Chairman’s Statement

The year 2021 began with much hope and optimism. New vaccines against COVID-19 were becoming widely available signaling a possible end to the pandemic, oil prices were rebounding ushering in a period of recovery for the GCC, and financial markets were stabilizing globally—all indications that the year was shaping up to be one of recovery and renewal.

But as the year unfolded, it became clear that the challenges of 2020 were not entirely behind us. As new variants cropped up and case numbers took an upward trajectory, we became reluctantly accepting of the fact that COVID-19 was going to remain a part of our lives for some time to come. The difference this time around was that we were better equipped to deal with the difficulties, and we knew how to live with the uncertainty.

Despite the unforeseen challenges of the past two years, there has been a learning curve, and there is no denying that some positive changes have come about as a result of the turbulence. From the shift in focus on personal, professional, and financial wellbeing, to changes in the way we work and interact with our communities, having to deal with a collective problem of this magnitude has made businesses across the globe revisit their strategies to ensure that their approach to value creation is fair, inclusive, and sustainable.

At SICO, we have given much thought and attention to the crafting of a strategy that will take us to where we want to go in the coming years while keeping in mind the crucial pillars of fairness, inclusivity, and sustainability. Our strategy is a At SICO, we have given much thought and attention to the crafting of a strategy that will take us to where we want to go in the coming years while keeping in mind the crucial pillars of fairness, inclusivity, and sustainability. Our strategy is a holistic approach that leverages our key strengths as an organization and our ability to create value to expand regionally in high-growth markets while preserving our lead in Bahrain.

Our 2021 results already prove that we are well on our way to achieving our goals. We have successfully implemented our growth strategy despite the challenges brought about by the pandemic, and we have captured opportunities that were presented by the market recovery, cementing our reputation as a leading regional financial services provider.

The acquisition of SICO Capital in KSA is one of our notable achievements this year; it not only gives us access to the highly promising Saudi market but also serves as a springboard for further regional growth. With the official launch of operations at our full-fledged financial services subsidiary, SICO Capital, we look forward to exploring new opportunities and offering a wider suite of products and services to an aspirational client base across the region.

Our KSA acquisition has unfolded over the course of the past two years, which have been characterized by volatility, making the acquisition particularly difficult to navigate. Credit is due to our exceptional leadership team for expertly structuring and closing the acquisition in an efficient and timely manner under such trying conditions. Post-acquisition, we are extremely pleased with the contribution and efforts exerted by all of our divisions and the management team on the ground at SICO Capital to enhance and streamline systems and procedures in a manner that will ensure operational alignment and the maximization of synergies across the board.

Our financial results for the year have been impressive with BD 6.4 million (USD 17 million) in net profit, an increase of 116% year-on-year from the BD 3.0 million (USD 7.8 million) recorded at year-end 2020. We experienced strong bottom line growth with net fee income climbing 142% and investment income nearly doubling. Earnings per share increased by nearly 100% to 15.96 Bahraini fils during the year from 8.00 Bahraini fils in 2020.

Strong performances across SICO’s lines of business maintained the Bank’s growth momentum throughout the year, with a further boost from strong results by our subsidiaries at SICO Capital and SFS. SICO’s assets under management (AUM) increased substantially during the year on the back of new mandates and the introduction of new products, coupled with the consolidation of SICO Capital AUM. On a gross basis (including leverage), SICO’s total AUM increased by 80% to BD 1.7 billion (USD 4.5 billion) in 2021 compared with the BD 946.1 million (USD 2.5 billion) recorded on 31 December 2020. This growth in AUM exceeded our expectations and reinforced our ability to successfully leverage our core strengths to drive solid growth and deliver value to our stakeholders.

Our 2021 operational and financial results paint a clear picture of an organization that has demonstrated its resilience and come out on top during a particularly challenging period.

As the new year unfolded, we were extremely pleased to announce that we expanded the size of our Board of Directors from nine to ten members to welcome our newest Executive Director, Shaikh Waleed Khamis Al Hashar, the CEO of Bank Muscat, which now owns a 10.38% stake in SICO. As Bank Muscat’s representative on SICO’s Board, we will benefit greatly from Shaikh Waleed’s regional expertise and decades of experience as we grow and expand our businesses regionally in the coming years. We look forward to working with Shaikh Waleed and strengthening the fruitful partnership that we have with Bank Muscat.

To my fellow Board Members, kindly allow me to take this opportunity to extend my thanks and appreciation for the effort and dedication that you have demonstrated over the past year. I am extremely proud and honored to work alongside such a talented, diverse, and knowledgeable group of ladies and gentlemen. Your input has been invaluable.

No matter what the year ahead brings, I am confident that our senior management team at SICO is more than capable of capturing the upside and catapulting us to new heights. With exceptional leadership, a clear vision, a strong sense of purpose, and a talented team of professionals, SICO has the reputation, track record, and regional presence required to optimally deploy our capabilities and go from strength to strength across our lines of business and subsidiaries.

We look forward to capturing new opportunities regionally and, of course, in our home market of Bahrain as the government rolls out their new national economic growth and fiscal balance plan, one of Bahrain’s largest economic reform programs to date that aims to enhance our economy’s long-term competitiveness and support post-COVID recovery.

On behalf of the Board and the entire team at SICO, we wish to express our gratitude and appreciation to His Majesty the King and His Royal Highness the Crown Prince and the Prime Minister of Bahrain, Salman bin Hamad Al Khalifa. We would also like to convey our thanks and appreciation to the Ministry of Finance and National Economy, the Central Bank of Bahrain, and the Bahrain Bourse (BHB) for their steadfast support.

Abdulla bin Khalifa Al Khalifa

Chairman of the Board

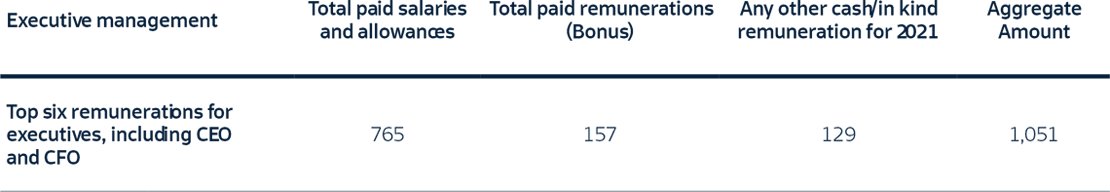

SICO’s Executive remuneration in BD ‘000

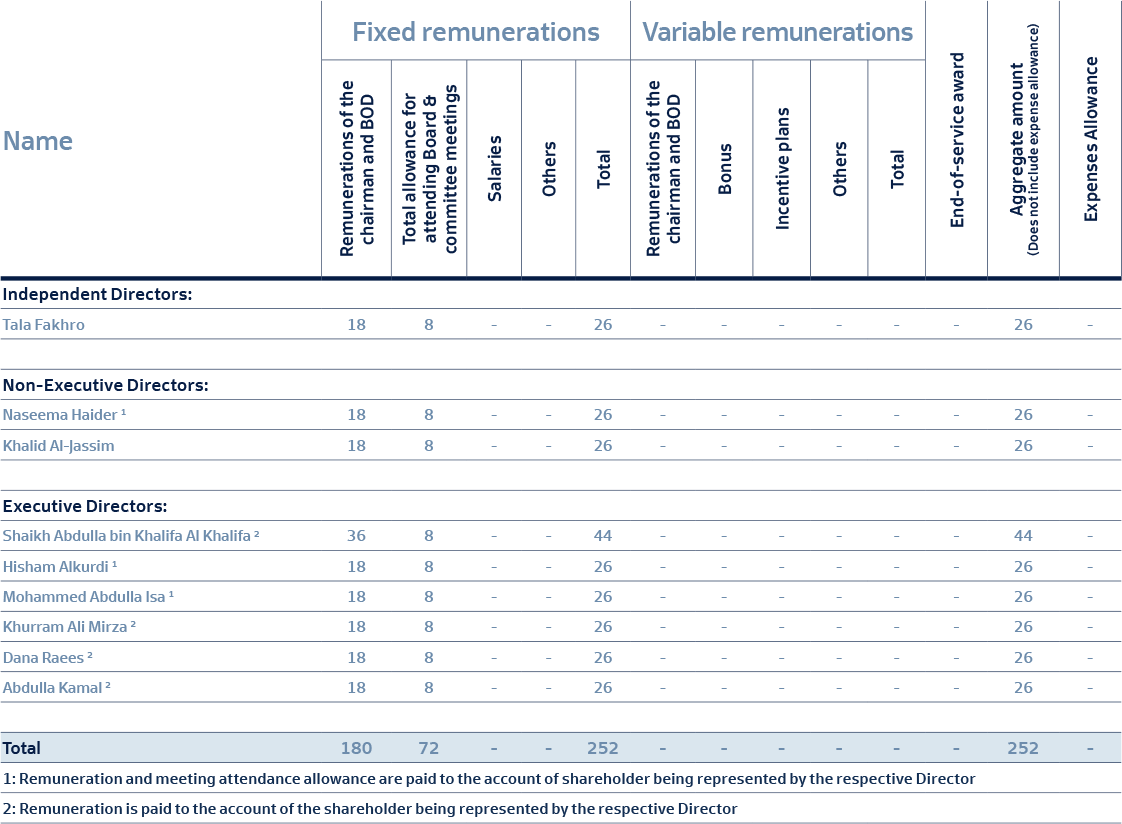

Details of SICO’s Board remuneration in BD ‘000