Chairman’s Statement

Abdulla bin Khalifa Al Khalifa

Chairman of the Board

By all accounts 2022 has been one of the most challenging periods of economic, political, and environmental upheaval that we have yet to witness. The optimism fueled by the post-COVID economic recovery was quite short-lived when very early in the year Russia invaded the Ukraine. In addition to the profound humanitarian issues brought on by a war that is now entering its second year, we saw commodity prices spike, stock markets crash, and supply chain issues intensify. By mid-year we were witnessing spiraling levels of inflation that have not been seen since the 1980’s. To combat the soaring prices, the FED embarked on an aggressive tightening cycle that included a total of seven rate hikes in 2022 alone. Economists worldwide sounded alarm bells to signal that the world may soon be edging towards a prolonged period of recession.

In parallel with the economic turmoil, concerns about the environment, global warming and the clean energy transition continued to mount as we witnessed record-breaking heat waves in Europe, deadly floods in Pakistan and Nigeria, and energy supply shortages perpetuated by sanctions against Russia. It was no surprise that this perfect storm did not fare well for financial markets. Global stock and bond markets experienced massive selloffs and lost trillions in value during the course of the year.

It’s safe to say that it was not a good year for investors, but the GCC remained a bright spot in 2022. Markets in our region were in a relatively stronger position than the rest of the world. Most GCC countries ended the year with a fiscal surplus on the back of higher oil prices that surpassed USD 80. While global markets were largely inactive, the GCC experienced strong IPO activity in 2022, particularly in the UAE and KSA. Our region outperformed other emerging markets and remains attractive as a defensive play.

But for financial institutions like SICO, with exposure to global markets, it was an exceptionally tough year that had a negative impact on our prop book performance. However, we still managed to close the year without losses despite the global market sell-off across asset classes.

SICO reported BD 3.6 million (USD 9.4 million) in consolidated net profit, a decrease of 44% compared to the BD 6.4 million (USD 17 million) recorded at year-end 2021. The lower investment income due to market sell-offs was offset by strong growth in other interest income as well as steady brokerage and net fee income for the year. Net fee income experienced a slight decline of just 5% for the twelve-month period, reflecting lower performance fees versus the previous year. Net interest income grew 43% year-on-year to BD 2.6 million (USD 6.9 million) while brokerage and other income recorded BD 2.5 million (USD 6.6 million) compared to BD 2.7 million (USD 7.1 million) in 2021. Earnings per share stood at 8.45 Bahraini fils down from 15.18 Bahraini fils in 2021 as a result of lower net profit for the year.

Solid operational performances across our lines of business are an ongoing source of pride, particularly in a challenging year like 2022. Our assets under management (AUM) hit a new record high at USD 4.8 bn on a gross basis reflecting an increase of 6% year-on-year. The SICO asset management team continues to outperform the market and

to introduce new products and services in both Bahrain and KSA. Our investment banking division maintained its momentum in Bahrain with the successful completion of a large cross boarder transaction while carving out a niche in the Saudi mid-cap space, a promising segment where we can leverage our capabilities and years of experience as the investment advisors of choice in Bahrain.

We remain highly optimistic about our growth prospects in KSA, even more so now that we have completed the purchase of the remaining shares of our Riyadh based subsidiary, SICO Capital from Bank Muscat. Now that SICO Capital is a fully owned subsidiary of SICO, we are fast-tracking the consolidation between the two entities so that we can be better positioned to capture new opportunities across all our lines of business.

Heading into 2023, I believe that our ability to weather an economic downturn and to deliver recurring revenue growth is a key indicator of SICO’s long term ability to perform under duress. It is what makes us a strong, agile organization that is capable of delivering positive returns for our clients irrespective of market volatility.

As we build an agile business increasing our digital adaptation across SICO’s offices is a top priority and an integral component of our group strategy. Our new offices at Bahrain’s World Trade Center are equipped with the most advanced systems and cybersecurity solutions but as technology continues to move forward at an exponentially fast pace, so must we.

The hallmarks of a resilient organization are preparedness, adaptability, collaboration, trustworthiness, and responsibility. SICO exemplifies all these qualities which is why I am optimistic about the future and look forward to embarking on a new era of resilient growth.

wish to extend my utmost thanks and appreciation to my fellow Board Members, who have worked tirelessly to ensure that the interests of SICO’s shareholders and stakeholders are met and that our talented management team receives that guidance and support that is necessary to navigate the volatility of the past years while staying true to SICO’s core vision and strategy. All of you bring unique perspective to the table, and I am proud to be a member of such a diverse group of ladies and gentlemen.

To the senior management team at SICO, I am grateful for your hard work, dedication, and resourcefulness in the face of significant challenges. Your ability to stay the course and deliver on your targets is commendable to say the least. I look forward to our continued success across the region.

On behalf of the Board and the entire team at SICO, we would like to take this opportunity to give our humble thanks to His Majesty the King and His Royal Highness the Crown Prince and the Prime Minister of Bahrain, Salman bin Hamad Al Khalifa for the vision that they have set out for the country and the support they have given to the financial sector. Special thanks also go out to our partners and regulators, the Ministry of Finance and National Economy, the Central Bank of Bahrain, and the Bahrain Bourse (BHB) for the steadfast support they have given us over the years.

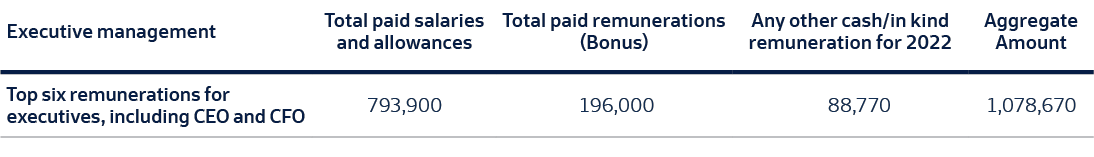

SICO’s Executive remuneration in BD

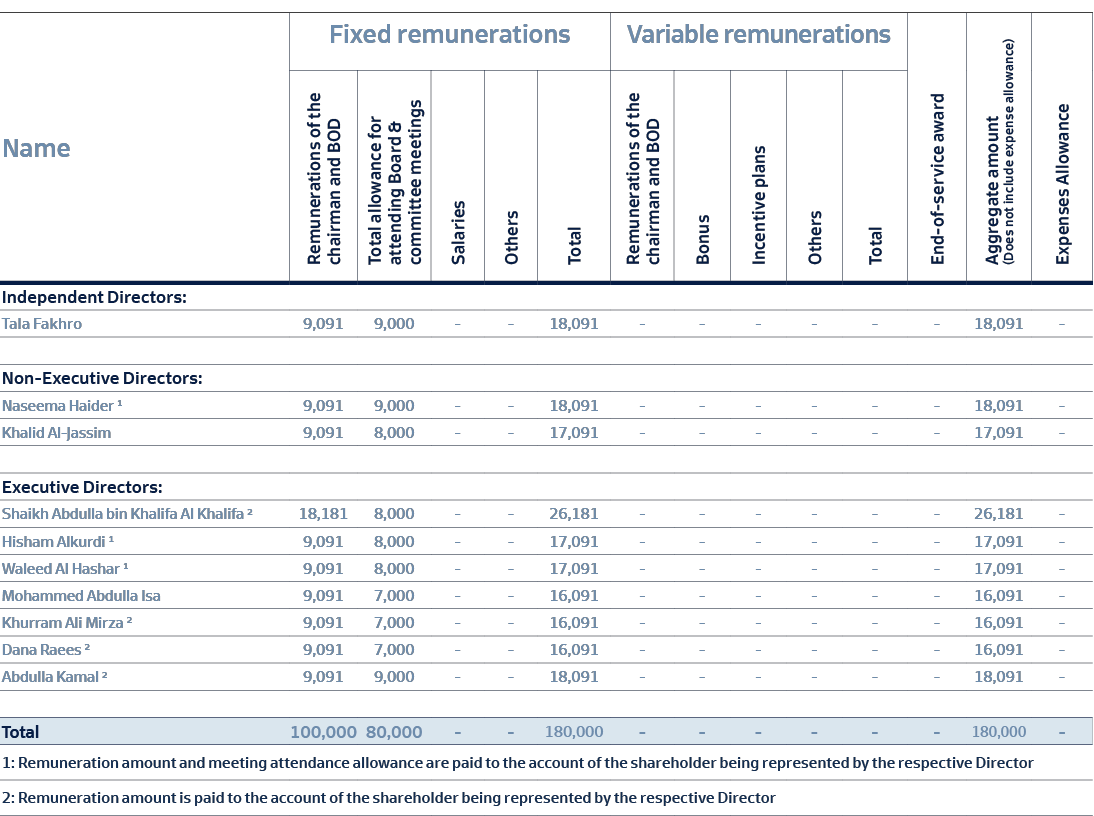

Details of SICO’s Board remuneration in BD

Abdulla bin Khalifa Al Khalifa

Chairman of the Board