The Bank’s total compensation approach, which includes the variable remuneration policy, sets out the Bank’s policy on remuneration for Directors and senior management, and the key factors that are taken into account in setting the policy.

The current policy framework and incentive components were approved by the shareholders in the Annual General Meeting held on March 30, 2015. The policy is effective from 2014's annual performance incentives onwards. The key features of the approved remuneration framework are summarized below.

Remuneration Strategy

It is the Bank’s basic compensation philosophy to provide a competitive level of total compensation to attract and retain qualified and competent employees. The Bank’s variable remuneration policy will be driven primarily by a performance-based culture that aligns employee interests with those of the shareholders of the Bank. These elements support the achievement of our objectives through balancing rewards for both short-term results and longterm sustainable performance. Our strategy is designed to share our success, and to align employees’ incentives with our risk framework and risk outcomes.

The quality and long-term commitment of all of our employees is fundamental to our success. We therefore aim to attract, retain and motivate the very best people who are committed to maintaining a career with the Bank, and who will perform their role in the long-term interests of our shareholders. The Bank’s reward package comprises the following key elements:

- Fixed pay

- Benefits

- Annual performance bonus

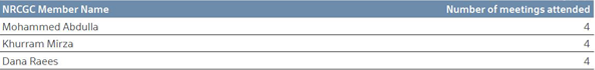

A robust and effective governance framework ensures that the Bank operates within clear parameters of its compensation strategy and policy. All compensation matters, and overall compliance with regulatory requirements, are overseen by the Nomination, Remuneration and Corporate Governance Committee of the Board of Directors (NRCGC).

The Bank’s remuneration policy in particular considers the role of each employee, and has set guidance on whether an employee is a Material Risk Taker and/or an Approved Person in a business line, control or support function. An Approved Person is an employee whose appointment requires prior regulatory approval because of the significance of the role within the Bank; and an employee is considered a Material Risk Taker if he/she is the Head of a significant business line, or any individuals within their control who have a material impact on the Bank’s risk profile.

In order to ensure alignment between what we pay our people and our business strategy, we assess individual performance against annual and long-term financial and non-financial objectives summarised in our performance management system. This assessment also takes into account adherence to the Bank’s values, risks and compliance measures and above all integrity. Altogether, performance is therefore judged not only on what is achieved over the short- and long-term, but also importantly on how it is achieved as the NRCGC believes the latter contributes to the long-term sustainability of the business.

NRCGC Role and Focus

The NRCGC has oversight of all reward policies for the Bank’s employees. The NRCGC is the supervisory and governing body for compensation policy, practices and plans. It is responsible for determining, reviewing, and proposing variable remuneration policies for approval by the Board. It is responsible for setting the principles and governance framework for all compensation decisions. The NRCGC ensures that all persons must be remunerated fairly and responsibly. The remuneration policy is reviewed on a periodic basis to reflect changes in market practices, the business plan, and risk profile of the Bank.

The responsibilities of the NRCGC with regards to the Bank’s variable remuneration policy, as stated in its mandate, include but are not limited to, the following:

- Approve, monitor, and review the remuneration system to ensure the system operates as intended.

- Approve the remuneration policy and amounts for Approved Persons and Material Risk-Takers, as well as total variable remuneration to be distributed, taking account of total remuneration including salaries, fees, expenses, bonuses, and other employee benefits.

- Ensure remuneration is adjusted for all types of risks, and that the remuneration system takes into consideration employees who earn the same short-run profit, but take different amounts of risk on behalf of the Bank.

- Ensure that for Material Risk Takers, variable remuneration forms a substantial part of their total remuneration.

- Review the stress testing and back testing results before approving the total variable remuneration to be distributed, including salaries, fees, expenses, bonuses, and other employee benefits.

- Carefully evaluate practices by which remuneration is paid for potential future revenues whose timing and likelihood remain uncertain. The NRCGC will question payouts for income that cannot be realised or whose likelihood of realisation remains uncertain at the time of payment.

- Ensure that for Approved Persons in risk management, internal audit, operations, financial control, and compliance functions, the mix of fixed and variable remuneration is weighted in favor of fixed remuneration.

- Recommend Board Members’ remuneration based on their attendance and performance, and in compliance with Article 188 of the Bahrain Commercial Companies Law.

- Ensure appropriate compliance mechanisms are in place to ensure that employees commit themselves not to use personal hedging strategies or remuneration-and-liability-related insurance to undermine the risk alignment effects embedded in their remuneration arrangements.

As outlined in the Corporate Governance section of the Annual Report, the Board is satisfied that all Non-Executive Directors are independent. The NRCGC comprises of the following members:

The total amount of NRCG siting fees for 2022 is BD 12,000 [2020: BD 9,000].

External Consultants

The NRCGC did not appoint any external consultants during the year.

Scope of Application of the Remuneration Policy

The principles of this remuneration policy apply on a Group-wide basis. However, application of deferral requirements and issue of non-cash instruments for each subsidiary of the Bank will be determined by applicable local regulations and market norms.

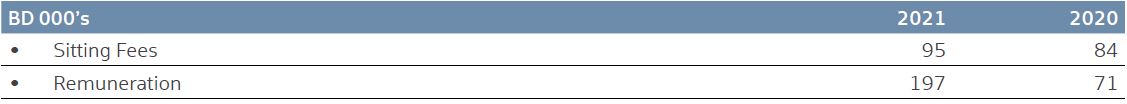

Board Remuneration

The Bank’s Board remuneration is determined in line with the provisions of Article 188 of the Bahrain Commercial Companies Law, 2001. The Board of Directors’ remuneration will be capped so that total remuneration (excluding sitting fees) does not exceed 10% of the Bank’s net profit after all required deductions as outlined in Article 188 of the Companies law, in any financial year. Board remuneration is subject to approval of the shareholders in the Annual General Meeting. Remuneration of non-executive Directors does not include performance-related elements such as grants of shares, share options or other deferred stock-related incentive schemes, bonuses or pension benefits.

Variable Remuneration for Staff

Variable remuneration is performance related and consists primarily of the annual performance bonus award. As a part of our staff’s variable remuneration, the annual bonus rewards delivery of operational and financial targets set each year, the individual performance of the employees in achieving those targets, and their contribution to delivering the Bank’s strategic objectives.

The Bank has adopted a Board-approved framework to develop a transparent link between variable remuneration and performance. The framework is designed on the basis of meeting both satisfactory financial performance and the achievement of other non-financial factors, that will, all other things being equal, deliver a target bonus pool for employees, prior to consideration of any allocation to business lines and employees individually. In the framework adopted for determining the variable remuneration pool, the NRCGC aims to balance the distribution of the Bank’s profits between shareholders and employees.

Key performance metrics at the Bank level include a combination of short-term and long-term measures, and include profitability, solvency, liquidity, risk diversification, strategy implementation and growth indicators. The performance management process ensures that all goals are appropriately cascaded down to respective business units and employees.

In determining the amount of variable remuneration, the Bank starts from setting specific targets and other qualitative performance measures that would result in a target top-down bonus pool. The bonus pool is then adjusted to take account of risk via the use of risk-adjusted measures (including forward-looking considerations).

The NRCGC carefully evaluates practices by which remuneration is paid for potential future revenues whose timing and likelihood remain uncertain. The NRCGC demonstrates that its decisions are consistent with an assessment of the Bank’s financial condition and future prospects.

The Bank uses a formalised and transparent process to adjust the bonus pool for quality of earnings. It is the Bank’s objective to pay bonuses out of realised and sustainable profits. If the quality of earnings is not strong, the profit base could be adjusted based on the discretion of the NRCGC.

For the overall Bank to have any funding for distribution of a bonus pool, threshold financial targets have to be achieved. The performance measures ensure that total variable remuneration is generally considerably contracted where subdued or negative financial performance of the Bank occurs. Furthermore, the target bonus pool as determined above is subject to risk adjustments in line with the risk assessment and linkage framework.

Remuneration of control functions

The remuneration level of staff in the control and support functions allows the Bank to employ qualified and experienced personnel in these functions. The Bank ensures that the mix of fixed and variable remuneration for control and support function personnel should be weighted in favour of fixed remuneration. The variable remuneration of control functions is to be based on function-specific objectives, and is not to be determined by the financial performance of the business areas they monitor.

The Bank’s performance management system plays a major role in deciding the performance of the support and control units on the basis of the objectives set for them. Such objectives are more focused on non-financial targets that include risk, control, compliance and ethical considerations, as well as the market and regulatory environment, apart from value-adding tasks which are specific to each unit.

Variable compensation for business units

The variable remuneration of the business units is primarily determined by key performance objectives set through the performance management system of the Bank. Such objectives contain financial and non-financial targets, including risk control, compliance and ethical considerations, as well as market and regulatory requirements. The consideration of risk assessments in the performance evaluation of individuals ensures that any two employees who generate the same short-run profits, but take different amounts of risk on behalf of the bank, are treated differently by the remuneration system.

Risk Assessment Framework

The purpose of risk linkages is to align variable remuneration to the risk profile of the Bank. In its endeavour to do so, the Bank considers both quantitative measures and qualitative measures in the risk assessment process. Both quantitative measures and human judgement play a role in determining any risk adjustments. The risk assessment process encompasses the need to ensure that the remuneration policy as designed reduces employees’ incentives to take excessive and undue risks, is symmetrical with risk outcomes, and delivers an appropriate mix of remuneration that is risk aligned.

The Bank’s NRCGC considers whether the variable remuneration policy is in line with the SICO’s risk profile, and ensures that through the Bank’s ex-ante and ex-post risk assessment framework and processes, remuneration practices where potential future revenues’ timing and likelihood remain uncertain, are carefully evaluated.

Risk adjustments take into account all types of risk, including intangible and other risks such as reputation risk, liquidity risk and the strategic measures. The Bank undertakes risk assessments to review financial and operational performance against business strategy and risk performance prior to distribution of the annual bonus. The Bank ensures that total variable remuneration does not limit its ability to strengthen its capital base. The extent to which capital needs to be built up is a function of the Bank’s current capital position and its ICAAP.

The bonus pool takes into account the performance of the Bank which is considered within the context of the Bank’s risk management framework. This ensures that the variable pay pool is shaped by risk considerations and Bankwide notable events.

The size of the variable remuneration pool and its allocation within the Bank takes into account the full range of current and potential risks, including:

- The cost and quantity of capital required to support the risks taken;

- The cost and quantity of the liquidity risk assumed in the conduct of business; and

- Consistency with the timing and likelihood of potential future revenues incorporated into current earnings.

The NRCGC keeps itself abreast of the Bank’s performance against the risk management framework. The NRCGC will use this information when considering remuneration to ensure returns, risks and remuneration are aligned.

Risk adjustments

The Bank has an ex-post risk assessment framework which is a qualitative assessment to back-test actual performance against prior risk assumptions.

In years where the Bank suffers material losses in its financial performance, the risk adjustment framework will work as follows:

- There will be considerable contraction of the Bank’s total variable remuneration

- At an individual level, poor performance by the Bank will mean individual KPIs are not met, and hence employee performance ratings will be lower

- Reduction in the value of deferred shares or awards

- Possible changes in vesting periods and additional deferral applied to unvested rewards

- Lastly, if the qualitative and quantitative impact of a loss incident is considered significant, a malus or clawback of previous variable awards may be considered

The NRCGC, with the Board’s approval, can rationalise and make the following discretionary decisions:

- Increase/ reduce the ex-post adjustment

- Consider additional deferrals or increase in the quantum of non-cash awards

- Recovery through malus and clawback arrangements

Malus and Clawback framework

The Bank’s malus and clawback provisions allow the Bank’s Board of Directors to determine that, if appropriate, unvested elements under the deferred bonus plan can be forfeited/adjusted, or the delivered variable remuneration recovered in certain situations. The intention is to allow the Bank to respond appropriately if the performance factors on which reward decisions were based turn out not to reflect the corresponding performance in the longer term. All deferred compensation awards contain provisions that enable the Bank to reduce or cancel the awards of employees whose individual behaviour has had a materially detrimental impact on the Bank during the concerned performance year.

Any decision to take back an individual’s awards can only be taken by the Bank’s NRCGC. The NRCGC takes into account the advice of the CEO, and Risk, Finance and HR Departments as appropriate.

The Bank’s malus and clawback provisions allow the Bank’s Board to determine that, if appropriate, vested/unvested elements under the deferred bonus plan can be adjusted/cancelled in certain situations. These events include the following:

- Reasonable evidence of misbehaviour or material error by the employee causing harm to the Bank’s reputation or where his/her actions have amounted to misconduct, incompetence or negligence

- The employee’s business unit suffers a material downturn in its financial performance or a material restatement of the financial statements of the Bank

- The employee’s business unit suffers a material risk management failure

- An employee deliberately misleading the market and/or shareholders in relation to the financial performance of the Bank

- A significant deterioration in the financial health of the Bank

- If the Bank and/or relevant line of business is incurring losses in any year during the vesting period, any unvested portions will be subject to malus.

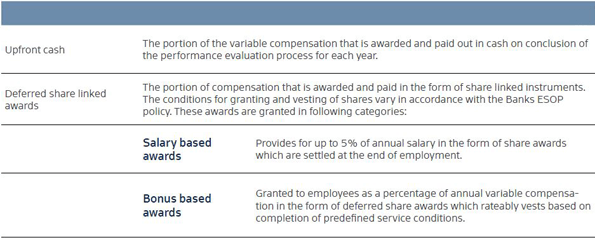

Components of Variable Remuneration

Variable remuneration has following main components:

All deferred awards are subject to malus provisions. The number of equity share awards is linked to the Bank’s share price as per the rules of the Bank’s ESOP Scheme. Any dividend on these shares is released to the employee as and when it is declared.

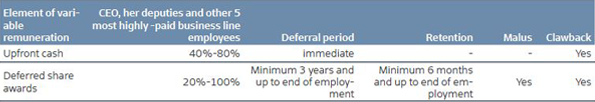

Deferred Compensation

All employees above a defined grade shall be subject to deferral of variable remuneration as follows:

The NRCGC, based on its assessment of role profile and risk taken by an employee, could increase the coverage of employees that will be subject to deferral arrangements.

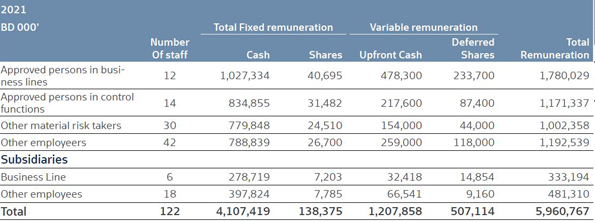

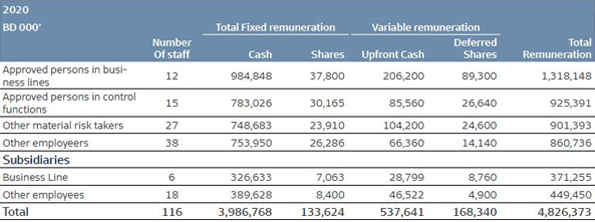

Details of remuneration paid

Board of Directors

Employee remuneration

Notes:

The amounts reported above represent actual awards for 2021 and 2020 rather than accruals and changes in value of prior period awards. Accordingly, the numbers and amounts reported above may not necessarily agree with numbers/amounts reported in the financial statements.Deferred awards

.png)

Notes :

- The above table summarises the movement in all categories of share awards (i.e. fixed and variable remuneration) issued by the Bank to its employees.

- The amounts and number of shares reported above include the gross value of awards and are not based on the proportion-based charge recognized in the financial statements over the vesting period of awards.