Asset Management

SICO Asset Management displayed remarkable resilience in the face of unprecedented market disruptions in 2020, maintaining a highly proactive operational approach and a prudent risk management posture that has safeguarded the division’s financial performance.

Travel and hospitality suffer a HUGE BLOW — 2020 was the year that people stopped going on vacation. Airlines, the cruise ship industry, hotels, and restaurants were devastated by the severe decline in both leisure and business travel

Overview

SICO Asset Management is a leading boutique asset manager focused on GCC and MENA mandates. Backed by a team of highly experienced industry professionals, the division consistently outperforms regional markets by placing innovation and diversity at the core of its investment strategy. Serving a wide and expanding base of institutional investors, sovereign wealth funds, family offices and private banks, SICO Asset Management caters to variant risk profiles and investment objectives.

The division’s investment methodology prioritizes healthy risk-adjusted returns, targeting securities with strong fundamental profiles, significant margins of safety, and limited downside risk. SICO Asset Management’s mandates cover conventional and Sharia-compliant equities, money market and fixed income securities. Several external funds are also managed on behalf of leading regional financial institutions. SICO’s mutual funds and discretionary portfolios consistently outperform their respective benchmarks, maintaining top rankings across a variety of league tables.

Operational Review 2020

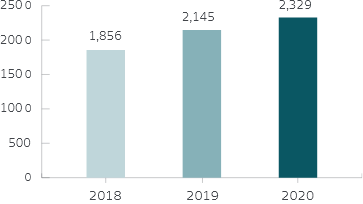

Capital markets witnessed a string of unprecedented developments in 2020. The onset of the COVID-19 crisis in Q1-2020 brought a steep and sudden decline in equity prices, with high uncertainty triggering a dash for cash among investors seeking to settle short-term debts or cover losses. Dysfunction and rising repo rates spread even to safe-haven markets such as that for US Treasuries, which is usually deep and highly liquid. Meanwhile, lockdowns precipitated sharp increases in unemployment in several major markets and a consequent collapse in commodity prices. In the GCC, a major decrease in oil prices was compounded by the heavy weight of government spending in aggregate demand, with bid-offer spreads on a number of sovereigns trading at record highs due to a shortfall in liquidity. At the close of the first half, SICO Asset Management’s AUMs were down by nearly 20% coming in at USD 1.7 billion in June 2020, compared to the USD 2.1 billion at year-end 2019, driven by asset price decreases and client redemptions.

Capital markets began a sharp and sustained recovery in the second quarter of 2020, buoyed by massive fiscal stimulus packages and unprecedented central bank interventions that have driven interest rates to historic lows. Decisive government intervention provided a significant boost in liquidity, with confidence in a post-COVID economic recovery in 2021 spurring a strong and speedy rebound in global markets and a decline in repo rates that has extended to emerging markets, including those in the GCC and MENA regions. By Q3-2020, SICO Asset Management had largely reversed the decline in AUMs sustained during the first half, successfully leveraging its diversified product offering to capture market upside and secure a significant influx of new institutional subscriptions. Despite significant restrictions on travel during the period, the influx was sourced largely from new and existing international clients. By year-end 2020, SICO Asset Management had enjoyed one of its most successful years on record in attracting additional fixed-income mandates, while the division’s repo book had attained a record size of USD 199 million. As of 31 December 2020, SICO Asset Management held total AUMs of USD 2.3 billion, up by 9% from the USD 2.1 billion booked one year previously.

AUM Growth (USD mn)

AUM by Asset Class

Equities

SICO’s Equity Asset Management team manages three equity funds, including its top-performing SICO Kingdom Equity Fund (SKEF) and Khaleej Equity Fund (KEF), together with several discretionary portfolio management accounts. SICO’s equity AUMs were significantly affected by COVID-related volatility during Q1-2020, falling to a trough of c. USD 972 million from the level of USD 1.5 billion booked at the close of FY2019. This quarterly decline was driven equally by market-driven price decreases and client redemptions. SICO’s equity AUMs began a sharp recovery in Q2-2020 as global equity markets rebounded and the division secured several new subscriptions. By year-end 2020, SICO’s equity AUMs had largely recovered to USD 1.26 billion, with SICO’s equity funds once again outperforming benchmarks to leave SICO in the top decile of regional fund managers for the year.

Strong performance in the face of unprecedented market volatility has reinforced clients’ confidence in the equity division’s ability to produce healthy and sustainable investment returns.

SICO’s flagship Khaleej Equity Fund, which invests in equities listed on stock markets in the GCC and Egypt, ended 2020 with a return of 5.8%, maintaining its position as one of the top performing funds in the MENA region. Meanwhile, SICO’s Kingdom Equity Fund, which offers investors market-beating exposure to Saudi equities, delivered positive returns of 7% in 2020, significantly outperforming the broader market.

SICO Asset Management continues to successfully manage external funds on behalf of Riyad Bank and Al Ahli Bank of Kuwait, a 16-year long relationship that has seen SICO generate solid returns for both funds.

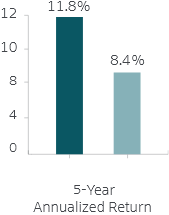

SICO Kingdom Equity Fund

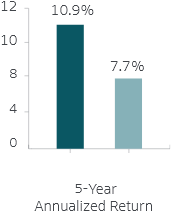

Khaleej Equity Fund

SICO Fund Performance 2020

| Fund Name | Launch Date | Principal Investment Focus | Benchmark | Peer Group | Return (January - December 2019) | Annualized Return |

|---|---|---|---|---|---|---|

| Khaleej Equity Fund | March 2004 | Equity securities listed on stock markets of GCC countries | S&P GCC Index | GCC | 5.8% vs. benchmark -1.7% | 10.9% vs. benchmark 7.7% |

| SICO Kingdom Equity Fund | February 2011 | Equity securities listed in Saudi Arabia | Tadawul | Equity Saudi | 7.0% vs. benchmark 6.4% | 11.8% vs. benchmark 8.4% |

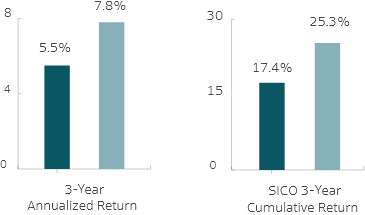

| SICO Fixed Income Fund | April 2013 | Government and corporate fixed income, sukuk, repo money market instruments, and other fixed income—related instruments | Barclays Emerging Markets GCC Bond Index | Fixed Income GCC | 5.5% vs. benchmark 7.8% |

Fixed Income

Fixed Income was subject to the same dislocations witnessed in equity markets at the start of 2020. The rush to liquidity caused by the COVID-19 crisis precipitated an across-the-board increase in bond yields, affecting even safe-haven assets such as US Treasuries and bringing on a sharp rise in repo rates. MENA bond markets were not immune to instability during the period, with their recent inclusion in the JP Morgan EM Bond index amplifying the transmission of volatility from abroad. Investor uncertainty was further compounded by a sharp decline in oil prices, with which GCC markets are tightly correlated and on which most regional sovereigns are dependent for budget finance. At the peak of the crisis, z-spreads on sovereign bonds, such as those issued by Bahrain and Oman, had reached record highs.

Debt capital markets began a sharp recovery in Q2-2020 as central banks injected massive amounts of liquidity into financial systems, heavily cutting interest rates and intervening directly in corporate and other markets for private debt. Helped by improving global conditions and by strong fundamentals, GCC debt capital markets saw a remarkable rebound following Q1-2020, with sovereign and quasi-sovereign issuers, corporates, and financial institutions seeking to leverage the low-interest-rate environment to reinforce their balance sheets — a task made more urgent by the decline in oil prices. On the other hand, investors were eager to deepen their exposure to MENA fixed income, attracted by credit ratings higher than those offered by most emerging market bonds and by yields higher than those to be found in more developed markets such as the US and Europe. GCC sovereigns and corporates issued a record total of USD 142.3 billion during 2020, up from USD 140.8 billion in 2019.

Despite historic volatility in 2020, SICO’s fixed income asset management business enjoyed a record-breaking year in multiple respects. The division ended 2020 with USD 893 million in AUMs, up by 109% from the level booked at year-end 2019.

The division’s flagship SICO Fixed Income Fund generated returns of 4.2% for 2020, driven by the recovery in MENA fixed income activity during the year. Additionally, several of SICO’s discretionary portfolios, outperformed benchmark indices in 2020.

SICO Fixed Income Fund Performance

2021 Outlook

SICO’s Asset Management division is approaching 2021 in a spirit of cautious optimism, fully committed to the prudent risk management approach that has served it well over previous years. Although the US Federal Reserve’s new policy displays a bias to keeping rates on hold well after economic and inflation growth set in, global economic recovery may be sluggish and uneven. Global economic activity will not fully normalize until a vaccine for COVID-19 is produced at scale and widely distributed, compounding the uncertainty. Performance in GCC markets is expected to remain relatively subdued during 2021. The IMF forecasts no significant recovery in oil prices in 2021, predicting a price range of USD 40 to USD 50, while the World Bank forecasts an average oil price of USD 44, significantly below the level required to balance certain GCC sovereign budgets.

Although the correlation between oil prices and GCC bonds is limited, investor sentiment toward broader indices of economic performance may compromise the fixed income environment, with the IMF forecasting that the GCC economies will experience a real GDP contraction of 6% for 2020. On the other hand, as yields on US Treasures fall closer to zero and the negative correlation between equities and fixed income continues to reverse, international investors could seek to deepen their exposure to emerging market debt and equity, of which GCC issuers have come to comprise an increasingly larger portion. Notwithstanding the dislocations of the pandemic and the rapid decline in oil prices, GCC issuers now account for more than 20% of sovereign and corporate emerging market bond indices.

Based on earnings growth and dividend yields, SICO Asset Management anticipates flat to low-single- digit returns of around 3% on GCC and MENA equities in 2021. On the fixed income front, SICO Asset Management sees less room for significant spread compression and therefore performances will mainly be driven by carry trades. Nevertheless, MENA fixed income is expected to be a prime beneficiary of a return to ‘normal’ in 2021. A combination of low interest rates, additional stimulus, the arrival of a vaccine, progressive economic US policies as well as reasonable EM valuations should bode well for MENA fixed income assets going forward. Market shifts towards lower volatility and further risk premia reduction are likely to extend, while pro-cyclical EM assets are likely to get a boost. The entirety of the MENA region is further expected to benefit from an inflow of EM ETF trackers as developed market liquidity continues to find its way into emerging markets.

2020 Asset Management Highlights

- AUMs during the year increased by 9% from FY2019 levels, closing the year on a high note, despite a drop during the first half and the onset of the COVID-19 crisis.

- The recovery was led by an overall rebound in markets, following increased subscriptions and government stimulus.

- SICO is in final stages of negotiation to acquire Muscat Capital, a full-service investment banking firm based in Riyadh, Saudi Arabia.

- Significant upgrades were made to SICO Asset Management’s operating infrastructure, with a successful transition to Bloomberg’s Asset and Investment Manager (AIM) system.

POLITICS TAKE CENTER STAGE — From the dramatic end of the Trump administration, to the election of the first female vice president in the United States, Brexit, a new era for Middle East Peace, and race riots that erupted across the globe, politics were in the spotlight as the world struggled to contain a raging pandemic.