Asset Management

SICO’s Asset Management division successfully navigated the volatility of 2022, outh5erforming peers and creating value by utilizing a research driven approach based on solid fundamentals, innovation, and product diversity

SICO Asset Management is a leading regional asset manager with a consistent track record of outperformance on its GCC and MENA mandates. SICO’s team of renowned investment professionals bring over 50 years of combined industry knowledge that has helped them to successfully navigate market turbulence and expand assets under management despite a highly challenging environment. The division recently expanded its operations to Saudi Arabia through SICO’s fully owned, Riyadh-based subsidiary, SICO Capital.

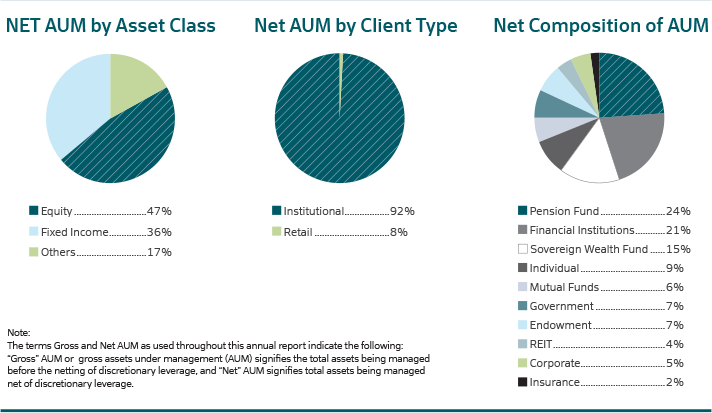

SICO Asset Management offers its clients access to a broad range of conventional and Sharia-compliant equities, fixed income, and money market securities, as well as real estate investment trusts (REITs) and private real estate funds across two geographies, Bahrain and Saudi Arabia. The team also manages various external funds on behalf of leading regional financial institutions. SICO’s mutual funds and discretionary portfolios consistently outperform their respective benchmarks and maintain the highest rankings across various league tables.

Named one of Forbes Middle East’s Top 30 Asset Managers in the Middle East in 2022, the current asset management team at SICO has worked together for over a decade. The longstanding team dynamic has allowed them to bring solid know-how to a client base comprised of large institutions, including pension funds, sovereign wealth funds, endowments, family offices, and private banks who look to them as trusted advisors and industry experts.

The Asset Management division’s investment methodology prioritizes healthy, risk-adjusted returns, targeting assets with robust fundamental profiles, significant safety margins, and minimal downside risk. The team’s exemplary performance over the years is a reflection of their long-term investment approach. As fundamental investors, the team ensures that they have a good grasp of the underlying fundamentals of both the businesses and the industries that they invest in, placing greater emphasis on downside risk than upside gains.

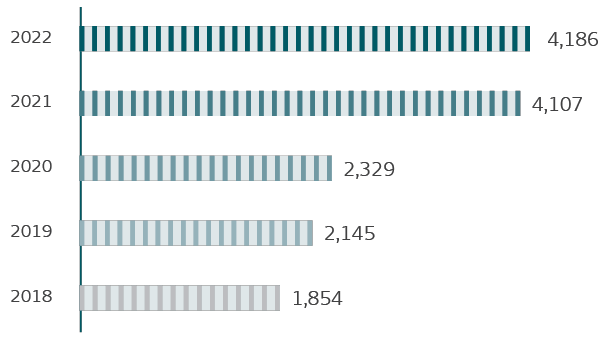

By offering customized, value-added services that vary according to different risk profiles and investment objectives, SICO has consistently grown its AUM over the course of a successful track record of more than 20 years, the longest consistent track record in the GCC market.

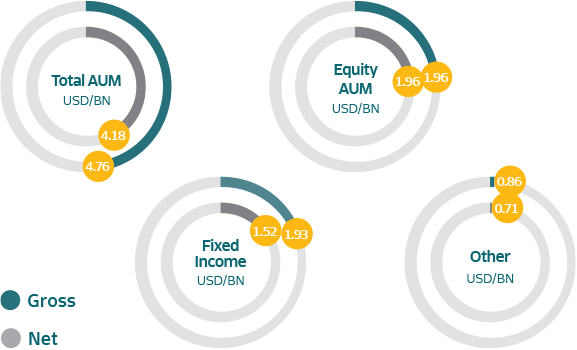

2022 was an eventful year for both equities and fixed income asset management. With unprecedented global selloffs, central bank tightening, soaring inflation, and the war in Ukraine, the asset management team was challenged with pushing hard to replace the significant outflows from the market and to end the year with a net surplus in AUM. The team managed to close the year with positive gains on several of its funds and mandates, with a significant amount of alpha generated.

Outperformance on the downside is part of SICO’s DNA. The division’s track record shows that this is where their expertise comes into play and where they have typically exceled by sticking with a consistent investment strategy. Going forward, the division will continue to deploy the same model while working on alignment between the teams in Bahrain and Saudi Arabia. With an aligned common strategy, the asset management divisions in Bahrain and Saudi Arabia will work as one team to launch new products and increase AUM within the region.

A large proportion of the division’s future growth is expected to emanate from Saudi Arabia once the alignment between the Kingdom and Bahrain is complete and stabilized. In 2023, new Saudi Equity and Saudi Islamic Funds will be launched, while the existing GCC Dividend Growth Fund (a MENA fund), will be rebranded as the Khaleej Equity Islamic Fund. The Elzaad Sukuk Fund, which will be launched in partnership with Wafra International Investment Company, will invest in a diverse portfolio of Sukuk and other Sharia-compliant fixed income instruments issued by sovereign, quasi sovereign, and corporate issuers globally, with a focus on the MENA region.