Brokerage

SICO Brokerage provides unique access to local, regional, and global markets backed by in-depth research, professional advisory services and on the ground presence in three regional markets: Bahrain, the UAE, and Saudi Arabia

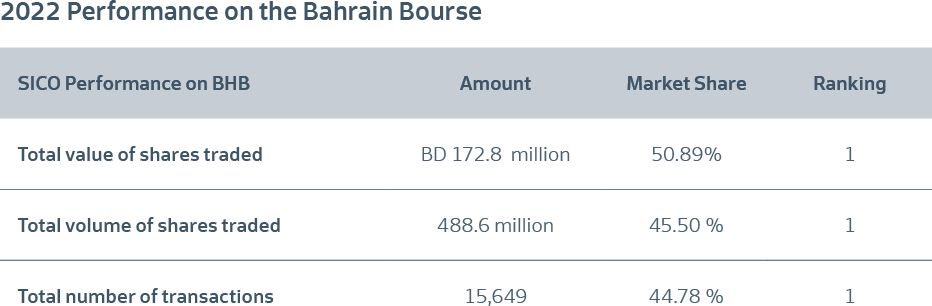

Entering into its 24th consecutive year as Bahrain’s number one broker, SICO Brokerage is backed by a highly experienced team of advisors, top-notch in-house research capabilities, and a world-class online trading platform for both local and international equities and fixed income securities. Maintaining the lion’s share of the market at 50.89%, SICO Brokerage remains the undisputed leader on the Bahrain Bourse providing access to equities, fixed income securities, and T-bills to a wide range of high-profile institutional and individual clients across the region. The division also offers margin trading facilities.

SICO’s exceptional team of relationship managers and trading experts work alongside clients as trusted partners to help them attain investment objectives that cater to their specific preferences and risk profiles..

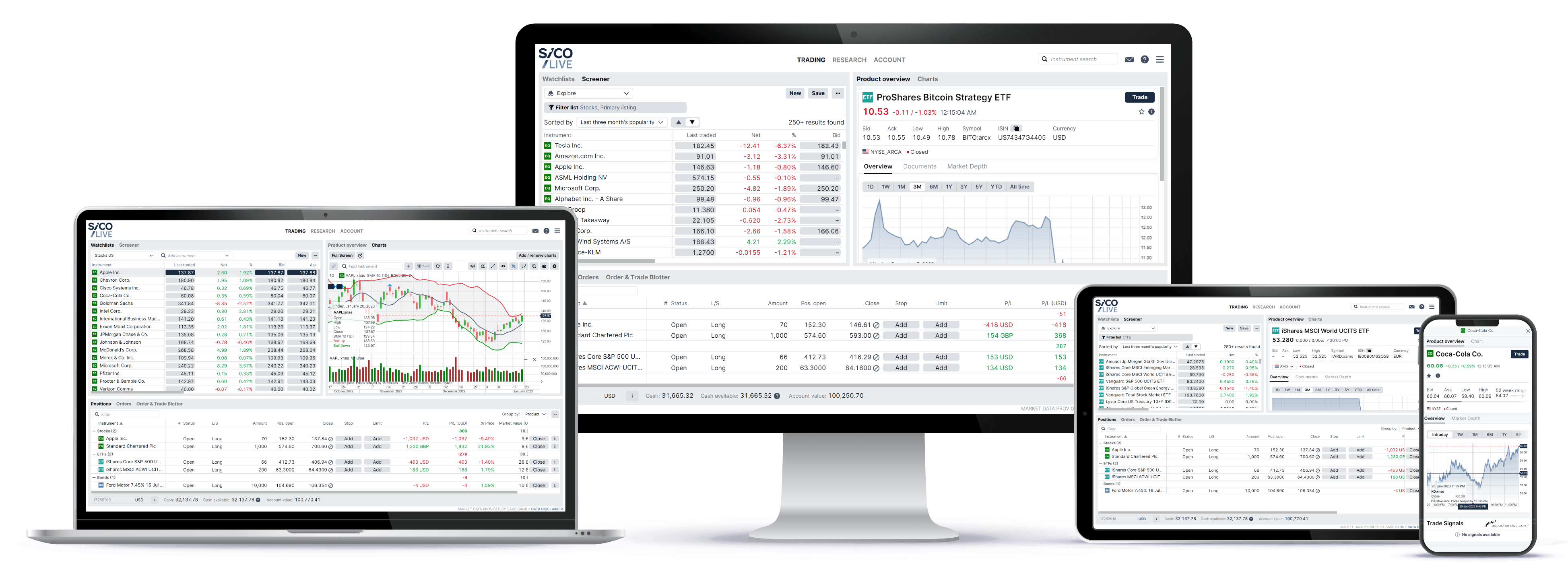

During the course of the year, SICO’s regional online trading platform, SICO LIVE Regional, was revamped to introduce new functionality and a more seamless trading experience for users. The new and improved platform now includes a simplified digital onboarding experience and account authentication process. SICO LIVE is also in the final stage of launching a feature that will allow users to transfer funds between accounts.

Brokerage services in Saudi Arabia and the UAE are delivered through SICO subsidiaries, SICO Capital in Riyadh, and SICO Financial Brokerage (SFB) in Abu Dhabi which offers equity and derivatives trading for retail and institutional clients on the Dubai Financial Market (DFM), Abu Dhabi Stock Exchange (ADX), and Nasdaq Dubai. SICO is currently in the process of acquiring two additional licences for wealth management and custody services in the UAE. The new services are due to launch in the second quarter of 2023, along with advisory services to complement the current offering in Bahrain.

In 2022, SICO Capital became an official member of the Saudi Exchange, Tadawul. In Saudi Arabia’s highly fragmented financial brokerage sector which is dominated by bank-based brokerages, SICO Capital Brokerage ranked 26th on the Saudi Exchange with traded volumes of SAR 5.26 billion representing 0.15% of the traded volume in 2022. As a relative newcomer during a highly volatile period where stocks measured in the MSCI All-World index experienced their largest annual loss since 2008, SICO’s commendable performance bodes well for its future growth prospects in the Saudi market. SICO Capital Brokerage also launched its new e-trading platform, SICO Capital LIVE, and its online onboarding during the year.

Global Markets

SICO’s Global Markets desk, which was established in 2020, provides clients with access to international stocks, bonds, and ETFs, spanning more than 25 exchanges in 17 countries through its SICO LIVE Global platform. Global Markets have been gradually ramping up access to different asset classes and markets over the past three years with the desk now providing access to the broadest range of international investments available to individuals and corporates through a single trading desk in the Kingdom of Bahrain.

2022 was extremely volatile for both global equities and fixed income asset classes. Both asset classes sustained significant losses, a rare historical event that has only happened three times since 1928. The last time that US stocks and bonds experienced such losses was 1969. Within this context, the year was characterized by broadly lower volumes as investors stayed away and showed more interest in short-term treasury bill securities, particularly towards the end of the year. Investors did however take advantage of the dip in long-dated bonds whenever they were able to find bargains yielding 8-10%, such as Bahrain sovereign bonds that mature in 2047.

Trading volumes in 2022 were also indicative of overall sentiment with fixed income transaction volume standing at USD 1 billion in 2022, compared to USD 2.3 billion booked in 2021. USD 300 million of that was local paper (T-bills and Bahraini bonds) compared to USD 240 million that was traded in 2021. Trading volumes for global stocks were similarly down at USD 23 million for 2022 compared to USD 87 million in 2021.

SICO’s global trading platform, SICO LIVE Global, was revamped and relaunched in 2022 to provide an easier, more transparent user experience that specifically caters to client needs and preferences. The new platform provides a more user-friendly interface, local funding transfers, and complete transparency of trading and investment fees.