Administration from the University of Strathclyde Business School in Glasgow, UK and a bachelor’s degree in Business Information Systems from University of Bahrain.

Husain Ahmed

Head of Operations

Husain has 17 years of banking experience, having joined SICO in 2006. Before becoming Acting Head of Operations in 2019, he held the position of Vice President of Operations at SICO. Husain holds a Master of Business Administration from Arabian Gulf University and a Bachelor of Science in Business Informatics from AMA University. Husain has also received numerous anti-money laundering and back office operation training certifications.

Mohammed Ibrahim

Head of Information Technology

Mohammed Ibrahim has over 22 years of experience in the field of information technology (IT), including IT project management, business analysis, complex system builds and interfaces, business continuity planning, and information security. Prior to joining SICO in 2007, he was Training Head and Technical Consultants Team Lead at the Bahrain Institute of Technology and Technical and Training Manager at YAT Group, Egypt. Mohammed is a Certified Information Systems Security Professional (CISSIP), a Master Certified Internet Web Professional (MCIW), a Microsoft Certified Solutions Expert, and a Microsoft Certified Trainer. He holds a Bachelor of Science and Education and a Postgraduate Diploma in Science and Education from Alexandria University, Egypt.

Simone Del Nevo

Head of Legal and Board Secretary

Simone Del Nevo has 15 years of experience in law, and he joined SICO as Head of Legal in 2018. Before joining SICO, Simone was an Associate with international law firm Baker & McKenzie in Europe and Japan where he specialized in banking, finance, and securities law. In 2012, he practiced as in-house Finance Counsel to a major European gas infrastructure company in an award-winning multi-billion- Euro refinancing. Simone relocated to Bahrain in 2014 working as Senior Associate in the leading regional firm ASAR - Al Ruwayeh and Partners. He received his Law Degree from Bocconi University of Milan in 2004 and was admitted to the Milan Bar Association as a qualified lawyer in 2007.

Mohammed Juma

Head of Compliance and MLRO

Mohammed Juma has over 19 years of experience in compliance, investment, and operations management. Mohammed joined SICO in 2016 as Head of Compliance and MLRO, assuming responsibility for monitoring SICO Group’s operational adherence with the guidelines of regulatory authorities. Previously, Mohammed was Head of Compliance and MLRO with the International Investment Bank and JS Bank Limited in Bahrain. Mohammed holds a Bachelor’s Degree in Banking and Finance from the University of Bahrain and has completed the Leadership Grooming Executive Program with the Ivy Business School in Canada and Hong Kong. He is a Certified Compliance Professional and a Certified Anti-Money Laundering Specialist.

Joseph Thomas

Head of Internal Audit

Joseph Thomas has over 20 years of experience in internal audits, assurance engagements, and other financial advisory services. Joseph joined SICO in 2015 after having been Head of Internal Audit at Global Banking Corporation and holding a post with the Risk Consulting division of KPMG Bahrain. He began his career with Bharat Overseas Bank in India, followed by an internal audit role at the South Indian Bank. He later served as Audit Manager and Partner at a Dubaibased auditing firm. Joseph is a Chartered Accountant and a Certified Internal Auditor. He holds a Bachelor of Commerce from Mahatma Gandhi University, India.

Bassam A. Khoury

General Manager of SICO Financial Brokerage LLC

Bassam has over 38 years of international experience in brokerage, investments, and financial consultancy. He joined SICO in 2008 as Head of Brokerage before leaving in 2010 to join QInvest, Qatar, as Head of Regional Brokerage. Prior to re-joining SICO in 2013 as General Manager of SICO Financial Brokerage in UAE, Bassam was Chief Executive Officer of Bahrain-based ABC Securities. Previously, he worked with Banque Saudi Fransi in KSA, BMB Investment Bank and Lehman Brothers in Bahrain, a private family office in Paris, and M Sternberg & Company in the USA. Bassam holds a Bachelor of Science in Business Administration and Economics from King’s College, New York, USA.

Governance Framework

SICO’s Corporate Governance framework comprises of Board and Committee Charters, Code of Business Conduct, operational policies and procedures, internal controls and risk management systems, compliance procedures, delegated authority limits (DAL), internal and external audit, effective communications and transparent disclosure, and measurement and accountability.

Code of Business Conduct

SICO conducts itself in accordance with the highest standards of ethical behavior. A Code of Conduct for SICO Staff has been developed to govern the personal and professional conduct of all employees. The Code of Conduct outlines areas of conflict of interest, confidentiality, fair and equitable treatment, ethics, and managing customer complaints. A Whistleblowing Policy and Procedures is also included within the Code of Conduct for SICO Staff.

Compliance and Anti-Money Laundering

As a licensed conventional wholesale bank and listed company, SICO has comprehensive policies and procedures in place to ensure full compliance with the relevant rules and regulations of the CBB and the BHB. The Bank has an independent Compliance Department, in keeping with Basel and CBB guidelines. The Compliance Department acts as the central coordinator for all matters relating to regulatory reporting and other requirements.

Anti-money laundering measures are also an important area for the Compliance Department, with a designated Money Laundering Reporting Officer (MLRO) and Deputy MLRO. The Bank has documented anti-money laundering and combating the financing of terrorism procedures in conformity to the regulatory requirements in the Kingdom of Bahrain. SICO has implemented a risk-based automated transaction monitoring system, which further enhances the Bank’s anti-money laundering measures in line with the regulations of the CBB.

Corporate Communications

SICO conducts all communications with its stakeholders in a professional, honest, transparent, understandable, accurate, and timely manner. Main communication channels include an annual report, a corporate website, and regular announcements in the appropriate local media. To ensure disclosure of relevant information to all shareholders on a timely basis, the Bank publishes its annual report and the past ten years’ financial statements on the corporate website (www.sicobank.com).

Related Party Transactions and Conflict of Interest

The Directors make every practicable effort to arrange their personal and business affairs to avoid a conflict of interest with the Bank. The Directors disclose their interests in other entities or activities to the NRCG Committee on an annual basis, inform the Bank of any conflict of interest whenever it arises, and abstain from voting on any related subject matter. The Bank reviewed all such transactions during 2022, and there were no transactions involving potential conflicts of interest that need to be brought to the shareholders’ attention. The related party transaction details are disclosed in Note 25 of the Consolidated Financial Statements.

Recruitment of Relatives

The Bank has a Board-approved policy in place on the employment of relatives to prevent potential favoritism and conflicts of interest in decision-making due to certain relationships amongst employees, including approved persons.

Remuneration of Board Members and Senior Management and Fees Paid to External Auditors

The remuneration paid to Board members and senior management personnel are disclosed in Note 25 of the Consolidated Financial Statements. The information on fees paid to External Auditors for audit and other services will be available to the CBB and shareholders upon request, provided such disclosure does not impact the interest of the Bank.

Compliance with the CBB’s High-Level Controls Module

Every conventional bank licensee is expected to comply with rules and guidance mentioned in the High-Level Controls Module issued by the CBB under Rulebook Volume 1. Any non-compliance with the Module needs to be explained by disclosure in the annual report to shareholders and the CBB.

SICO is in compliance with the module, except for the following:

HC-1.4.6 and HC-1.4.8, which stipulate that the Chairman of the Board of Directors should be an Independent Director. SICO Chairman Shaikh Abdulla bin Khalifa Al Khalifa is considered an Executive Director, as he represents SICO’s major shareholder. However, this does not compromise the high standards of corporate governance, as the Bank follows strict policies to manage conflict of interest in Board decisions.

HC-1.4.6 and HC-1.4.8, which stipulate that the Chairman of the Board of Directors should be an Independent Director. SICO Chairman Shaikh Abdulla bin Khalifa Al Khalifa is considered an Executive Director, as he represents SICO’s major shareholder. However, this does not compromise the high standards of corporate governance, as the Bank follows strict policies to manage conflict of interest in Board decisions.

HC-1.5.2 states that in conventional bank licensees with a controller, at least one-third of the board must be Independent Directors. The Bank is not in compliance with the mentioned rule. However, the Bank is of the view that this does not compromise the high standards of corporate governance, as four of the Executive Directors are representing Bahraini state-owned entity. In addition, the Bank has a comprehensive corporate governance framework and relevant measures in place to take care of the interest of all stakeholders, including minority or smaller shareholders.

HC-1.4.5, HC-1.8.2, HC-4.2.2, HC-3.2.1 and HC-5.3.2 state that the Corporate Governance Committee; Audit, Risk, and Compliance Committee; Nomination Committee; and Remuneration Committee must include only three independent or majority Independent Directors. The Chairman of the Audit and Risk Committee is an Independent Director. However, the remaining Directors are either Executive or Non-Executive Directors. The Bank is of the opinion that this does not compromise the high standards of corporate governance as the Bank has implemented measures to manage potential conflict of interest.

HC-6.5.51 stipulates that all Internal audit findings and recommendations are resolved within 6 months for high risk/critical issues and 12 months for any other issues. SICO follows a risk-based approach to the implementation of audit recommendations and hence Management ensures the devotion of adequate time and resources to the implementation/resolution of findings and recommendations that require the highest priority. There are no high-risk findings that have passed the recommended timelines. However, there are certain medium/low priority recommendations that are in progress of implementation as the closure of these recommendations is dependent on third parties, or for which system implementation projects are in progress or where coordination at a group level is required and hence there are certain added intricacies that slow down implementation. SICO has a defined regular and continuous follow up process to track the implementation of these recommendations till the desired conclusion is reached.